Markets May Stumble if Hot U.S. Inflation Data Puts the Brakes on Fed Rate Cuts

Markets May Stumble if Hot U.S. Inflation Data Puts the Brakes on Fed Rate Cuts

By:Ilya Spivak

The economy has outperformed relative baseline forecasts since late August

- All eyes are back on monetary policy and the Fed as U.S. inflation data looms.

- Bonds, gold and the U.S. dollar seem to position for hotter-than-expected CPI.

- Stocks turn defensive, warning that still higher rates may be tough to swallow.

With the U.S. presidential election outcome in the rearview, the focus has shifted once more to the Federal Reserve and interest rates. The debate about what comes next will get fresh fodder this week as U.S. consumer price index (CPI) inflation data comes across the wires.

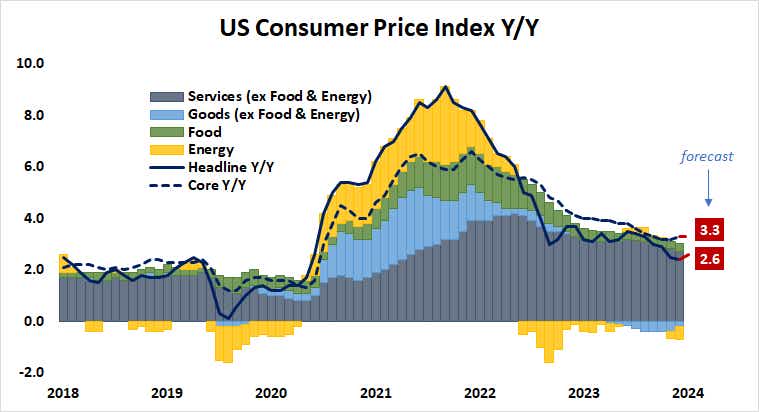

The headline inflation rate is expected to inch up to 2.6% year-on-year in October, marking the first uptick since March. The core rate excluding volatile food and energy prices—a focal point for Fed officials—is seen holding steady at 3.3% year-on-year. This would amount to the fourth consecutive month without disinflation.

U.S. inflation may be hotter than the markets are expecting

Analytics from Citigroup suggest U.S. economic data outcomes have increasingly outperformed relative baseline forecasts since late August. This points to a growth trajectory fundamentally hotter than analysts’ models have anticipated and might set the stage for CPI to overshoot.

Financial markets traded as if to position for just such an outcome on the day before the release. Treasury bonds plunged across maturities, but the long end underperformed, driving a steepening of the yield curve. The U.S. dollar surged against major currencies and gold prices slumped to the lowest in three weeks.

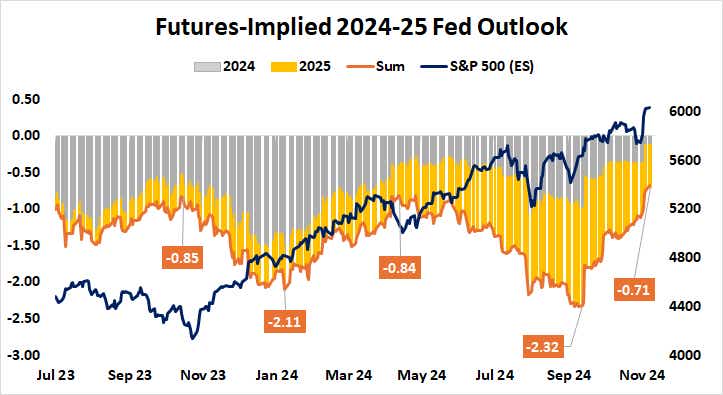

Tellingly, the priced-in probability of another 25-basis-point (bps) rate cut in December implied in Fed Funds futures fell to 58.7% from 65.3% yesterday. The path for 2025 grew shallower too. The markets now see just 53bps in cuts next year, which amounts to the most hawkish setting since mid-April.

Will stock markets break as Fed rate cut bets evaporate?

Wall Street seemed mildly annoyed against this backdrop. All the major U.S. stock indices are on track to finish the day lower but selling especially acute in the small-cup Russell 2000 and the blue-chip Dow. Tech names managed minor gains, helping to mitigate losses in nearly every other sector within the catch-all S&P 500 index.

Taken at face value, this foreshadowing suggests a hotter-than-expected CPI result will not sit well with stock markets. That would amount to regime change, at least for U.S. equities: They’ve managed to rise even as markets trimmed rate cut bets over the past two months. A flip of the relationship would be eye-catching, indeed.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.