Learning to Use tastytrade's New Backtesting Research Tool

Learning to Use tastytrade's New Backtesting Research Tool

By:Mike Butler

You can draw upon over 10 years of history to see how a strategy has performed in differing market conditions

- Backtesting tools enable you to research historical performance of options strategies.

- Test entry and exit conditions for different options strategies.

- See how the strategies performed in the most volatile of markets.

- Research over 10 years of options data with visual, in-depth options strategy results.

Investors can use an options backtesting tool to research trades with specific entry and exit conditions and see the historical results. The tools help you get a better idea of results for certain strategies in different stocks and exchange-traded funds (ETFs), without having to endure the stress of putting capital at risk. This is especially useful for traders looking for max loss, max profit, and average returns on defined and undefined risk strategies that experience volatile market movements. Examples include the recent market sell-off in August or the COVID-19 market meltdown.

The tastytrade brokerage firm offers tools for trade management. It recently released the options backtesting tool on the web-based platform. After signing in on my.tastytrade.com, you can access the backtesting tool along the left-side panel.

How does the tool work?

The tastytrade backtesting tool enables investors to research an options strategy on a stock or ETF over a specific timeframe. Once the backtest is run, the tool displays myriad results. After the results are populated, you can view trade metrics, such as average profit or loss, total profit or loss, return on used capital, and max loss drawdown. Learn how to set up the backtest with an options strategy below:

1) Select a ticker symbol

Choose one of the popular stock or ETF ticker symbols from the drop-down menu. More symbols are added regularly.

2) Select a research timeframe

Use more than 10 years of historical options data to create a window of time to analyze your strategy in volatile stock market periods, calm stock market periods or a mixture of both.

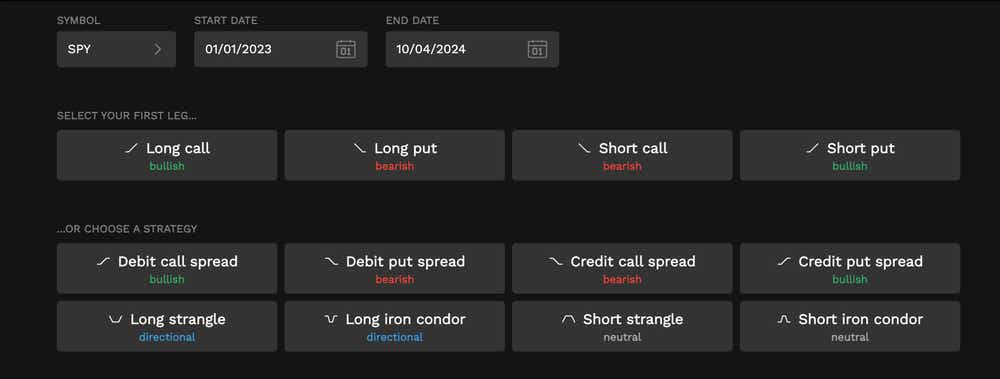

3) Choose your options strategy or build a custom one

The tool enables you to build and analyze a custom strategy manually, using a long call, short call, long put or short put. Alternatively, you can choose from one of the popular strategies listed:

- Short vertical call spread

- Long vertical call spread

- Short vertical put spread

- Long vertical put spread

- Short strangle

- Long strangle

- Short iron condor

- Long iron condor

For this example, I'm going to backtest a short put in SPY from Jan. 1, 2023, through last week. In the next section, we can further customize our trade entry and exit parameters.

Backtesting an options strategy

Now that we've selected an options strategy and specified our data timeframe, we can further customize the trade parameters. This will ensure trades are entered as closely as possible to your intended style of trading.

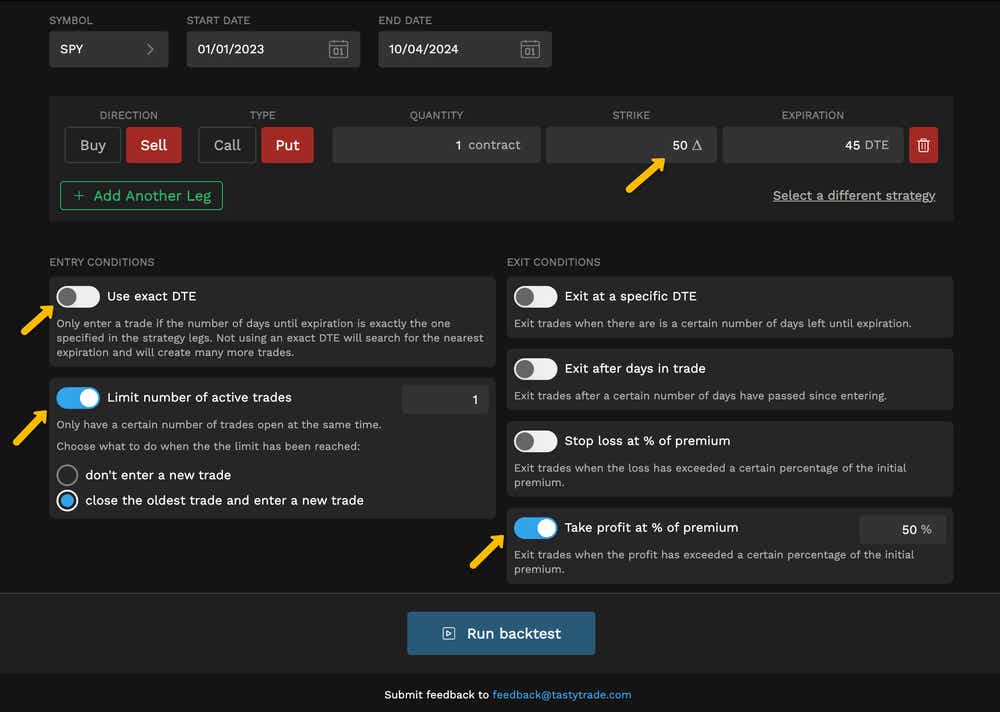

4) Edit strike delta, quantity and days to expiration (DTE)

For this example, I've adjusted the strike delta on entry to 50. This will tell the system to sell an at-the-money (ATM) put strike closest to the stock price each time a new trade is entered, to maximize extrinsic value collection at the beginning of the trade. I've left the contract quantity at one contract by default, and I've left the DTE at 45, which is where theta can start to accelerate based on our research pieces.

5) Edit options trade entry conditions

Here you can decide whether to use exact DTE parameters or the closest expiration to your target DTE. I've disabled this feature for this example, so this is not a limiting factor on new trades—we’ll choose the nearest options expiration for this simulation.

You can also set an active trade cap in this section. I've enabled this feature to ensure only one short put is on at any time. If the trade is active, you can’t place a new trade until the present trade is closed.

6) Edit options trade exit conditions

Adjust your options trade exit parameters on this page to ensure trades are closed based on DTE remaining, days in the trade, percentage of loss realized or percentage of profit realized. In this example, I've only adjusted the percentage profit realized. The short put will be closed if the trade reaches 50% of max profit, which means buying it back for half of the value I sold it for.

Once you're happy with all of the trade entry and exit parameters, it's time to run the backtest.

View the options backtest results

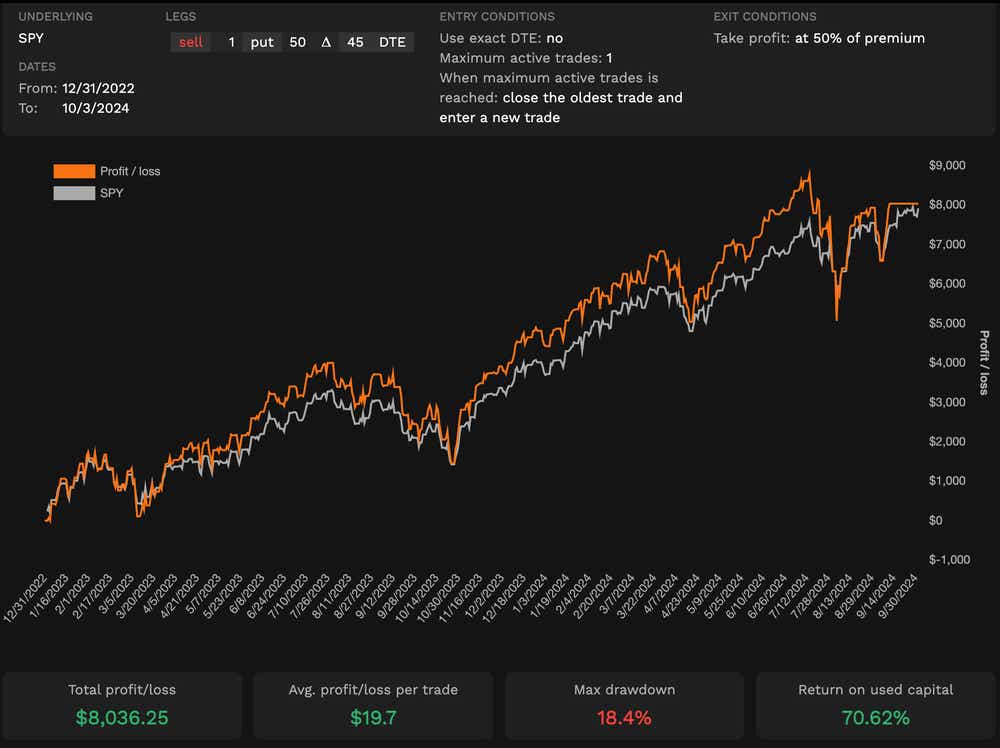

Options backtest result summary page

If you've reached this point, you've done it! The backtest results are in, and you're ready to analyze the trade. The first page you'll land on is the summary page, which shows you a graphical representation of cumulative profit or loss (orange line), relative to the price performance of the underlying asset (grey line).

Below the chart, you can see total profit or loss, the average profit or loss per trade, the max drawdown and the overall return on capital used based on buying power requirement. This page is a nice visual summary page, but more granular data can be found on the details tab along the top.

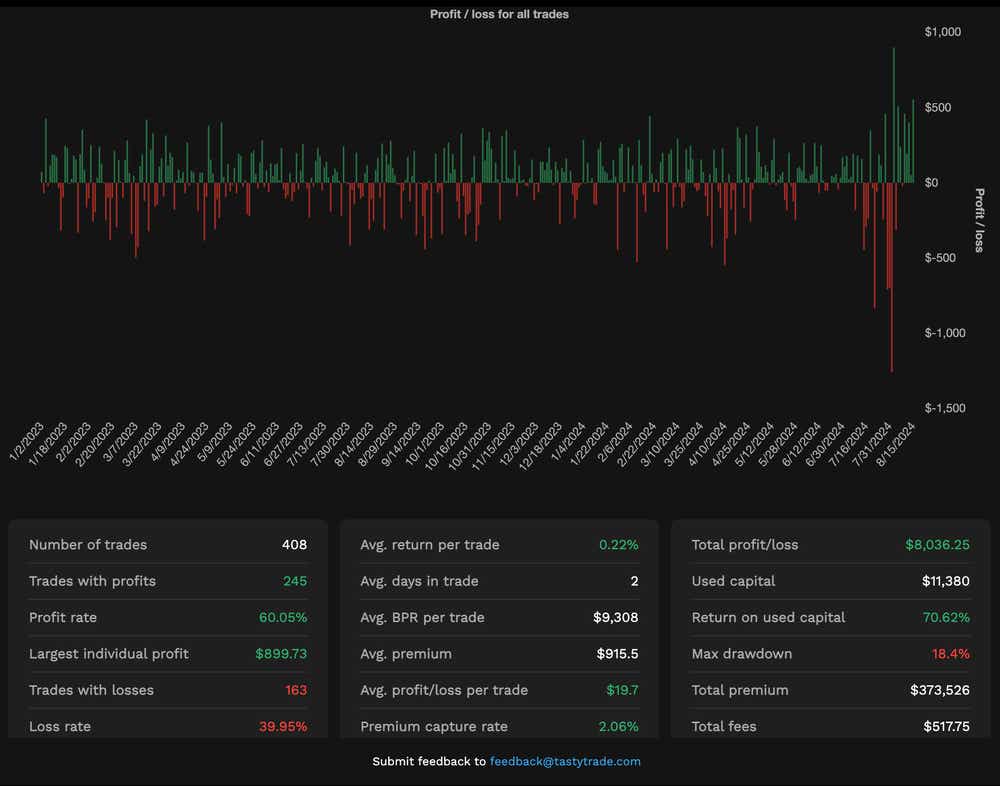

Options backtest result details page

The details tab shows you a different view of the backtest, and the graphic you see is the isolated profit and loss (P/L) for each options trade instead of a cumulative total. You can see exactly where the biggest drawdowns and biggest gains took place on this page.

Below the chart, granular simulation data—like the total number of trades that were placed, the number of trades with profit and the number of trades with loss, the average days in a trade and much more.

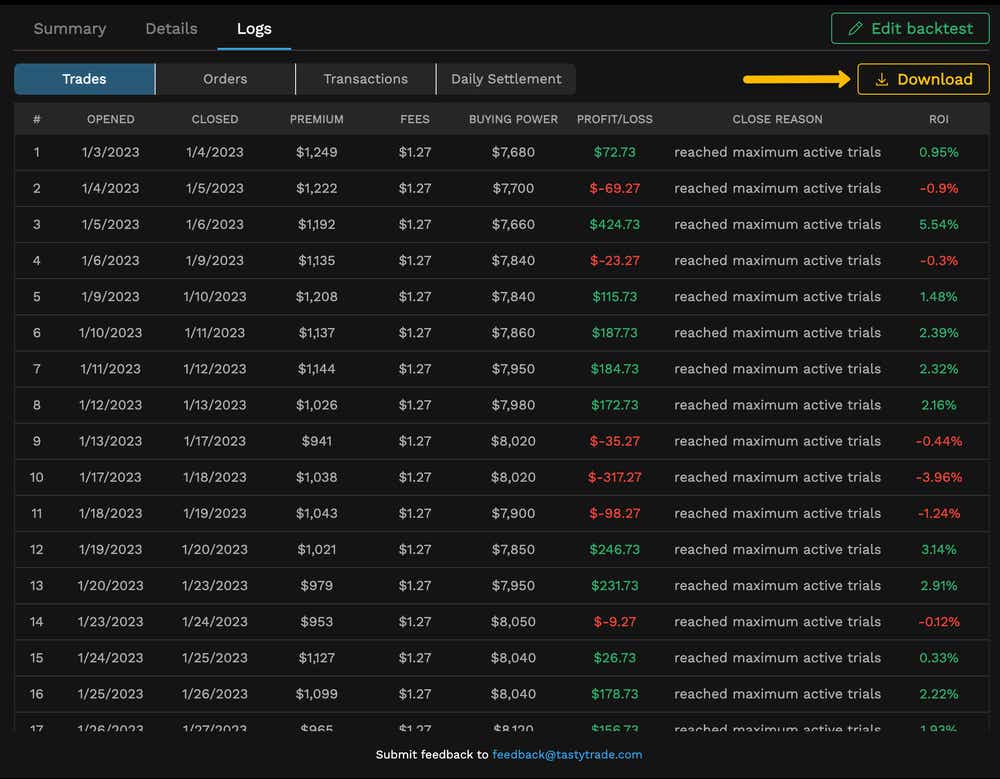

Options backtest result logs page

On the final tab of the backtest results page, you'll find the trade logs for each line item entered and exited. This is a true raw view of the data for the backtest where trades, orders, transactions and settlement can be analyzed. The best part? You can download results from this page for additional analysis.

Backtesting options trades on the tastytrade platform can now become a staple in your pre-trade planning, giving you a better idea of profit and loss estimations based on different eras of implied volatility, price action and much more.

Shoot us a note in the YouTube chat during Options Trading Concepts Live at 11 a.m. CDT every market day if you'd like us to analyze trades using the backtesting tool!

Check out the tastytrade help center article for more information on the backtesting tool.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.