AMC APE Preferred Stock: Everything You Need to Know

AMC APE Preferred Stock: Everything You Need to Know

AMC Entertainment announced earnings on August 4th with a loss of (0.20) EPS in the second quarter of 2022, a surprise “beat” on the streets (0.22) expectation. What followed on the earnings call was arguably more surprising - CEO Adam Aron announced the distribution of a preferred stock dividend, APE, for all AMC stockholders.

What is AMC’s meme stock history?

AMC’s recent history is tied closely to the “meme” stock craze that started with GME in early 2021, along with many other stocks which the market had largely written off like BBBY, BB, FIZZ and others. Retail traders have continued to pile into the “HODL” mentality with day-to-day stock trading volume remaining high – many multiples of pre-2021. Stock price volatility has been digested by the retail following as a short-term hiccup to the long-term fight against the hedge funds. Option volume has followed a similar path, with option volatility expanding on the upside as traders position for the next mother-of-all-short-squeezes.

What is the APE preferred stock?

At first glance, this preferred stock distribution looks a lot like a stock split based. This is based on the OCC Settlement Notice, which indicated a 95%/5% split of AMC/APE shares for the settlement of the current open options. In this case, AMC will be issuing 1 share of APE preferred equity for every 1 share of AMC. Traditionally, a stock will split shares to add liquidity, reduce volatility, and to reduce the notional value of one share of stock by issuing more shares of stock. A current holder will still hold the same amount of notional value in the stock as they had pre-split, with more shares of the stock at a lower spot price.

Tune into Options Trading Concepts Live to learn more about AMC & APE Stock Categorization.

How are investors and traders affected?

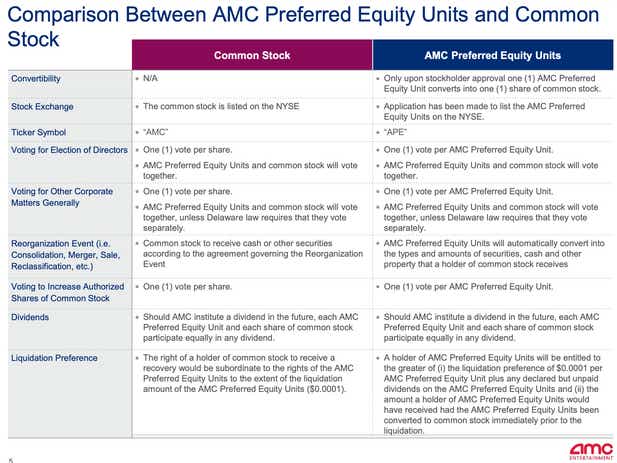

In this case, the preferred stock shares will trade independently of AMC stock at the time of the distribution, with the potential to be converted to AMC shares at a point in the future based on a shareholder vote. This is unique in that most preferred stock don’t have voting rights. With voting rights, holders can choose to vote to convert shares of APE into stock shares (AMC) at a later date.

Who qualifies for AMC’s “APE” special dividend?

All holders of AMC stock as of the August 19th record date received one share of APE, with the first trade of AMC and APE on Monday August 22nd.

Post distribution, APE stock will trade independent of AMC shares. This means that traders can buy and sell AMC and APE separately, the shares will not be tied together as a package.

On the option side, current expirations available prior to the distribution will become non standard, with deliverables of 95%/5% AMC/APE shares. After the distribution, new options chains will be available that will trade based on the post distribution price. With the potential price of APE in the single digits, it’s unlikely that options will be issued for the APE shares.

AMC Stock Outlook and Current Trading

AMC and APE have both been trending lower since the distribution, with AMC trading around $8.25 and APE around $5.00. AMC standard options have been offered, while APE still trades without options. There has be no news from the OCC as to when or if APE options will be offered.

Trading AMC stock is less about fundamentals and more about sentiment. Option pricing is heavily inflated due to huge volume, interest, and speculation, which has driven large day to day price fluctuations in the stock. With an implied volatility north of 100% (according to the tastytrade platform at the time of writing), the option market is implying that the stock could be zero, or double, from its current price over the next year.

Create a tastytrade account or log in (learn more about opening an account at tastytrade)

tastytrade, Inc. and tastylive, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.