BOE Preview: End of Rate Hikes May Lift U.K. Stocks, British Pound

BOE Preview: End of Rate Hikes May Lift U.K. Stocks, British Pound

By:Ilya Spivak

The Bank of England appears likely to keep rates unchanged and signal the end of its hiking cycle this month. That may support U.K. stocks and the British pound.

- The Bank of England is keeping rates on hold and follow the European Central Bank’s signal of the end of the hiking cycle.

- Sticky inflation is ebbing amid a U.K. growth slump, and some see cuts by September 2024.

- U.K. stocks and the British pound might benefit as risk-seeking capital rotates.

The Bank of England (BoE) looks set to follow the European Central Bank (ECB) into the end of interest rate hikes.

The U.K. central bank is expected to keep its target rate on hold this month, as will its cousin on the Continent. A deep economic downturn appears to give cover to Gov. Andrew Bailey and company to end the fight against inflation and refocus on growth.

The probability of a rate increase at November’s conclave is just 4.6%. The likelihood of another hike in this tightening cycle tops out in February 2024 at 36%, implying that investors assign better than even odds to rates having already peaked. The first cut is priced in by September but could arrive as soon as August. The chance of that outcome is penciled in at over 63%.

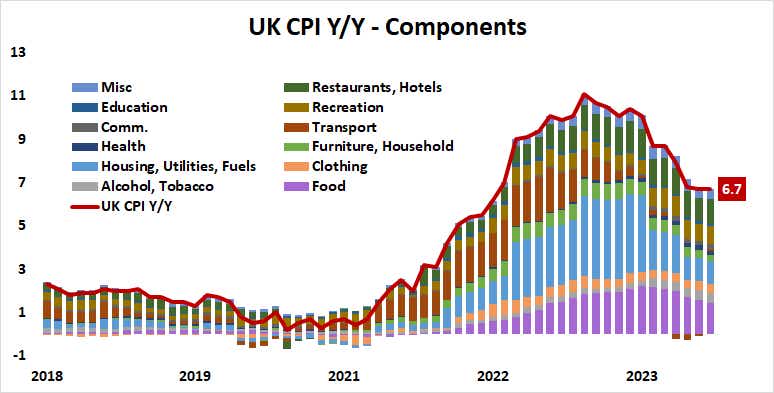

U.K. inflation: pressure continues to ease

October’s round of leading purchasing managers’ index (PMI) data showed the economy shrank for a third consecutive month. Meanwhile, food prices remain the biggest contributor to consumer price index (CPI) inflation. Monetary policy can’t do much about that. Base effects ought to keep driving fuel cost disinflation, however while a deepening economic downturn breaks down the uplift from discretionary spending.

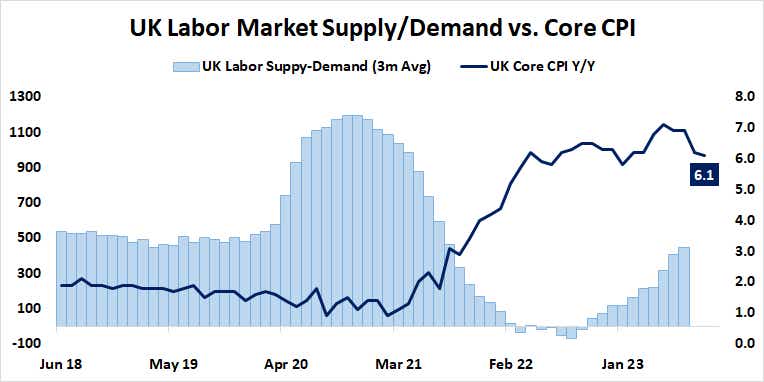

At the same time, progress is being made on the sticky component of inflation locked up in the labor market. The supply-demand balance there continues to unwind a shortage of workers. The shortfall peaked in August 2022 and a surplus has been building thereafter. It registered a two-year high in July, the latest month of data.

U.K. stocks and British pound may benefit from dovish BoE turn

The policy statement and the press conference with Mr. Bailey thereafter will probably stress officials’ intent to hold rates at the cycle high for now to anchor expectations. At the same time, they are likely to hint that the bias has shifted to timing the next rate cut, as opposed to the next hike.

U.K. stocks will probably like that, cheering the prospect that monetary authorities are turning a corner and relief is coming closer into view. The British pound may find a way higher as well, shrugging off the dovish adjustment as capital flows search for bargains in battered corners of the markets where a policy pivot seems closest to delivering a lifeline.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.