A Little Less Hot: CPI Comes in Lower Than Expected

A Little Less Hot: CPI Comes in Lower Than Expected

Stocks and bonds markets shrug as the headline year-over-year core inflation number comes in at 4.7%, below (4.8%) consensus

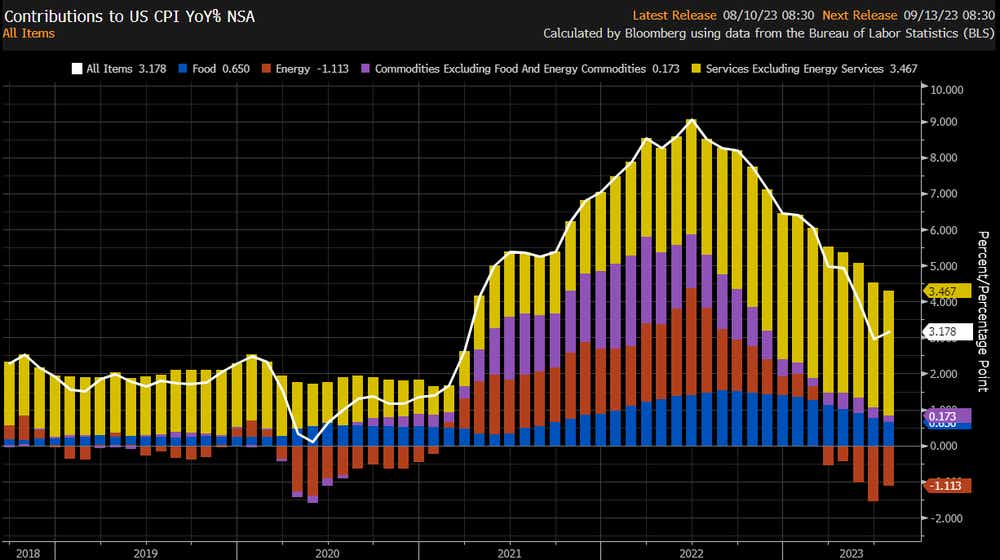

- The July U.S. consumer price index came in softer than anticipated, at +3.2% year over year on the headline and at +4.7% y/y on the core.

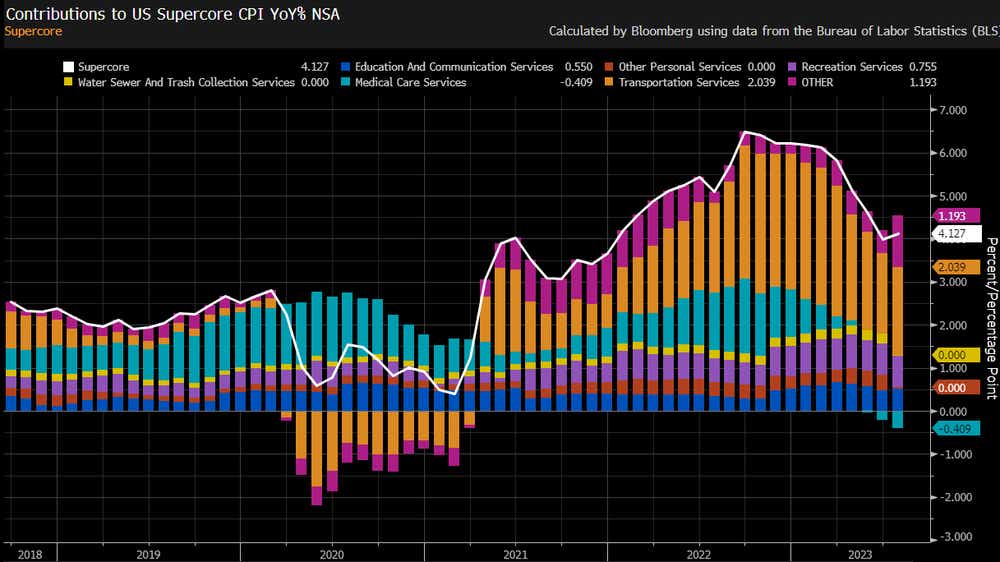

- The Fed’s preferred “supercore” measure—core ex-shelter—increased to +4.1% year over year.

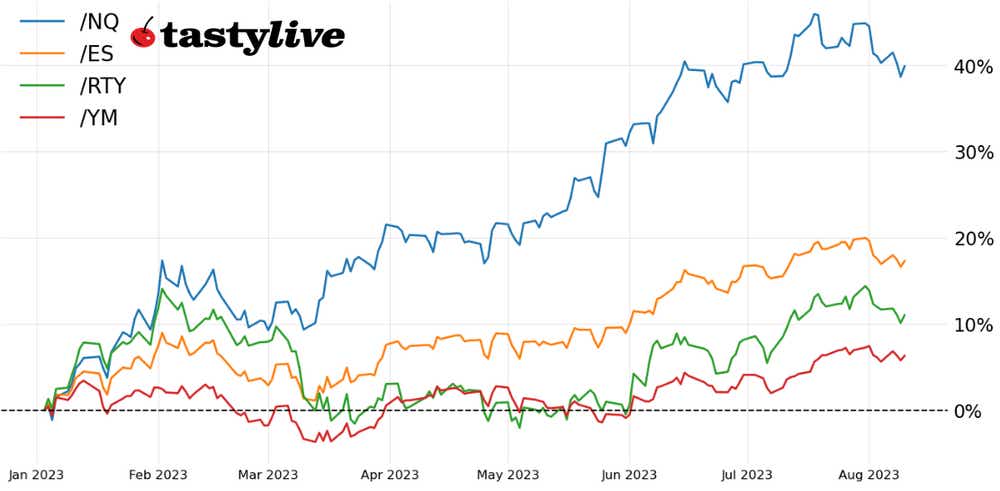

- Equity futures initially rallied, as did bonds, but the reaction has been volatile and mostly directionless following the July U.S. inflation data.

Is the Federal Reserve’s fight against inflation finished? Not quite yet—but we may be getting closer. The July U.S. consumer price index showed gains of 0.2% month over month and 3.2% year over year on the headline and 0.2% month over month and 4.7% year over year on the core. Both year-over-year readings were a touch softer than anticipated (+3.3%/+4.8%).

Courtesy of Michael McDonough, chief economist of financial products at Bloomberg, here’s the breakdown of the headline inflation reading:

And the breakdown of the supercore inflation reading:

The good, the bad and the ugly

The July U.S. inflation report is multi-faceted and has aspects that both inflationistas and transitorians will latch onto to validate their respective beliefs.

There are legitimate deflationary pressures in the pipeline, if you look at the prices paid subcomponent of the ISM Services report. Advanced by three months, ISM services prices paid and headline U.S. inflation have a +0.92 correlation over the past decade. Furthermore, delivery times in the recent ISM surveys—not just for the US, but globally—are at post-COVID lows (and in some cases, challenging lows last seen around the GFC).

And while the OER (owner’s equivalent rent) portion of CPI came in higher than anticipated, private sector measures (like the Apartment List National Rent Index) are showing clear signs of disinflation, if not outright deflation. That’s the good news in terms of why we should anticipate U.S. inflation to come down in the coming months.

The bad news is twofold. First, we’re out of the statistically friendly part of the cycle, as far as base effects in the data will make it more difficult to see headline U.S. inflation come down in the leaps and bounds it did during late-2022 and early-2023. In fact, even if we were to run a very mild +0.1% or +0.2% month over month pace the next few months, headline U.S. inflation would stay above +3% year over year—and potentially see a +4% year-over year-handle—by the December 2023 print (even if that means headline inflation is likely to settle in the +2% year-over-year range by early-/mid-2024).

And the ugly? Commodity prices, from crude oil to live cattle to rice and wheat—are all up considerably from their summer lows (+10% or more in many cases). Inflation breakevens and forwards are at or near multi-year highs, suggesting that these inputs will keep headline inflation elevated in the short term.

How have markets reacted?

The reaction to the data has been mixed, whereby stocks and bonds across the curve initially rallied. But the optimism has thus far been curtailed, as far as stocks backed off their gains (/ES rallied from 4508 to as high as 4525, but was last seen at 4512) and Treasury yields have reversed their losses (/10Y dropped from 3.997% to as low as 3.957%, before returning to 3.997% at the time of writing).

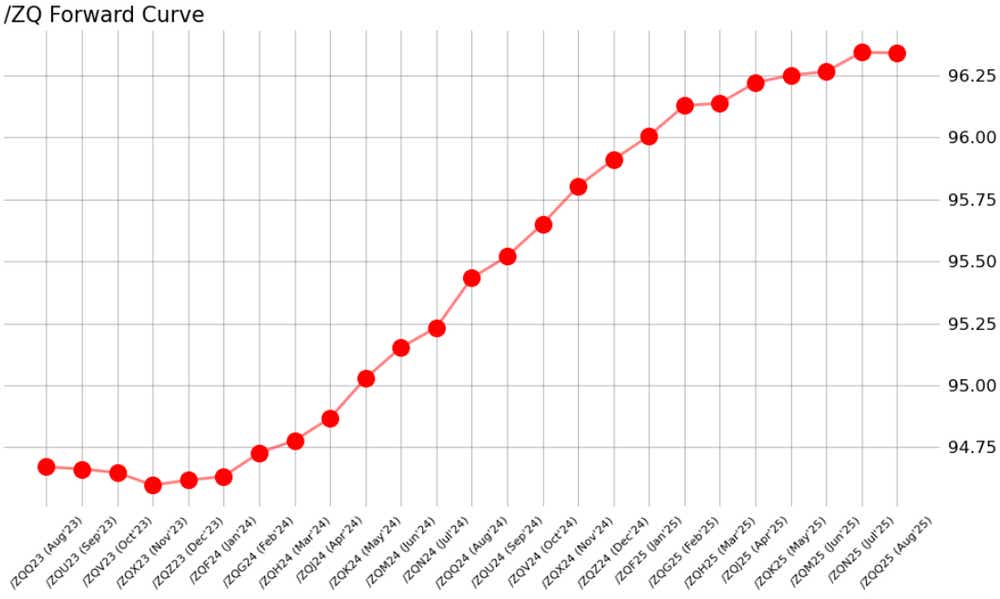

Thus far, the mixed reaction to the report has not done much to shift Fed rate hike expectations in the near term: yesterday, markets were pricing in a meager 14% chance of a 25-basis-point rate hike in September; today, there is a 13% chance, according to Fed funds futures.

/ZQ Fed funds futures forward curve (August 2023 to December 2025)

What does the Fed do next?

Now back to +3.2% year over year, headline inflation is still above the Fed’s medium-term target of +2%, and with the U.S. labor market still showing signs of resilience, Fed policymakers remain of the mindset (as Phillips Curve economic theorists) that they still may need to do more to tame price pressures.

This may not necessarily mean more rate hikes; it could mean interest rates stay higher for longer, which means those rate cuts priced-in for early-2024 are unlikely to actually transpire. After all, Fed Chair Jerome Powell has said interest rates could remain elevated for “years”–the July US inflation report does not necessarily change that calculus.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.