Will the Bank of Japan Call the Top on U.S. Interest Rates and the Dollar?

Will the Bank of Japan Call the Top on U.S. Interest Rates and the Dollar?

By:Ilya Spivak

Will the Bank of Japan call the top on U.S. yields and the bottom on the bond market?

- The Bank of Japan is set to hike rates this week as CPI inflation rises

- Japanese price growth is mainly imported, putting the yen in focus

- Hawkish BOJ signaling may imply it expects U.S. yields have topped

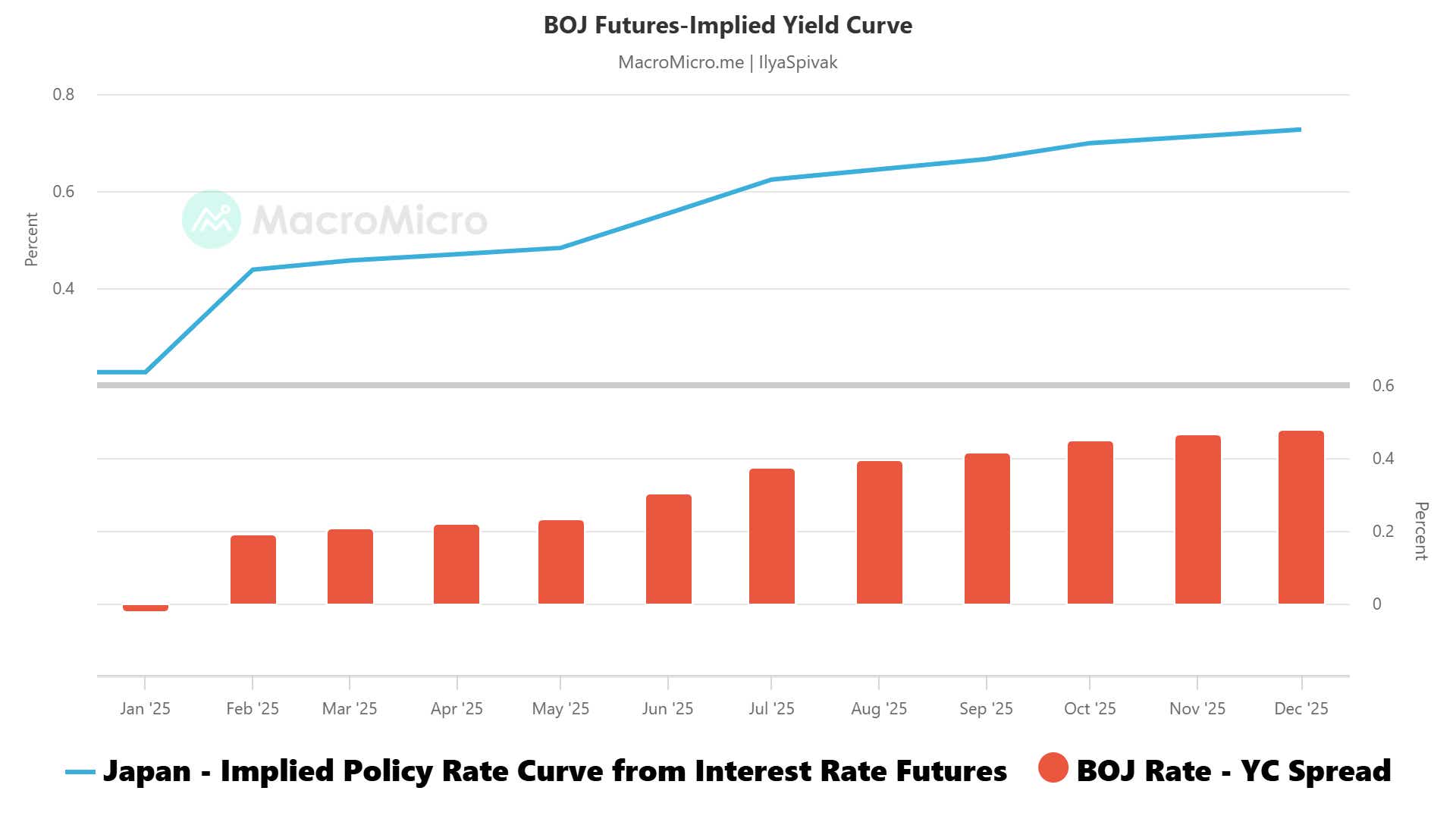

Japan stands alone as the only major economy where the central bank is expected to raise interest rates in 2025. The Bank of Japan (BOJ) is expected to deliver 50 basis points (bps) in hikes this year. The next most hawkish stance is priced in for the U.S. Federal Reserve, where markets see at least one 25bps rate cut and a 50% chance of a second one.

Economists’ median forecasts anticipate that the first of the BOJ’s moves will come when central bank officials meet this week. For their part, benchmark interest rate futures put the probability of an increase at a commanding 76%. The second upshift might appear as soon as August. By October, its probability rises to 80%. It is near-certain by year end.

Most of Japan’s inflation is imported via food and energy costs

An update of official inflation figures will helpfully set the stage for the BOJ conclave. It is expected to show that the consumer price index (CPI) accelerated upward in December, rising 3.2% year-on-year. The core measure excluding food prices is seen at 2.9%. These would amount to the highest readings since October 2023.

.png?format=pjpg&auto=webp&quality=50&width=752&disable=upscale)

Imported food and fuel costs have accounted for more than half of overall inflation since May 2024. Global price gyrations for these essentials – tracked by the United Nations’ FAO Food Price Index and the Brent crude oil price – seem to appear in Japanese headline CPI with a lag of about seven months.

These measures have trended in opposite directions since April, implying a tail of conflicting influences pulling on Japan’s inflation readings in the months to come. On balance, this looks likely to anchor price growth, if not push it back a bit as last year’s April to September oil price selloff is absorbed into the data by end of the second quarter.

The Bank of Japan must consider the Fed and the Trump administration

While this seems unlikely to stop a rate hike this week – BOJ Governor Kazuo Ueda and his Deputy Governor Ryozo Himino both hinted at the hike in speeches last week – it may give officials more room to maneuver thereafter. That may be helpful as the central bank grapples with the long shadow cast by U.S. monetary policy.

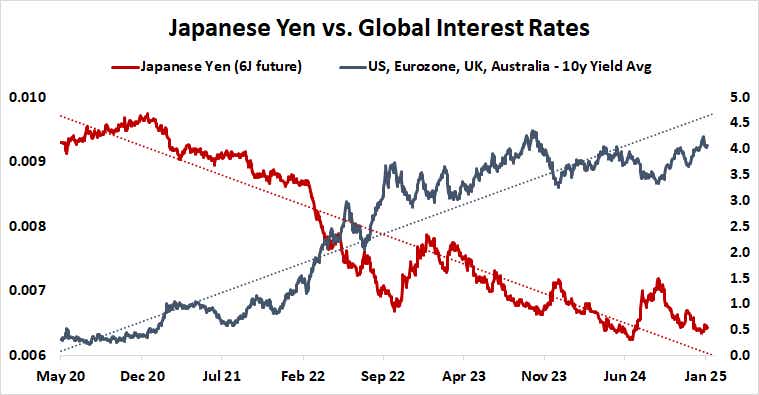

Interest rates rose globally as U.S. Treasury yields began to rise in mid-September Fed stimulus bets cooled. That lifted borrowing costs worldwide because of the U.S. dollar’s ubiquity in settling monetary transactions. The greenback commands close to an 88% market share, according to the Bank of International Settlements (BIS).

That is anathema to the perennially low-yielding yen, encouraging the proliferation of the so-called “carry trade”. This is where speculators borrow cheaply in yen, then sell the currency in exchange for higher yielding assets. The currency has dutifully tumbled in recent months, amplifying Japan’s imported inflation problem.

Will Japan’s central bank call the top on U.S. interest rates?

This puts the BOJ squarely within the blast radius of the new economic policies prosed by the Trump administration as it takes the reins in Washington DC. Its emphasis on a mix of tax cuts and deregulation coupled with higher tariffs and an immigration crackdown seem likely to bias U.S. prices higher, capping Fed rate cuts.

That may set the BOJ and its U.S. counterpart on a collision course. Mr. Ueda and company would probably prefer to avoid that, biding their time to hike again until it seems that scope for a hawkish rethink at the Fed has been exhausted and amplifying yen strength emanating from cooling yields for a potent disinflationary jolt.

So, the BOJ might be reluctant to dial up rate hike expectations this week, opting for neutral messaging and only modest updates to official economic forecasts. If policymakers embrace a more assertive stance however, this may imply that in their estimation, the peak in in U.S. yields is already in view.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.