Avoid Leveraged Exchange-Traded Funds

Avoid Leveraged Exchange-Traded Funds

We've receive lots of questions about leveraged ETFs. Here’s why we avoid trading them. Also, new VIX backtesting features and two strategic options trades on GOOGL, DKNG.

When comments and questions roll in about leveraged exchange-traded funds (ETFs), like SQQQ, TQQQ, MSTX, UPRO and FAS, we advise steering clear.

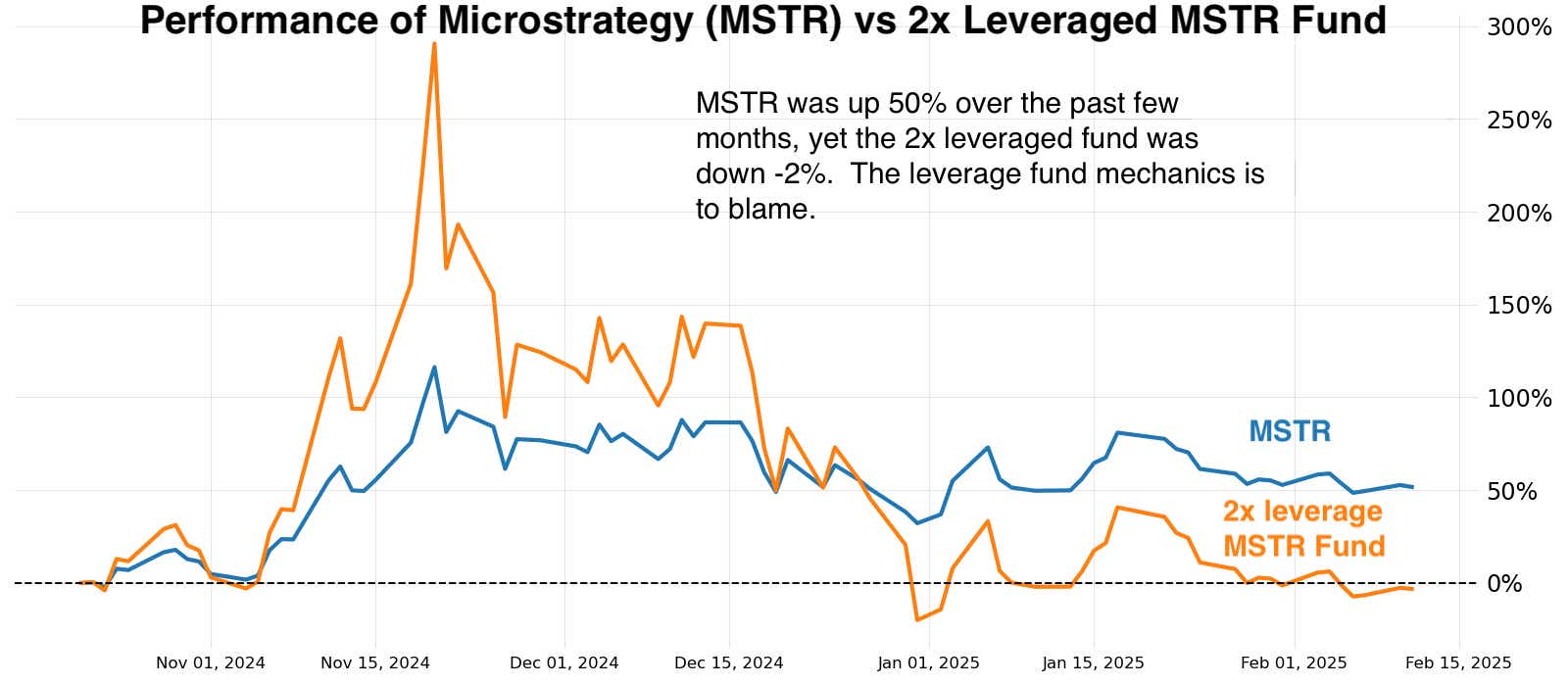

Here’s a real-life example that demonstrates the problem:

MicroStrategy (MSTR) gained 50% from November to today, yet MSTX, its 2x leveraged fund, lost 2%.

While compounding amplifies gains, it also magnifies losses. When a stock drops 20%, a 2x leveraged product falls 40%. The problem? To recover from a 40% decline, you need a 67% gain to break even.

The math below shows why:

Breakeven increase % = ((1 / (1-d) -1)) × 100 = ((1 / (1-0.40) - 1) × 100) = 66.67%

For this reason, we avoid leveraged funds. Options provide plenty of leverage as-is.

New Feature on the Backtester

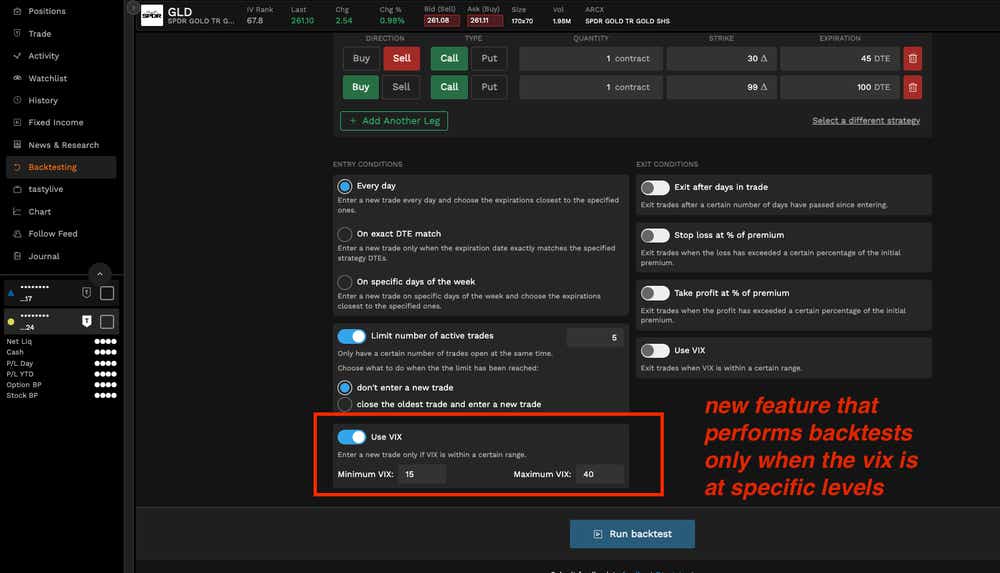

This is super-cool stuff. The backtester now can place trades based on different levels of the VIX.

This new feature enables you to run backtests filtered by VIX levels. For example, you can test strategies only when the VIX is between specific thresholds, like above 15 and below 40. Or you can exit the trade if the VIX gets above a specific threshold.

It’s available for free with tastytrade.com.

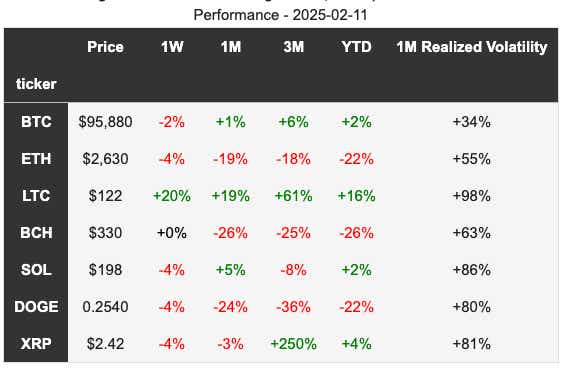

Available Crypto

Below, we show the coins available for trading on tastytrade. You can buy, sell or transfer to a self-custody wallet through the platform. If you haven't signed up already, Ryan's weekly newsletter is a great source of articles and insight into what’s happenings in the crypto world!

More information can be found here:

Two Trade Ideas

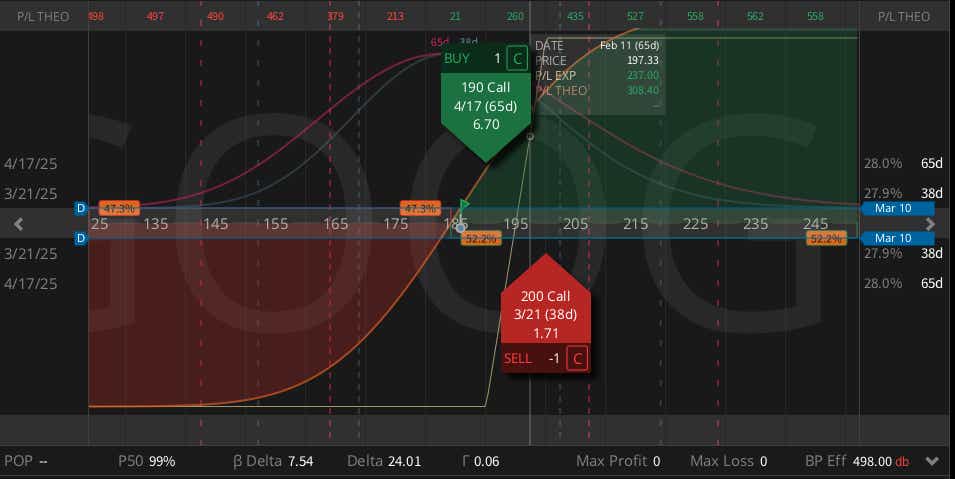

GOOGL ($185) Call Diagonal Spread (APR/MAR) $4.98 debit

Alphabet (GOOG) has been left for dead after earnings, which were down 5% to 10% from highs with volatility near lows. If you think it might be time to start getting long, diagonal spreads are relatively cheap given the current volatility. Go long the 190 call in APR and short the 200 call in MAR. This provides nearly 25 long delta for just under a $5.00 debit.

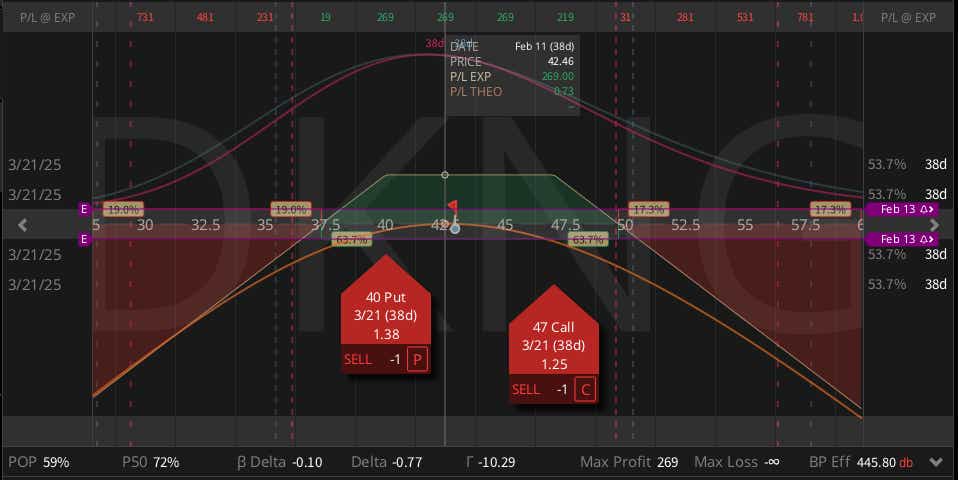

DKNG ($42.90) Short Strangle (MAR) $2.69 Credit

DraftKings (DKNG) reports earnings after the close this Thursday, with volatility high with IVR at 43. No Saquon Barkley touchdown for the Super Bowl? That must be good for business, but it is nearing recent highs. If you think there is a sideways move and a nice volatility crush, the 40/47 strangle in MAR is a delta neutral strangle that uses only around $500 in BP for a high potential ROC if it stays inside the $3.50 expected move.

Subscribe to Cherry Picks to be Cool. We’re OK with grifters, but to be on our good side subscribe to our newsletter.

Sharing is caring. Forward this email to your friends so they can subscribe to our newsletters, too! Get weekly data-driven trade ideas with Cherry Picks and daily pre-market insights and trade ideas with Cherry Bomb.

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He’s best known for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex and macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.