Applied Digital (APLD) Valuation in Focus After Nvidia (NVDA) Reveals New Stake

Applied Digital (APLD) Valuation in Focus After Nvidia (NVDA) Reveals New Stake

This small-cap stock is clinging to Nvidia’s coattails, all the way to a 90% rally

- Applied Digital’s shares have climbed more than 90% in the past six months, fueled by a pivot toward high-performance computing and a new investment by Nvidia.

- The company has expanded from blockchain to AI infrastructure, delivering impressive revenue growth in recent quarters as it scales its operations to meet surging demand for high-performance computing.

- Small-cap companies like Applied Digital aren’t easy to value, but the combination of the latest strategic pivot, increasing revenue and Nvidia’s backing suggests the stock has more room to run.

As artificial intelligence and high-performance computing continue to evolve, Applied Digital (APLD) has emerged as a company to watch. The stock has surged an impressive 90% over the past six months, fueled by strong revenue growth and a strategic pivot toward AI infrastructure. Adding to the buzz, Nvidia (NVDA), the undisputed leader in AI hardware, recently disclosed a 3% stake in Applied Digital, representing 7.72 million shares valued at $63.66 million as of the end of Q3 on Sept. 30.

What does Nvidia’s involvement mean for Applied Digital’s valuation and long-term prospects? The investment not only strengthens the company’s financial position but also highlights its potential to become a key player in the AI-driven economy. With momentum on its side and a growing footprint in cloud services and high-performance computing (HPC), Applied Digital is navigating a critical phase in its growth. Let’s explore the company’s recent developments, assess its valuation and consider what might constitute a fair price for its shares.

Building infrastructure for cutting-edge technology

In the rapidly evolving world of technology, Applied Digital has emerged as a key player in HPC. Specializing in next-generation data centers, the company is positioned to support the growing demands of AI and blockchain technology—two forces reshaping tech.

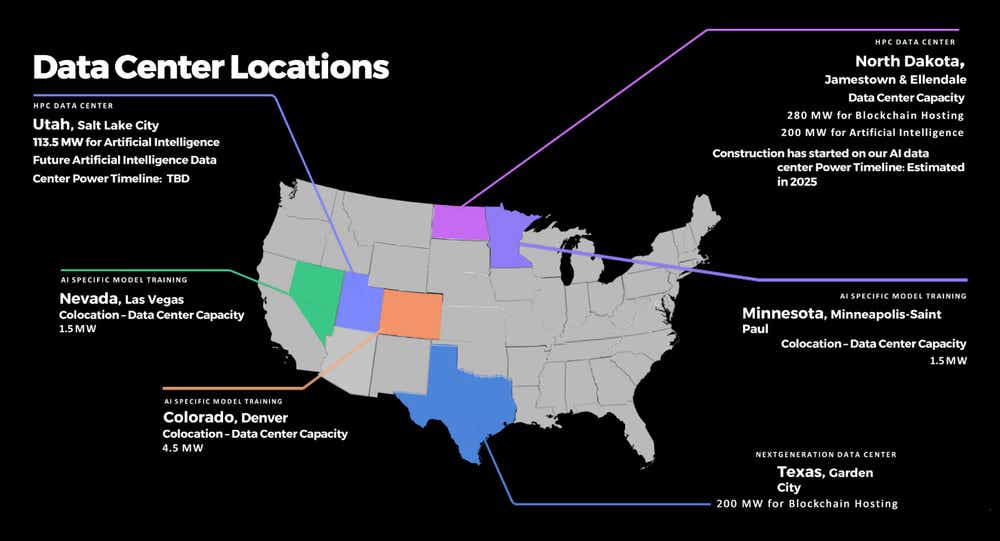

Applied Digital’s business model revolves around designing and operating cutting-edge data centers capable of managing the vast computational and energy requirements of AI workloads and blockchain networks. Strategically located in areas with access to low-cost renewable energy, these facilities underscore the company’s commitment to sustainability—an increasingly critical factor in an industry grappling with its environmental impact.

The company’s rise coincides with a broader shift toward decentralized systems and generative AI—both requiring immense computing resources. From training large language models to powering decentralized finance and Web3 applications, the demand for scalable, energy-efficient infrastructure has never been greater. Applied Digital’s ability to deliver, build and operate data centers places it in a strong competitive position as businesses and developers seek reliable partners to meet their growing needs.

Competing on sustainability and cost efficiency

In the competitive world of high-performance computing, Applied Digital is carving a niche by targeting cost-conscious and sustainability-focused clients. The company finds itself compared to players like CoreWeave, a rapidly growing provider of AI server rentals with high-profile contracts, including its partnership with Microsoft. While CoreWeave leverages scale and strategic relationships to dominate certain segments of the AI infrastructure market, Applied Digital offers a distinct value proposition: cost-effective, energy-efficient data centers tailored to the surging demand for AI-driven workloads.

Applied Digital’s recent pivot from its blockchain-focused origins to a broader emphasis on AI infrastructure marks a significant step in its evolution. This diversification aligns with industry trends, as AI applications continue to outpace other technologies as growth drivers for businesses across sectors.

Despite its promising focus, Applied Digital operates in a highly competitive field. Established giants like Nvidia, AWS and Google Cloud dominate the HPC market, while smaller, specialized providers, including CoreWeave, vie for market share. The company’s success hinges on its ability to stand out through innovation and sustainability—qualities that resonate with clients balancing performance needs with financial and environmental concerns.

By positioning itself as a critical enabler of emerging technologies, Applied Digital is playing a pivotal role in bridging the gap between innovation and infrastructure. As AI and decentralized systems continue to shape the future, companies like Applied Digital may become indispensable in building the foundation for tomorrow’s breakthroughs.

Surging revenue, rising profit potential

Applied Digital’s financial performance showcases a company in transition, navigating the challenges of scaling while delivering substantial revenue growth. In Q4 2024, revenue surged 98% year-over-year (YoY) to $43.7 million, up from $22 million in the same period of the previous year. This remarkable growth was fueled by the expansion of its data center hosting operations and the early deployment of its cloud-services business. The momentum carried into Q1 2025, with revenue climbing 67% YoY to $60.7 million, driven by the addition of cloud clusters and increased use of HPC facilities (highlighted below).

Sequentially, revenue grew 38.9%, rising from $43.7 million in Q4 2024 to $60.7 million in Q1 2025. This robust quarter-over-quarter growth underscores Applied Digital’s ability to diversify its revenue streams and optimize its infrastructure. However, the company’s path to profitability remains a challenge, with significant investments in expansion weighing on the bottom line. The net loss widened substantially in Q4 2024 to $64.8 million, up from just $6.5 million in the same quarter the previous year, reflecting increased depreciation expenses and operational setbacks like power outages.

In Q1 2025, there was a notable improvement as the net loss narrowed to $4.2 million, thanks to operational efficiencies and stabilized revenue growth. Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization)—a key indicator of operational cash flow—improved from $4.8 million in Q4 2024 to $20 million in Q1 2025, signaling progress in managing costs while driving revenue. However, adjusted net loss for the quarter remained significant at $21.6 million, partly because of $4.4 million in expenses tied to facilities not yet generating revenue.

Applied Digital’s liquidity has also strengthened. Cash holdings rose to $86.6 million in Q1 2025, up from $31.7 million at the end of Q4 2024, boosted by a $160 million private placement financing led by Nvidia. This funding supports ongoing development of the Ellendale HPC campus, which will eventually provide 400 MW of total capacity with plans for further expansion. Debt levels increased modestly to $143.6 million, reflecting the capital-intensive nature of the company’s growth initiatives.

With its ability to sustain strong revenue growth while narrowing losses, Applied Digital is establishing itself as a promising player in HPC and cloud services. However, the company’s long-term success hinges on its capacity to deploy infrastructure effectively and turn its investments into sustainable revenue streams. For investors, the latest earnings results signal progress, but they also highlight the high stakes and inherent risks of Applied Digital’s ambitious growth strategy.

Assessing Applied Digital’s valuation

Valuing Applied Digital presents challenges because the company remains in a high-growth phase, marked by expanding revenue but ongoing net losses. Traditional valuation metrics, such as the price-to-earnings (P/E) ratio, are rendered moot given the company’s history of reporting losses. However, several factors suggest Applied Digital's valuation merits closer consideration, particularly as it narrows its losses and demonstrates strong revenue growth.

One key factor boosting the company’s prospects is the recent $160 million private placement financing, which included an investment from Nvidia, a titan in AI and HPC. Nvidia’s involvement signals more than just financial backing—it implies a level of strategic support that could enhance Applied Digital’s credibility and positioning in the market. Whether through direct partnerships, technical collaboration or broader ecosystem integration, Nvidia’s backing makes Applied Digital a trusted player in fast-growing HPC and cloud services.

Wall Street analysts appear to share this optimism. Of the seven analysts covering Applied Digital, all rate the stock a “buy,” with an average price target of $10.70, reflecting attractive upside from the current price of around $9/share. This bullish consensus is underpinned by Applied Digital’s strong revenue trajectory, with quarterly revenue increasing nearly 100% year-over-year in Q4 2024 and continuing to climb in Q1 2025. Moreover, the company’s financials are trending in the right direction: Applied Digital recently reported a loss of $0.15 per share, which was narrower than the $0.27 consensus loss forecasted by analysts. This beat on earnings highlights the company’s improving operational efficiency and ability to manage costs, even as it invests heavily in its expansion.

At a market cap of approximately $2 billion, Applied Digital remains a small-cap stock, which inherently comes with an added layer of volatility. This relative uncertainty is amplified by the company’s ambitious growth plans and the nascent stage of its profitability journey. However, its low market cap also suggests significant upside potential, particularly if the company can continue its revenue growth trajectory and demonstrate progress toward sustained profitability. Rising revenue—fueled by cloud services and HPC infrastructure— support the notion that the company is moving in the right direction.

Compelling value proposition, but risks remain

Valuing a company like Applied Digital is anything but straightforward, especially following its remarkable 90% rally over the last six months. The momentum driving both the stock and the broader AI sector has been a key factor in its rise, demonstrating the market’s enthusiasm for all things AI. With Nvidia’s recent investment in Applied Digital, the company’s story has become even more compelling, adding a layer of credibility and fueling expectations for future growth.

Applied Digital’s enterprise value/sales (EV/Sales) ratio of approximately 11 suggests the company’s current valuation is not excessively inflated, especially in the context of its high-growth focus on AI and cloud computing. While this figure is higher than the sector median, it remains far more reasonable than Nvidia’s elevated EV/Sales ratio of 35. In comparison, companies like Dell (DELL) (EV/Sales: 1) and Microsoft (MSFT) (EV/Sales: 12) reflect the diversity of valuations within the tech sector, with Dell’s lower multiple tied to its focus on traditional hardware, which doesn’t command the same premium as the cutting-edge niches of AI.

This places Applied Digital in a middle ground—valued as a growth company with strong potential, but not priced at the extremes often seen with AI. This measured valuation, combined with the company’s growing revenue, suggests its stock may be appropriately priced, with further upside as it continues to scale its operations. Reflecting that optimism, all seven analysts who cover Applied Digital currently rate the stock a “buy,” with an average price target of around $10.75/share.

However, investors should remain cautious. Smaller-cap stocks like Applied Digital, especially those with valuations based on future growth assumptions, are highly sensitive to broader market conditions. If the market encounters turbulence, Applied Digital could see a sharp pullback, as high-momentum sectors like AI often experience disproportionate sell-offs during periods of uncertainty. In a scenario like that, it wouldn’t be surprising to see shares dip temporarily into the $4-$6 range.

For now, a price target of $10-$12 per share appears reasonable, balancing the company’s upside potential against its inherent risk. Applied Digital is undoubtedly positioned to capitalize on the AI boom, but its journey will likely remain volatile—a hallmark of small-cap stocks operating in fast-evolving, momentum-driven sectors. Investors and traders would therefore do well to approach with a blend of optimism and caution, recognizing both the transformative potential of AI, as well as the cyclical nature of market sentiment.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.