Why Bitcoin is Selling Off Alongside Tech

Why Bitcoin is Selling Off Alongside Tech

By:Mike Butler

The crypto’s futures were down over $12,000 this morning in the biggest selloff so far in 2024

Bitcoin futures were down over $12,000 this morning in the biggest selloff so far in 2024.

Meanwhile, Ethereum futures are down 20% from Friday's close.

With the rest of the stock market taking heat, what can we expect from the crypto space?

Why is the stock market selling off today?

The stock market was in free fall this morning, with the VIX (CBOE Volatility S&P 500 Index) ripping to a near-term high of $65.73 as futures sold off aggressively Sunday night. The Bank of Japan (BOJ) raised interest rates to 0.25%, a level the markets have not seen since 2008. As a result, the Japanese yen (/6J) is ripping higher, erasing months of weakness relative to the U.S. dollar, and the Nikkei 225 stock index realized its worst day since 1987. The U.S. markets are continuing the selloff that started on Friday of last week because global market conditions have not improved.

As they say, markets can grind higher slowly but surely, but a selloff can erase gains in a matter of minutes. This is why we tend to see price velocity to the downside in sector exchange-traded funds (ETFs) like SPY (S&P 500 ETF) and QQQ (NASDAQ ETF) in the U.S. markets.

Bitcoin pressure and recession fears

Just like the rest of the stock market, Bitcoin is not immune to the liquidation event we're seeing today. Bitcoin (BTC) futures were down over $12,000 at the lows, which is a massive move to be sure. With that said, it's not something that should totally surprise us in the same way that market indices are surprising us today.

While SPY and QQQ set new implied volatility levels we haven't seen in a year with implied volatility ranks (IVRs) exceeding 100, the implied volatility for Bitcoin futures remain in the middle of the range with an IV Rank around 55.

You might be wondering how this can this be. These are huge market moves after all!

Today, tastycrypto's Ryan Grace gave us clarity around moves like this and highlighted some key takeaways that he saw in the last 48 hours of price action in cryptocurrency on Options Trading Concepts Live.

Get the tastycrypto newsletter for free for a weekly dose of all things crypto every Saturday.

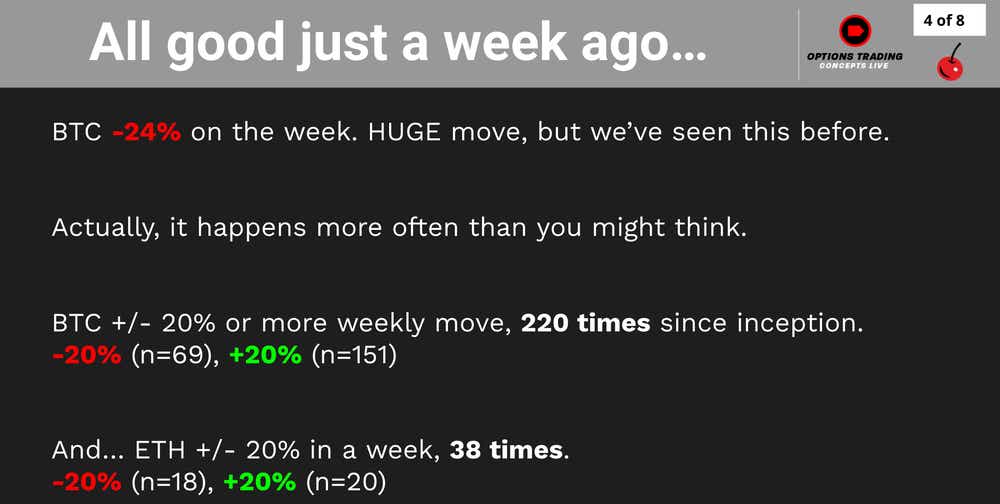

Bitcoin has had +/- 20% moves 220 times

Moves of that magnitude have been to the upside at more than twice the rate of downside moves, which makes sense given the amazing returns in bitcoin over the years.

Still, this sort of volatility should not surprise us, and we should continue to see this moving forward:

Over the next 25 days, Bitcoin futures are expected to fall within a range of +/- $5,473.02, based on current implied volatility. The range for the next 81 days is expected to be within a span of +/- $12,267.14, based on current implied volatility.

Relative to time, we're seeing a dramatic boost in implied volatility in the near-term cycle, given the spike in implied volatility across the board today.

Bullish on Bitcoin futures

Bitcoin bulls are not liking the tape action today, but many may see this as a discounted price to get bullish fresh off of a recent high. Some highly correlated products,—Coinbase (COIN) and MicroStrategy (MSTR), are seeing some downside pressure today as well, but they have interesting charts to say the least

Coinbase has closed lower than the open for nine straight trading sessions, until today when the crypto exchange will likely close well above the opening print near the lows of the day. It seems there are buyers at this price point, and crypto traders may see this as a bullish sign.

MicroStrategy is another interesting chart because the stock price is still well above where it was trading when bitcoin futures were at $50,000 last in late February.

With that said, if bitcoin futures are going to see some big green bars, it seems the rest of the stock market will have to follow suit as well. Bitcoin futures are down over 4x more than the Nasdaq and S&P 500 today.

Bearish on Bitcoin futures

Bearish bitcoin traders may believe that if the market is liquidating assets to free up cash and cash equivalents, Bitcoin futures and products correlated to Bitcoin may be the first to go because it is a volatile speculative sector after all. As stated before, it's important to note the lack of implied volatility change in Bitcoin futures today. We're seeing a big selloff to the downside, but implied volatility hasn't moved too much. This tells us the move today isn't too far outside of the expected range, but we also know that when we see big moves to the upside in BTC, we usually see implied volatility rise with it. Bitcoin futures have sold off over $16,000 from top to bottom from Friday's price action but have rallied back since.

Tune in to Options Trading Concepts Live at 11 a.m. CDT for a look at the wild market each day this week, and join us on YouTube to ask trading questions!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.