Top 10 Stocks to Watch: January 2025

Top 10 Stocks to Watch: January 2025

The markets may quickly reverse and then push to new all-time highs in early January

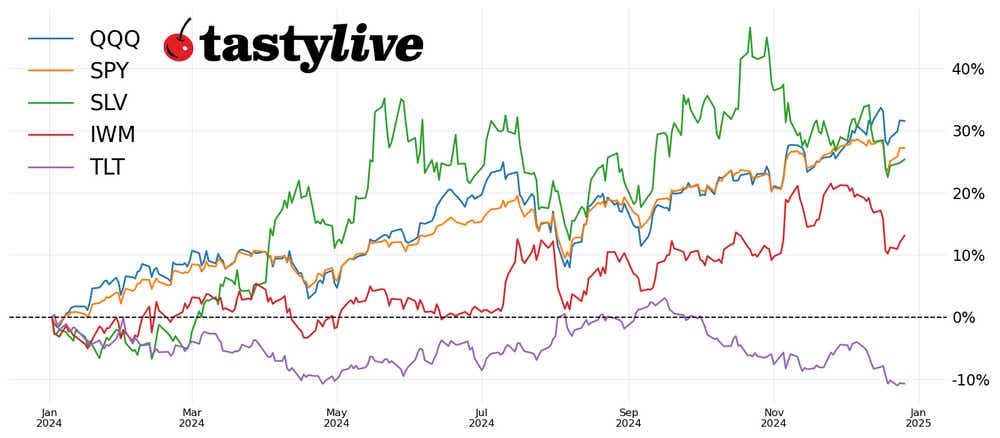

Market update: S&P 500 E-mini futures up 18.83% year to date

Since last month's update, price action briefly bounced above the $6,000 level near the end of November, which was followed by a push to new all-time highs at $6,111. The next week of price action consisted of consolidation between about $6,100 and $6,039.

In mid-December price jumped to $6,152, then immediately dipped to $5,906 and then $5,866, followed by a quick move up to $6,099. This indicates buyers are in control, but sellers have enough power to test the downside.

Price action remains bullish. However, at the end of December, price has since retested the downside, touching $5,982.

The last two weeks of December have shown big price swings, which indicates indecision in the market. Buyers and sellers have both been able to take control in a short amount of time. That said, buyers have displayed stronger tendencies. Dips have been bought up more quickly than sell offs have been sold.

Although sellers appear to have the opportunity to continue to push down beyond $5,866, I would not be surprised if we quickly reverse to push to new all-time highs in early January.

A note on earnings trades

To capture the bulk of the volatility of earnings announcements, earnings trades are often executed either the day before or on the day of the earnings announcement. However, earnings trades can also be placed days or weeks before an earnings event, which could lead to early profit taking.

Alternatively, placing a trade shortly after an earnings announcement can be a strategic choice to circumvent the binary nature of the event. Evaluate each trade in a way that allows you to execute the position that matches your strategy.

If you're considering a trade going into an earnings event, one approach is to initiate the position in the monthly options contract that follows the earnings event. This strategy offers flexibility. Should you need to defend your position—perhaps because of unexpected market movements—you have the choice to “roll” it out to the subsequent monthly options. Rolling out the position in this way enables you to extend its duration and potentially collect more premium, providing a buffer against market volatility.

Top 10 stocks to watch in January 2025

- Delta Air Lines (DAL) – Jan. 10, Before the open

- Wells Fargo (WFC) – Jan 15, Before the open

- Alcoa (AA) – Jan. 15, After the close

- Bank of America (BAC) – Jan 16, .Before the open

- United Airlines (UAL) – Jan. 20, Before the open

- Freeport-McMoRan (FCX) – Jan. 21, Before the open

- General Electric (GE) – Jan. 21, Before the open

- Netflix (NFLX) – Jan. 21, After the close

- Tesla (TSLA) – Jan. 22, After the close

- American Express (AXP) – Jan. 24, Before the open

- Delta Air Lines

Delta Air Lines (DAL) operates major airline services, including passenger and cargo transport globally. DAL is up 57.8% year-to-date. Its IVR is 34.4, with December IVx at 52.8, January IVx at 44, and its liquidity is rated four out of four on the tastytrade platform.

DAL is a lower-priced stock, so small to medium-sized accounts could consider undefined risk positions. 20-delta short Strangles and 25-delta short Iron condors set up well. At the money (ATM) short directional spreads also set up well if you have a directional assumption.

2. Wells Fargo

Wells Fargo & Company (WFC) provides banking, investment, mortgage, and consumer and commercial financial services. WFC is up 49.31% year-to-date. Its IVR is 22.4, with December IVx at 34.5, January IVx at 30.8, and its liquidity is rated four out of four on the tastytrade platform.

WFC is a low- to medium-priced stock, so small to medium-sized accounts could consider undefined risk positions. 22-delta short Strangles and 25-delta short Iron condors set up well.

3. Alcoa

Alcoa (AA) engages in the production of bauxite, alumina and aluminum products. AA is up 15.73% year-to-date. Its IVR is 15, with December IVx at 54.1, January IVx at 51.6, and its liquidity is rated four out of four on the tastytrade platform.

AA a lowerp-riced stock, so small to medium-sized accounts could consider undefined risk positions. 25-delta short Iron condors set up well. $5-wide, at-the-money directional short spreads also set up well.

4. Bank of America

Bank of America (BAC) offers banking and financial services to individuals, small businesses and corporations. BAC is up 36.82% year-to-date. Its IVR is 26.9, with December IVx at 31.3, January IVx at 28.3, and its liquidity is rated four out of four on the tastytrade platform.

BAC is a lower-priced stock, so small to medium-sized accounts could consider undefined risk positions. 22-delta short Strangles set up well. $5-wide, at-the-money directional short spreads also set up well.

5. United Airlines

United Airlines (UAL) provides air transportation for passengers and cargo in the United States and internationally. UAL is up 145.25% year-to-date. Its IVR is 50.2, with December IVx at 53.6, January IVx at 52.6, and its liquidity is rated three out of four on the tastytrade platform.

UAL is a medium-priced stock, so medium-sized accounts could consider undefined risk positions. One-standard deviation short Strangles set up well. 20-delta short Iron condors also setup up well.

6. Freeport-McMoRan

Freeport-McMoRan (FCX), a leading international mining company with significant gold, copper and molybdenum production, is down 5.42% year-to-date. Its IVR is 18, with December IVx at 38.4, January IVx at 38.9, and its liquidity is rated four out of four on the tastytrade platform.

FCX is a lower-priced stock, so small to medium-sized accounts could consider undefined risk positions. One-standard deviation short strangles set up well. $5-wide, at-the-money directional short spreads also set up well.

7. General Electric

General Electric (GE) operates in sectors including aviation, power, renewable energy and healthcare. GE is up 70.79% year-to-date. Its IVR is 42.5, with Decemb/er IVx at 26.9, January IVx at 34.9, and its liquidity is rated 3 out of 4 on the tastytrade platform. UAL is a medium to high-priced stock, so medium-sized accounts could consider undefined risk positions. 20-delta short Strangles setup up well. 35-delta, $5-wide directional short spreads also set up well.

8. Netflix

Netflix (NFLX) offers streaming and content production for a wide variety of films and television series. NFLX is up 91.26% year-to-date. Its IVR is 29.2, with December IVx at 27.5, January IVx at 41.2, and its liquidity is rated teo out of four on the tastytrade platform.

NFLX is a high-priced stock, so only big accounts should consider undefined risk positions. 19-delta short strangles set up well. 30-delta, $5-wide directional short spreads also set up well.

9. Tesla

Tesla (TSLA) designs, manufactures, and sells electric vehicles and energy generation and storage systems. TSLA is up 81.59% year-to-date. Its IVR is 51.8, with December IVx at 69.9, January IVx at 76.6, and its liquidity is rated four out of four on the tastytrade platform.

TSLA is a high-priced stock, so only big accounts should consider undefined risk positions. 20-delta short Iron condors set up well. A 30-delta, $5-wide directional short spreads also set up well.

10. American Express

American Express (AXP) provides charge and credit payment card products and travel-related services worldwide. AXP is up 64.96% year-to-date. Its IVR is 39.2, with December IVx at 25.7, January IVx at 28, and its liquidity is rated three out of four on the tastytrade platform.

AXP is a high-priced stock, so only big accounts should consider undefined risk positions. One-standard deviation iron condors set up well. $5-wide, at-the-money directional short spreads also set up well.

Ryan Sullivan is an active options and forex trader and programming producer for the tastylive network.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.