Big Wigs Convene in Europe: Will Fed Chair Powell Comments Hurt Stocks, Boost Dollar?

Big Wigs Convene in Europe: Will Fed Chair Powell Comments Hurt Stocks, Boost Dollar?

By:Ilya Spivak

Powell Speech at ECB Forum May Hurt Stocks, Boost Dollar

- All eyes are on Fed Chair Powell again, now at the European Central Bank forum.

- U.S. inflation has slowed but continued progress may be a struggle.

- Service-sector job losses may be necessary to put prices back on track.

For the third week in a row, financial markets are on tenterhooks as they await a speech from Federal Reserve Chair Jerome Powell.

The central bank chief was at center stage as the policy-setting Federal Open Market Committee (FOMC) committee opted to pause after raising rates at 10 consecutive meetings. The very next week, he sat for semi-annual testimony before Congress, clarifying and reiterating as market watchers parsed the details. This time, he will appear at the European Central Bank (ECB) Forum on Central Banking in Sintra, Portugal.

The annual gathering of monetary policy bigwigs will feature speeches from Powell, ECB President Christine Lagarde, Bank of Japan Governor Kazuo Ueda and Bank of England Governor Andrew Bailey. The markets will be all ears as everyone involved tries to nail down how much economic pain must be endured to vanquish still-too-high inflation.

U.S. inflation slowing but continued progress may require a struggle

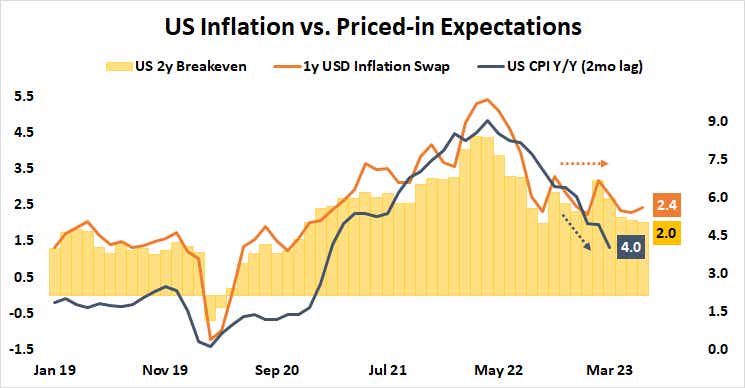

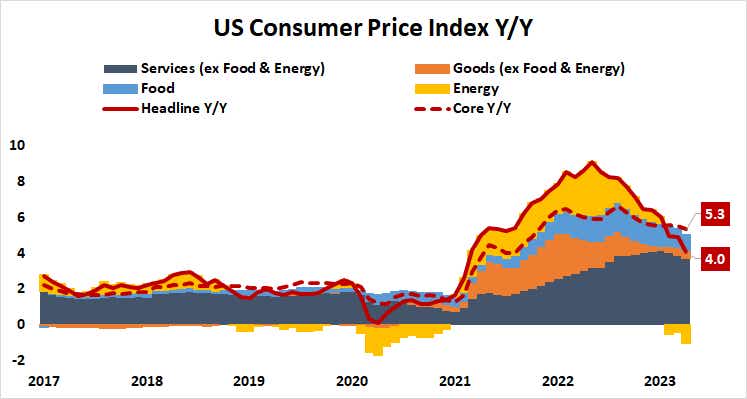

The U.S. has fared better than most major economies in the fight against price growth. Increases in the consumer price index (CPI) measure of inflation slowed from a high above 9% year-on-year in June 2022 to 4% in May, the lowest in over two years.

The worry now is that progress could stall. Near-term inflation expectations priced into the swap and bond markets have worryingly paused their descent. Traders expect to just barely get to the Fed’s 2% inflation objective in two years. This appears to leave no room for error between now and then. A slight shock might knock the Fed off-target.

As it stands, the markets already price in one more rate hike this year. Rates futures imply it is likely to arrive at September’s policy meeting and no later than the November gathering. Cuts are then slated for nearly every FOMC sit-down in 2024, bringing the Fed Funds benchmark into the 3.5%-3.75% range. It is set to a band of 5%-5.25%.

Job losses may be the price of putting U.S. inflation back on track

Getting inflation expectations to resume their decline—a move to give the Fed some breathing room to steer its way back to target—will demand that Powell convince markets to both upgrade near-term rate hike bets and downscale the expected easing path thereafter.

He will have to sell that message with a downturn already underway. Purchasing managers surveyed in the U.S. put economic activity growth at the slowest in three months in June. The move was driven by the first downtick in the pace of service-sector expansion this year. That’s good news for the Fed, but a worrying prospect for jobs.

Having squeezed out nearly all the price growth contribution from the goods side with a combination of higher borrowing costs and a complimentary mending of pandemic-damaged supply chains, the Fed has been keen to work down the dominant “core services” component. That may be starting to happen.

However, the service sector also accounts for a dominant share of U.S. employment, at close to 80%. Turning the screws here will probably mean job losses in an economy where household consumption is close to 70% of gross domestic product (GDP). A slowdown in growth looks to be baked into the policy cake.

The key question now is how much more pain the Fed must threaten to inflict to get markets busy repricing expectations to a less dovish setting. If Powell appears in Sintra in a believably combative mood, risk appetite may flounder. That would hurt stocks and cyclical commodities like crude oil and copper, while the U.S. dollar may rise on haven demand.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, specializing in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.