Google Earnings Preview—5% Stock Price Move Expected

Google Earnings Preview—5% Stock Price Move Expected

By:Mike Butler

The company has exceeded expectations for earnings per share and revenue for four quarters in a row

Alphabet will report earnings after the stock market closes tomorrow.

The company has exceeded earnings-per-share and revenue expectations four earnings announcements in a row.

The expected earnings result is a $1.84 per share on $84.27 billion in revenue, both figures up from last quarter.

Google Cloud revenue and AI updates will be a focal point for this earnings call.

Google Earnings Preview

The stock market has taken a nose-dive recently, but the Magnificent Seven are reporting earnings in the next few weeks. Alphabet (GOOGL) is one of the first to report after the market closes tomorrow.

Google's earnings track record has been stellar, exceeding earnings expectations four quarters in a row for both earnings per share (EPS) and revenue. This time around, an EPS of $1.84 on $84.27 billion in revenue is the consensus estimate.

GOOGL stock has had a strong 2024 so far, opening the year at $138.55 and currently sitting around $181, up over 30% on the year.

Optimism is abundant at Google, following strong words from CEO Sundar Pichai during the last earnings call: “Our results in the first quarter reflect strong performance from Search, YouTube and Cloud. We are well underway with our Gemini era, and there’s great momentum across the company. Our leadership in AI research and infrastructure, and our global product footprint, position us well for the next wave of AI innovation."

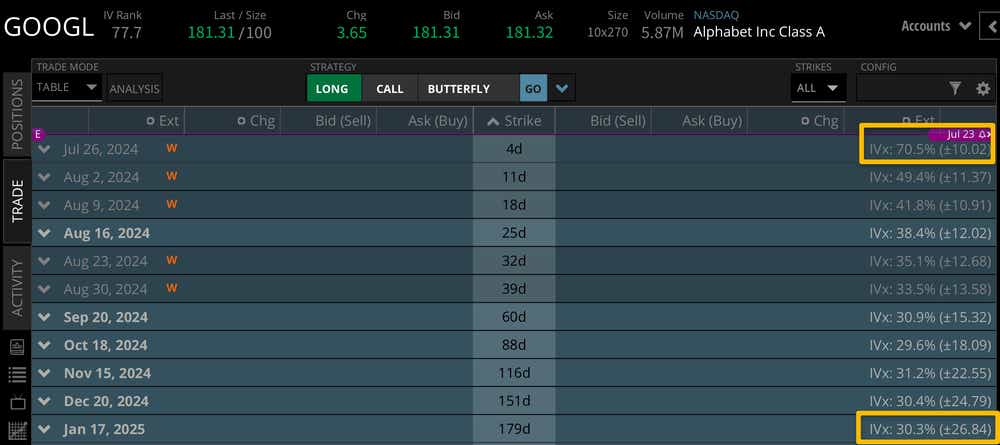

At first glance, it's surprising to see such a low expected stock price move for earnings based on current implied volatility. The expected move for this week is currently +/-$10.02, just over 5% of the current stock price. Typically, we see earnings announcements land in the 5%-10%+ range for the stock price, so this is certainly on the lower end compared to other Magnificent Seven stocks.

With that said, the expected stock price move through the January 2025 expiration cycle is +/-$26.84, so this earnings announcement still makes up over 30% of the expected move through the end of the year.

Many active investors will look for guidance on AI initiatives and growth in important business sectors like Cloud, Search and YouTube.

Bullish on GOOGL stock for earnings

If you're bullish on GOOGL stock for earnings, you likely want to see a strong EPS and revenue beat, with plenty of chatter around artificial intelligence on the earnings call.

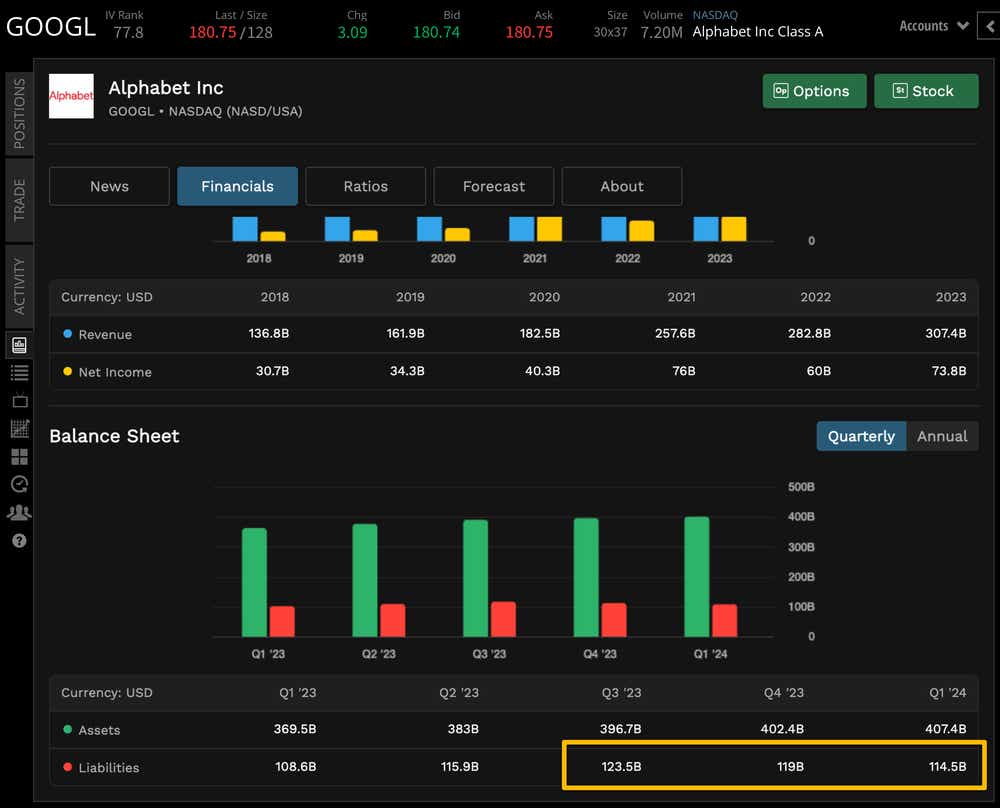

The tech giant has managed to increase assets three quarters in a row, while reducing liabilities three quarters in a row at the same time. This is a great sign for any company, but especially for a company that has the capital to compete in the AI space. If Google can post a strong earnings report with some positive guidance, we may see the stock rally after the fact.

Bearish on GOOGL Stock for Earnings

If you're bearish on GOOGL stock for earnings, you likely believe there will be an EPS and/or revenue miss on the report. If this is coupled with a neutral to bearish guidance for the rest of the year, we could see the stock sell off from the recent rally. Another interesting angle for Google bears could be the result of competitor earnings. If one company really blows things out of the water and a direct competitor's stock price rallies because of it, we could see capital rotate out of GOOGL as well.

Any way you slice it, we're in for an interesting few weeks with plenty of big-name tech stocks reporting earnings soon. Tune in to Options Trading Concepts Live at 11 a.m. CDT tomorrow for a look at options strategies ahead of the earnings announcement!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.