Top 10 Stocks to Watch: October 2024

Top 10 Stocks to Watch: October 2024

The market appears likely to continue to rally, but sellers might want to test the downside in the next couple of weeks

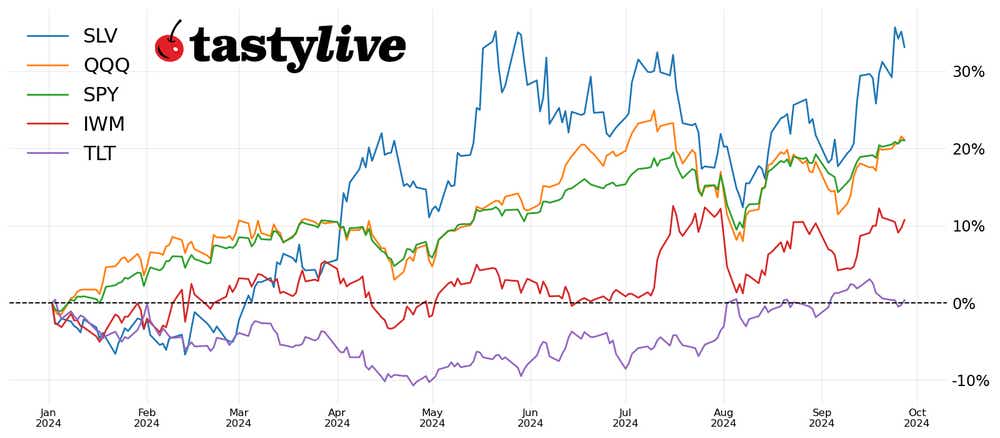

Market Update: S&P 500 E-Mini futures up 20.35% year-to-date

Since our last update at the end of August, the market dropped to $5,394 on Sept. 6 and then rallied to all-time highs, peaking at $5,380 last Thursday. That’s a 436-point rally in 20 days.

This price action shows sellers took over at the end of August through early September, possibly looking to push beneath the August low of $5,120, but were met with strong buying support on Sept. 6, far above August’s low.

Price action remains bullish. We have yet to see sellers take over since that Sept. 6 low. The market will likely continue to rally into October, but it feels as though sellers want to test the downside again in the next couple of weeks. If that’s the case, look for continued stair stepping upward after a selloff. Broader economic market influences are likely at work. We continue to wait for market weakness from the current price.

A note on earnings trades

To capture the volatility of earnings announcements, earnings trades are often executed either the day before or on the day of the earnings announcement. However, earnings trades can also be placed days or weeks before an earnings event, which could lead to early profit taking.

Alternatively, placing a trade shortly after an earnings announcement can be a strategic choice to circumvent the binary nature of the event. Evaluate each trade in a way that allows you to execute the position that matches your strategy.

If you're considering a trade going into an earnings event, one approach is to initiate the position in the monthly options contract that follows the earnings event. This strategy offers flexibility. Should you need to defend your position—perhaps because of unexpected market movements—you have the choice to “roll” it out to the subsequent monthly options. Rolling out the position enables you to extend its duration and potentially collect more premium, providing a buffer against market volatility.

Top 10 stocks to watch in October 2024

Nike (NKE) – Oct. 1, After the close

Delta Air Lines (DAL) – Oct. 10, Before the close

Alcoa (AA) – Oct. 16, After the close

Tesla (TSLA) – Oct. 16, After the close

Charles Schwab (SCHW) – Oct. 21

Alphabet (GOOGL) – Oct. 22, After the close

Visa Inc. (V) – October 22, After the close

Microsoft (MSFT) – Oct. 22, After the close

Amazon.com (AMZN) – Oct. 24, After the close

Advanced Micro Devices (AMD) – October29, After the close

1.Nike (NKE)

Nike designs, develops, markets and sells athletic footwear, apparel, equipment and accessories. NKE is down 16.33% year-to-date. Its IVR is 54.8, with October IVx at 40.4, November IVx at 33.4, and its liquidity is rated four out of four on the tastytrade platform.

NKE is a medium-priced stock, so medium sized accounts could consider a naked position. A 20-delta short strangle sets up well. 30-delta short directional spreads also set up well with your desired amount of risk.

2. Delta Air Lines (DAL)

Delta Air Lines transports passengers and cargo throughout the United States and around the world. DAL is up 30% year-to-date. Its IVR is 61.3, with October IVx at 42.2, November IVx at 39.9, and its liquidity is rated three out of four on the tastytrade platform.

DAL is a lower-priced stock, so smaller-sized accounts could consider a naked position. A 19-delta short strangle sets up well. At the money, $5-wide, short directional spreads also set up well if you have a directional assumption.

3.Alcoa (AA)

Alcoa produces bauxite, alumina and aluminum products. AA is up 17.95% year-to-date. Its IVR is 73.2, with October IVx at 61.4, November IVx at 57.9, and its liquidity is rated three out of four on the tastytrade platform.

AA is a low-priced stock, so smaller-sized accounts could consider a naked position. A 19-delta short strangle sets up well. At the money, $5-wide, short directional spreads also set up well if you have a directional assumption.

4. Tesla (TSLA)

Tesla designs, manufactures and sells electric vehicles and energy-generation and storage systems. TSLA is up 3.45% year-to-date. Its IVR is 101.9, with October IVx at 78.5, November IVx at 70, and its liquidity is rated four out of four on the tastytrade platform.

TSLA is a high-priced stock, so the majority of accounts will want to consider defined risk positions. A short, 19-delta iron condor sets up well. Directional spreads can be set up in either direction with your preferred amount of risk. Watch out for wider bid-ask spreads.

5. Charles Schwab (SCHW)

Charles Schwab offers banking, securities brokerage and financial advisory services. SCHW is down 5.77% year-to-date. Its IVR is 47.4, with October IVx at 41.2, November IVx at 37.7, and its liquidity is rated four out of four on the tastytrade platform.

SCHW is a lower-priced stock, so smaller sized accounts could consider a naked position. A short, one-standard deviation strangle sets up well. At the money, $5-wide, short directional spreads also set up well if you have a directional assumption.

6. Alphabet (GOOGL)

Alphabet, the parent company of Google, offers technology services like search engines, advertising and operating systems. GOOGL is up 18.68% year-to-date. Its IVR is 44.6, with October IVx at 25.5, November IVx at 32.6, and its liquidity is rated four out of four on the tastytrade platform.

GOOGL is a high-priced stock, so most accounts will want to consider defined risk positions. A short, 19-delta iron condor sets up well. 30-delta, short directional spreads also set up decently if you have a directional assumption.

7. Visa (V)

Visa operates a global payments technology company that facilitates digital payments among consumers, merchants, financial institutions and government entities. V is up 6.58% year-to-date. Its IVR is 48.1, with October IVx at 18.7, November IVx at 23.9, and its liquidity is rated three out of four on the tastytrade platform.

V is a high-priced stock, so most accounts will want to consider defined risk positions. A short, 21-delta iron condor sets up well. 30-delta, short directional spreads also set up decently if you have a directional assumption.

8. Microsoft (MSFT)

Microsoft develops, licenses and supports software products, services and devices. MSFT is up 14.6% year-to-date. Its IVR is 31.1, with October IVx at 20.7, November IVx at 26.7, and its liquidity is rated four out of four on the tastytrade platform.

MSFT is a very high-priced stock, so most accounts will want to consider defined risk positions. A short, 19-delta iron condor sets up well. Directional spreads can be set up in either direction with your preference of risk if you have a directional assumption.

9. Amazon.com (AMZN)

Amazon.com, an online retailer, provides cloud computing and digital streaming. AMZN is up 23.92% year-to-date. Its IVR is 31.1, with October IVx at 27.3, November IVx at 36.3, and its liquidity is rated four out of four on the tastytrade platform.

AMZN is a high-priced stock, so most accounts will want to consider defined risk positions. However, a one-standard deviation short strangle sets up well. A short, 21-delta iron condor sets up well. 30-delta, short directional spreads also set up decently if you have a directional assumption.

10. Advanced Micro Devices (AMD)

Advanced Micro Devices designs and produces microprocessors and low-power processors for the computer and consumer electronics industries. AMD is up 14.36% year-to-date. Its IVR is 41.2, with October IVx at 45.7, November IVx at 51.6, and its liquidity is rated four out of four on the tastytrade platform.

AMD is a high-priced stock, so most accounts will want to consider defined risk positions. However, a one-standard deviation short strangle sets up well. A short, 20-delta iron condor sets up well. Directional spreads can be set up in either direction with your preference of risk.

Ryan Sullivan is an active options and forex trader and programming producer for the tastylive network.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.