Top 10 Stocks to Watch: August 2024

Top 10 Stocks to Watch: August 2024

Stock prices are in line with mid-June. If sellers maintain control, look for a target of $5,340

The markets rose until about the middle of July and then sold off.

Price action around $5,470 indicates a short-term stalemate between buyers and sellers.

The bullish bias from the current price may or may not carry on.

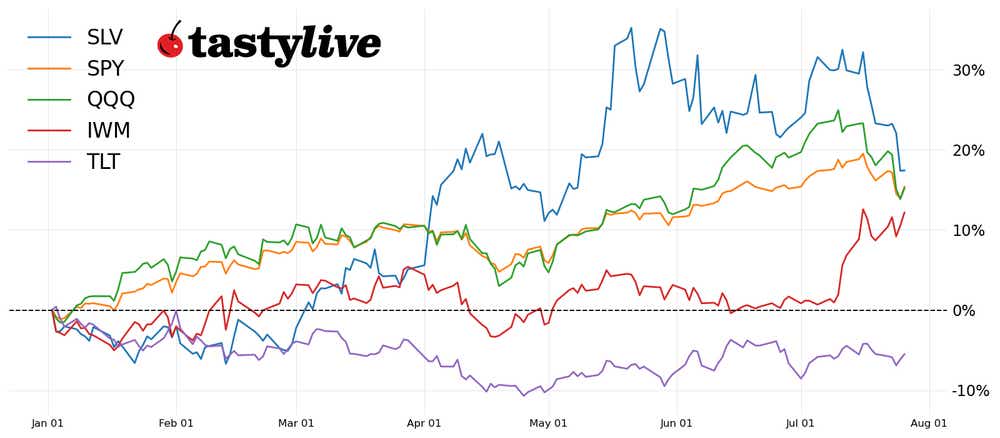

Market Update: S&P 500 E-Mini Futures up 10.56% year-to-date

The S&P 500 continued its bullish journey until July 17 and then proceeded to sell off from about $5,700 to $5,432.50. In the last 48 hours we’ve bounced back slightly. It’s possible the selloff will continue, but most of the velocity seems to have worn off.

Price action around $5,470 indicates a short-term stalemate between buyers and sellers. The current price puts us back in line with prices in mid-June. If sellers continue to control price action, look for them to target the $5,340 level.

However, there is an equally strong chance that the market will carry on with its bullish bias from the current price. The price action over the last two months does appear to mimic the price action back in March through May of this year. I would not be surprised if we see something similar again.

A note on earnings trades

To capture most of the volatility of earnings announcements, earnings trades are often executed either the day before or on the day of the company’s report. However, active investors can also place the trades days or weeks before an earnings event, which could lead to early profit taking.

Alternatively, placing a trade shortly after an earnings announcement can be a strategic choice to circumvent the binary nature of the event. Evaluate each trade in a way that enables you to execute the position that matches your strategy.

If you're considering a trade going into an earnings event, one approach is to initiate the position in the monthly options contract that follows the announcement. This strategy offers flexibility. Should you need to defend your position—perhaps because of unexpected market movements—you have the choice to “roll” it out to the subsequent monthly options. Rolling out the position in this way enables you to extend its duration and potentially collect more premium, providing a buffer against market volatility.

Top 10 stocks to watch in August 2024

Amazon (AMZN) – Aug. 1, after the close

Apple (AAPL) – August 1, After the close

Coinbase (COIN) – August 1, After the close

DraftKings (DKNG) – August 1, After the close

Palantir (PLTR) – August 5, After the close

Uber (UBER) – August 6, Before the open

Applied Materials (AMAT) – August 15, After the close

Snowflake (SNOW) – August 21, After the close

Nvidia (NVDA) – August 28, After the close

Dell (DELL) – August 29, After the close

1. Amazon (AMZN)

Amazon operates as a global e-commerce retailer and provides cloud computing services. AMZN is up 20.07% year-to-date. Its implied volatility rank (IVR) is 73.1, with August IVx at 49.5, September IVx at 30, and its liquidity is rated four out of four on the tastytrade platform.

AMZN is a pricier stock, so smaller accounts will want to define their risk. Medium to large accounts could consider undefined risk positions. A one-standard deviation short strangle sets up well and can be converted to a short iron condor if desired. Directional spreads can be set up in either direction with your preference for risk.

2. Apple (AAPL)

Apple designs, manufactures and markets consumer electronics, computer software and online services. It’s up 16.55% year-to-date. ItsIVR is 78.5, with August IVx at 32.3, September IVx at 28.1, and its liquidity is rated four out of four on the tastytrade platform.

AAPL is a pricier stock, so smaller accounts will want to define their risk. Medium to large accounts could consider undefined risk positions. A 22-delta short strangle sets up well and can be converted to a short iron condor if desired. Directional spreads can be set up in either direction with your preference of risk.

3. Coinbase (COIN)

Coinbase provides financial infrastructure and technology for the crypto-economy. COIN is up 40.44% year-to-date. Its IVR is 53, with August IVx at 88.6, September IVx at 80.4, and its liquidity is rated three out of four on the tastytrade platform.

COIN is an expensive stock to trade, so only larger accounts should consider undefined risk positions. An 18-delta short iron condor sets up decently. Directional spreads can be set up in either direction with your preference of risk.

4. DraftKings (DKNG)

DraftKings is an online sports betting and gaming company. DKNG is up 5.43% year-to-date. Its IVR is 66.1, with August IVx at 74.6, September IVx at 59, and its liquidity is rated four out of four on the tastytrade platform.

DKNG is a less expensive stock to trade, so smaller accounts could consider undefined risk positions. A 22-delta short strangle sets up well and can be converted to a short iron condor if desired. Directional spreads can be set up in either direction with your preference of risk.

5. Palantir (PLTR)

Palantir builds software platforms for institutions that analyze large data sets. PLTR is up 59.71% year-to-date. Its IVR is 39.3, with August IVx at 80.3, September IVx at 64.4, and its liquidity is rated four out of four on the tastytrade platform.

PLTR is a less expensive stock to trade, but undefined risk positions use a lot of buying power compared to the credit received, so most accounts will want to trade defined risk positions. A 22-delta short iron condor sets up well. Directional spreads can be set up in either direction with your preference of risk.

6. Uber (UBER)

Uber offers a technology platform for peer-to-peer ridesharing, ride service hailing, and food delivery. UBER is up 6.49% year-to-date. Its IVR is 54.8, with August IVx at 55.3, September IVx at 45, and its liquidity is rated four out of four on the tastytrade platform.

UBER is a less expensive stock to trade, so smaller accounts could consider undefined risk positions. A 20-delta short strangle sets up well and can be converted to a short iron condor if desired. Directional spreads can be set up in either direction with your preference of risk.

7. Applied Materials (AMAT)

Applied Materials provides materials engineering solutions used to produce virtually every new chip and advanced display. AMAT is up 28.55% year-to-date. Its IVR is 83.2, with August IVx at 50.2, September IVx at 44.9, and its liquidity is rated three out of four on the tastytrade platform.

AMAT is an expensive stock to trade, so only larger accounts should consider undefined risk positions. A 20-delta short strangle sets up well and can be converted to a short iron condor if desired. Directional spreads can be set up in either direction with your preference of risk.

8. Snowflake (SNOW)

Snowflake offers cloud-based data storage and analytics services, known for its data warehouse capabilities. SNOW is down 33.88% year-to-date. Its IVR is 54.8, with August IVx at 51.1, September IVx at 57.1, and its liquidity is rated three out of four on the tastytrade platform.

SNOW is an expensive stock to trade, so only larger accounts should consider undefined risk positions. A 20-delta short strangle sets up well and can be converted to a short iron condor if desired. Directional spreads can be set up in either direction with your preference of risk.

9. Nvidia (NVDA)

Nvidia designs and manufactures computer graphics processors, chipsets and related multimedia software. NVDA is up 128.58% year-to-date. Its IVR is 92, with August IVx at 58.2, September IVx at 65.3, and its liquidity is rated four out of four on the tastytrade platform.

NVDA is a slightly expensive stock to trade, so only medium and larger accounts should consider undefined risk positions. An 18-delta short strangle sets up well and can be converted to a short iron condor if desired. Directional spreads can be set up in either direction with your preference of risk.

10. Dell Technologies (DELL)

Dell Technologies provides a wide range of technology, products, and services in various computing sectors. DELL is up 49.58% year-to-date. Its IVR is 51.4, with August IVx at 49, September IVx at 58.5, and its liquidity is rated three out of four on the tastytrade platform.

NVDA is a medium-priced stock to trade, so only medium and larger accounts should consider undefined risk positions. An 18-delta short strangle sets up well and can be converted to a short iron condor if desired. Directional spreads can be set up in either direction with your preference of risk.

Ryan Sullivan is an active options and forex trader and programming producer for the tastylive network.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.