Adobe Earnings Preview - Almost 8% Stock Price Move Expected

Adobe Earnings Preview - Almost 8% Stock Price Move Expected

By:Mike Butler

AI attracts customers and adds value for existing clients, the CEO said last year

Adobe is slated to report earnings this week.

It’s expected to beat last quarter’s figures.

This year, the stock has reached a high of $6 38.25 and low of $433.97.

Adobe is scheduled to announce quarterly earnings after the market closes at 3:05 CDT on Thursday.

The company exceeded estimates four quarters in a rowAdobe raised annual performance targets last quarter, so a strong showing is expected.

Adobe Earnings Preview

Adobe is set to announce quarterly earnings on Sept. 12 after the stock market closes at 3:05pm CST. The software company has exceeded earnings expectations from both a revenue and EPS standpoint four quarters in a row, and annual guidance was raised in the last earnings call resulting in a sharp increase in the stock price from annual lows. After opening 2024 at $589.51 and reaching an annual high of $638.25 in early February, the stock has dropped as low as $433.97. Adobe stock currently sits around $570 per share.

Shantanu Narayen, the CEO of Adobe, offered positive remarks on performance last quarter:

“Adobe achieved record revenue of $5.31 billion driven by strong growth across Creative Cloud, Document Cloud and Experience Cloud...”

“...Our highly differentiated approach to AI and innovative product delivery are attracting an expanding universe of customers and providing more value to existing users.”

As you might expect, AI and cloud performance drives success for the software giant.

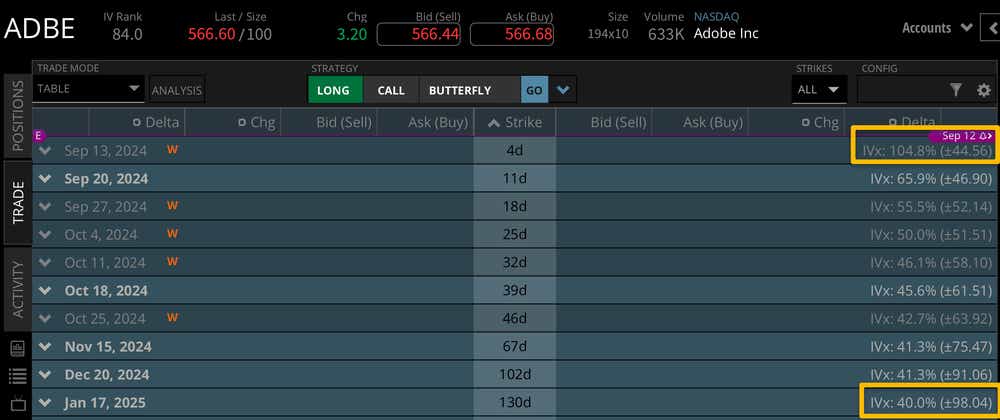

For this quarterly earnings announcement, implied volatility is quite high. Implied volatility helps us put context around earnings announcements, as we can gauge the weekly expected move for the stock price. Today, Adobe has a +-$44.56 expected stock price move for the rest of the week, which contains the earnings announcement Thursday after the close.

This expected range is just under 8% of the notional value of the stock price, which is on the higher end of the typical earnings range of 5-10% for most stocks. Looking further to the end of the year, we can see the implied volatility range of +-$98.04 in the January 2025 expiration cycle. This earnings announcement makes up just under half of that range, so the market is expecting some movement after the close on Thursday.

Bullish on Adobe Stock for Earnings

Traders and investors that are bullish on Adobe stock need a strong earnings call on Thursday. With a stellar track record for earnings recently and an increased annual guidance last quarter, Adobe really needs to wow the market if this stock is going to rally in a meaningful way this week. Bulls will be looking for both an EPS and revenue beat relative to expectations, and ideally some word on being ahead of expectations on increased annual guidance. Any sort of EPS/revenue miss or a stall in performance could break the recent rally we've seen in ADBE stock.

Bearish on Adobe Stock for Earnings

Traders that are bearish on ADBE stock are clearly looking for an earnings miss this time around. The general tech market has been pretty weak recently, which could mean that investors are much more hesitant to pile into stocks that aren't showing great results quarter after quarter. If there is a slowdown in sentiment around Adobe this week, we could see the stock sell off from the recent rally.

Tune in to Options Trading Concepts Live on Thursday, September 12 at 11am CST for a full options trading breakdown in ADBE stock ahead of the announcement after the close!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.