Bank Earnings Preview: Bank of America, Citigroup, JPMorgan and Wells Fargo

Bank Earnings Preview: Bank of America, Citigroup, JPMorgan and Wells Fargo

By:Mike Butler

These four banking companies beat forecasts last quarter and closed the year at annual highs

- Bank of America, Citigroup, JPMorgan and Wells Fargo are all set to report quarterly earnings on Jan. 12 before the market opens.

- All four of these banking companies closed 2023 at annual highs.

- They all beat earnings-per-share (EPS) and revenue forecasts last quarter.

- All four have a lower expected EPS compared to the previous quarter.

- Only JPMorgan and Wells Fargo have an expectation for higher revenue compared to the previous quarter.

1.Bank of America earnings preview

Bank of America (BAC) will report quarterly earnings at 5:45 a.m. CDT before the market opens on Jan. 12. The banking company is expected to report earnings per share (EPS) of $0.65 on $23.81 billion in revenue. This is significantly lower than the previous EPS expectation of $0.82 on $25.07 billion in revenue, which the company beat handily. Bank of America beat EPS and revenue expectations four quarters in a row leading into this announcement.

The expected stock price move this week based on current implied volatility in BAC is very low at +-$0.94. This is less than 3% of the current stock price at $33, but it does account for over 50% of the expected move in the February 2024 cycle which is at +-$1.76 based on current implied volatility.

2.Citigroup earnings preview

Citigroup (C) will report quarterly earnings at 7:00 a.m. CST before the market opens on Jan. 12. It is expected to report an EPS of $0.77 on $18.73 billion in revenue. That is much lower than the previous EPS expectation of $1.22 on $19.27 billion in revenue, and the banking company beat both of these figures last quarter. Citigroup has a spotty earnings history, beating EPS only two of the four previous quarters, and revenue figures three of the four previous quarters.

Citigroup has an expected stock price move of +-$1.77 for this week, which is just over 3% of the current stock price which sits at $52.86. While this is a low expected move relative to other earnings announcements coming up, it does account for over 50% of the expected m n the February options cycle which is +-$2.80. Citigroup has the highest expected move for earnings relative to the Fm

Citigroup has an expected stock price move of +-$1.77 for this week, which is just over 3% of the current stock price which sits at $52.86. While this is a low expected move relative to other earnings announcements coming up, it does account for over 50% of the expected move in the February options cycle which is at +-$2.80. Citigroup has the highest expected move for earnings relative to the February options cycle of the four banking stocks highlighted here.

3.JPMorgan Chase earnings preview

JPMorgan Chase (JPM) will report quarterly earnings at 6:00 a.m. CST before the market opens on Jan. 12. It is expected to report an EPS of $3.61 on $39.72 billion in revenue. This is a lower EPS expectation compared to the previous quarter's $3.97 figure but a higher revenue expectation than last quarter which was $39.40 billion. JPMorgan beat both of these expectations the past four quarters in a row.

JPM stock has an expected move of +-$3.74 based on current implied volatility for this week, which translates to a 2.2% stock price move for the week. This expected move is the lowest of these four banking stocks. The February 2024 cycle reflects a +-$6.44 stock price expected move, so this earnings announcement still makes up for a large chunk of expected movement over the next month.

4.Wells Fargo earnings preview

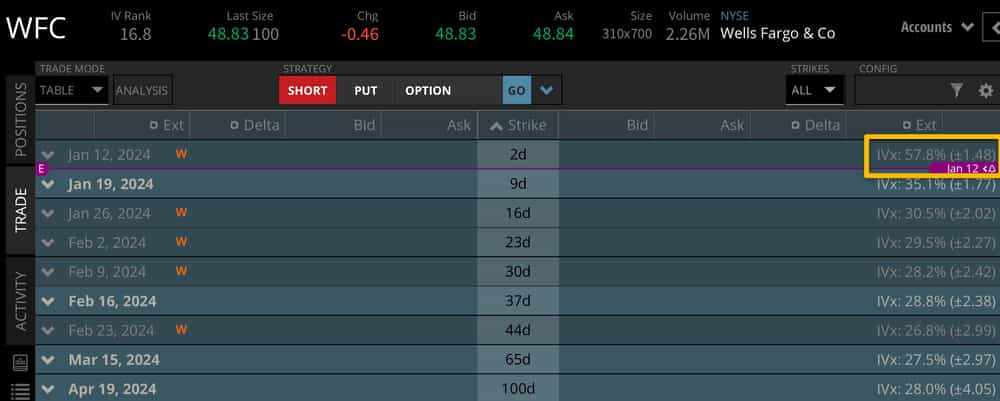

Wells Fargo (WFC) will report quarterly earnings at 5:55 a.m. CST before the market opens on Jan. 12. Wells Fargo is expected to report an EPS of $1.08 on $20.37 billion in revenue. This is a lower EPS expectation compared to the previous quarter's $1.22 figure but a higher revenue expectation than last quarter which was $20.01 billion. Wells Fargo exceeded EPS expectations the past four quarters in a row and has missed revenue expectations only once over the past four quarters.

WFC stock has an expected move of +-$1.48 this week, which makes up for just over 3% of the current stock price which sits at $48.83. The February 2024 cycle has an expected move of +-$2.38, so this expected move is the second-highest of the banking stocks discussed relative to February.

Bullish on bank stocks for earnings

With the interest rate cut narrative for 2024, a bullish picture for bank earnings may need to come with the Federal Reserve extending the time-horizon for interest rate cuts. With EPS and revenue figures for most of these stocks much lower than in the previous quarter, it could be easier for the banks to beat expectations. But the market would have to digest this information positively alongside a strong 2024 forecast.

Bearish on bank stocks for earnings

Net interest income (NII) has been and should continue to be strong for all four of these banking stocks in the higher interest rate environment we've seen in many years, but the implied decline in interest rates this year and beyond from the Fed could paint a bearish picture for banking stocks. Pair this with the slowdown in lending and a large reduction in EPS and revenue expectations for most of these banking stocks, and we might see a much more choppy 2024 for these banks relative to the rally we saw at the end of 2023.

Tune in to Options Trading Concepts Live on Friday, Jan. 12, as we review each banking stock's figures after they report earnings.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.