Bitcoin's Seasonality: The November Effect

Bitcoin's Seasonality: The November Effect

In the 11th month of the year, Bitcoin tipiccally averages 55% returns. This time, we can add the election to the mix, too.

There appears to be a degree of seasonality in Bitcoin’s performance over the years.

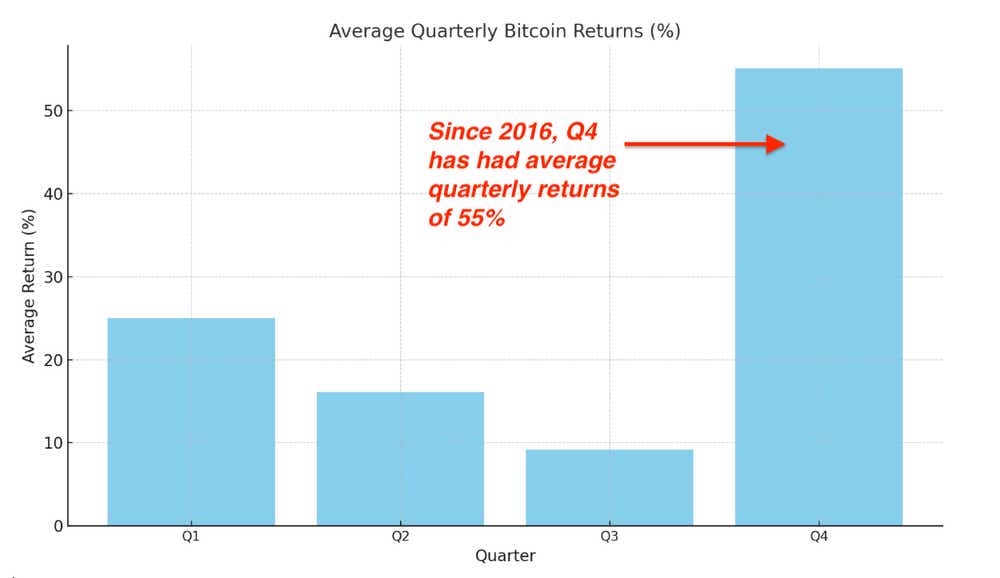

Q4 has been the best quarter for Bitcoin price performance since 2016, with average quarterly returns of 55%.

More specifically, November has emerged as Bitcoin's standout month for price performance, delivering average returns of over 30%—making it the most profitable month for the cryptocurrency by a significant margin.

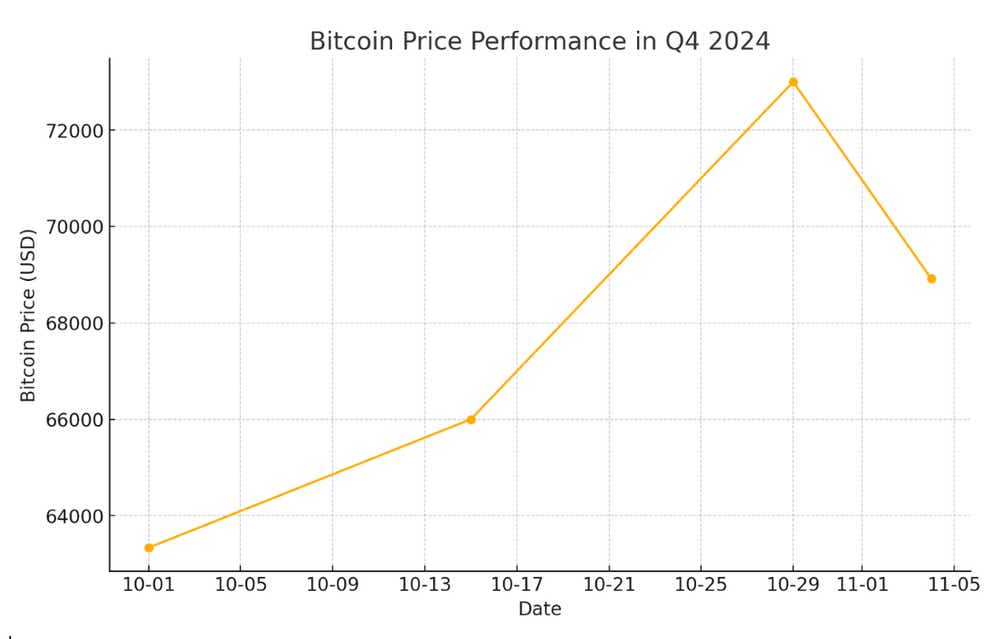

History doesn’t always repeat, but it often rhymes. Since the start of Q4 2024, Bitcoin is up around 8%.

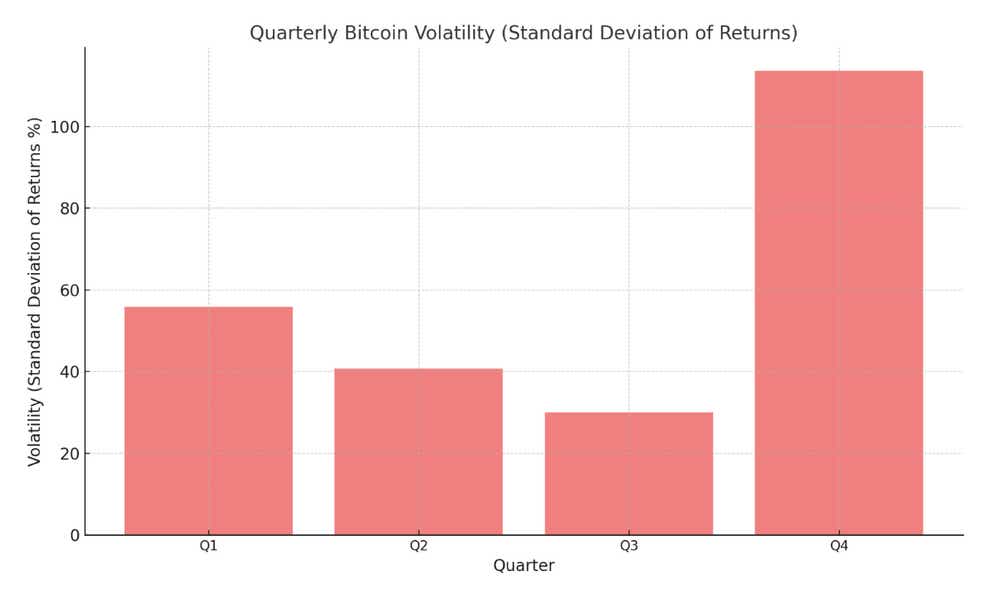

Seasonality shows up in Bitcoin’s volatility too, with Q4 also the most volatile quarter for bitcoin going back to 2016. On average Bitcoin has realized a volatility of over 100%. It’s not surprising because we often witness a positive correlation between bitcoin price performance and volatility.

We’re in the middle of what would typically be Bitcoin’s most volatile quarter, and we have an election tonight! What are the global crypto markets pricing in over the next week?

Check out tastycrypto!

Access more crypto data-driven insight and ideas each week in the tastycrypto newsletter. Subscribe for free!

Enable crypto trading in your tastytrade account, Click here!

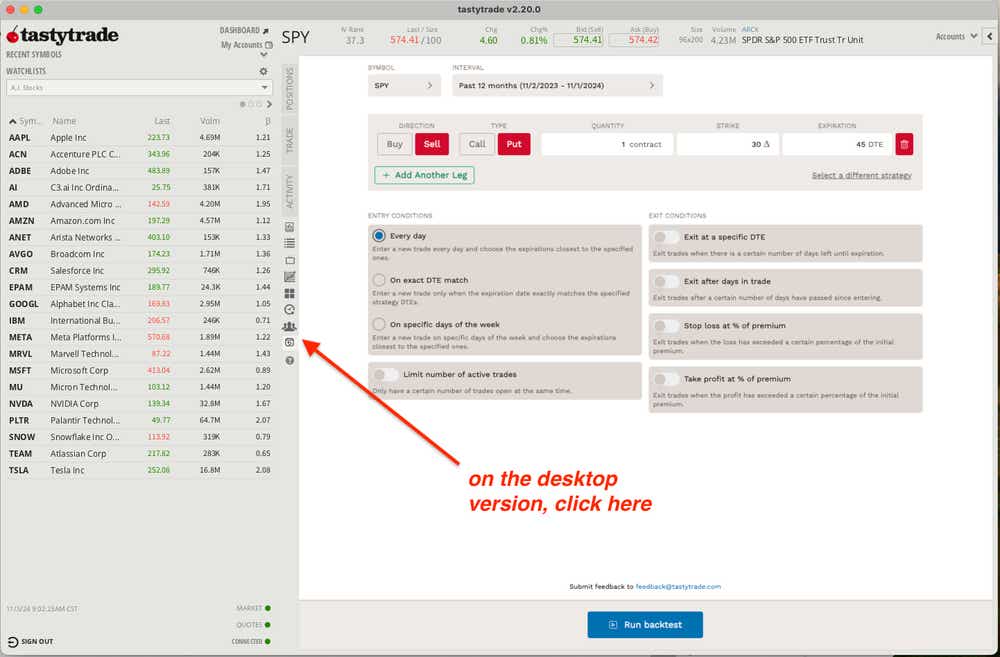

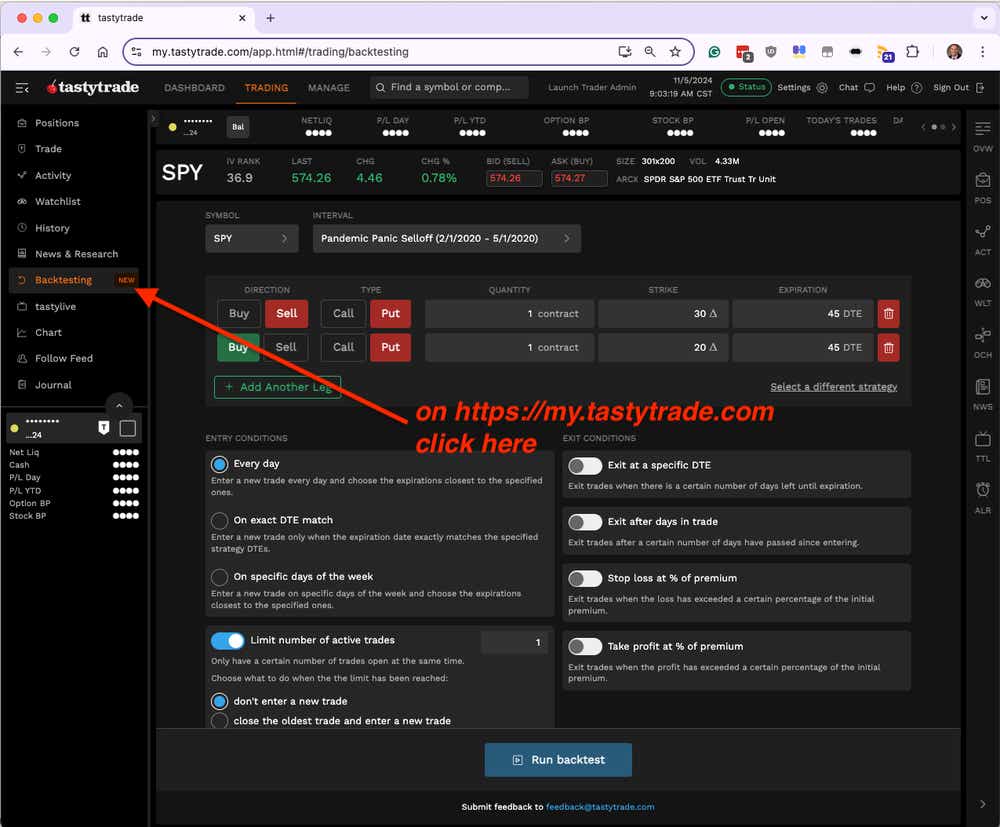

Backtesting on tastytrade

We wrote about this last week, but we decided to discuss it again because it has been requested. Click here for more information.

Luckbox newsletter

Need a little more luck in your life? Join other active traders, investors, entrepreneurs, risk-takers and alpha-types. Subscribe for free to tastylive's Luckbox newsletter for your weekly look at life, money and probability.

Two Trade Ideas

COIN ($191) Calendarized Ratio Spread CRAB! (DEC/NOV) $11.09 Debit

Coinbase (COIN) is one of the highest beta stocks to the crypto space, along with MicroStrategy (MSTR). If you think there might be some upside in the election, and then a dip after earnings, an upside CRAB trade might fit the assumption. Try a long DEC 200 call, short 2x the NOV 220 calls, and long the 240 NOV call to define the risk sets up with 13 long delta and some positive gamma up to 220.

MARA ($16) Short Put and Call Ratio (DEC) $1.92 Credit

MARA is one of the more prominent crypto miners. Sitting near lows, with IV at 120%, short premium is certainly juicy. Selling the 15 strike put, with the 1x/2x call ratio 17/21, trades at a $1.92 credit with some added profit potential up to 21, and only uses $950 in buying power.

Sharing is caring. Forward this email to your friends so they can subscribe to our newsletters, too! Get weekly data-driven trade ideas with Cherry Picks and daily pre-market insights and trade ideas with Cherry Bomb.

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He’s best known for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex and macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.