Traders Want More Zero DTE Options So Check Out These New Listings

Traders Want More Zero DTE Options So Check Out These New Listings

By:Mike Butler

Midweek expirations are offering traders more flexibility and a short, volatile timeframe

- The zero DTE craze is spreading across commodities including gold, silver, natural gas, treasuries and oil ETFs with new Wednesday expirations.

- 0DTE options refer to mid-week expirations, which means traders have more flexibility for expiration choices outside of the normal Friday weekly expirations.

- Options with shorter timeframes are more volatile, but they're cheaper than monthly cycle options.

What commodity ETFs are getting 0DTE Options?

The options market got a lot more flexible this week, with Wednesday expiration cycles added for the popular commodity exchange-traded funds (ETFs) listed below:

- iShares Silver Trust (SLV)

- iShares 20+ Year Treasury Bond ETF (TLT)

- SPDR Gold Shares (GLD)

- United States Natural Gas Fund (UNG)

- United States Oil Fund (USO)

If you're an options trader, you probably already know of these products that just got a lot more flexible. With new Wednesday expirations, traders and investors can get more granular with expiration choices,and options strategies that fit their plans to hedge or speculate.

What is a zero DTE (0DTE) option?

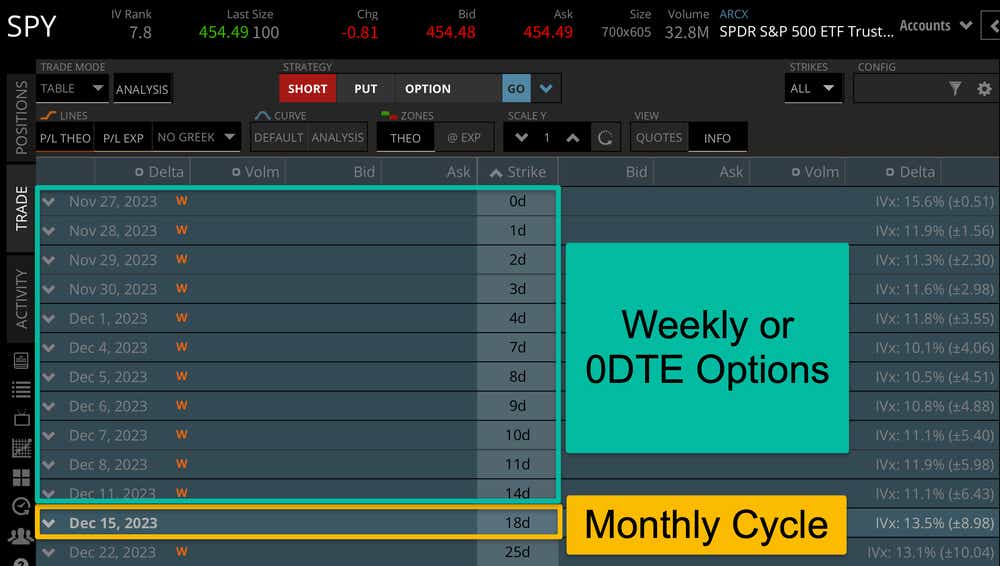

When it comes to options trading, the "normal" expiration cycle is the third Friday of every month. This standard options cycle applies to many products that have listed options. The more activity a stock or ETF sees from traders, the more likely they are to open up more options expirations, like 0DTE cycles, to allow for greater flexibility for traders and investors alike. Products like the S&P 500 ETF (SPY) and the Nasdaq ETF (QQQ), for example, have zero day options expirations every day.

That means traders and investors can speculate on the movement of one day in these products, which makes for a very cheap options contract, and therefore much more leverage. That’s because each options contract gives the owner the theoretical equivalent of 100 shares of stock in leverage if that option moves in-the-money (ITM) and takes on intrinsic value.

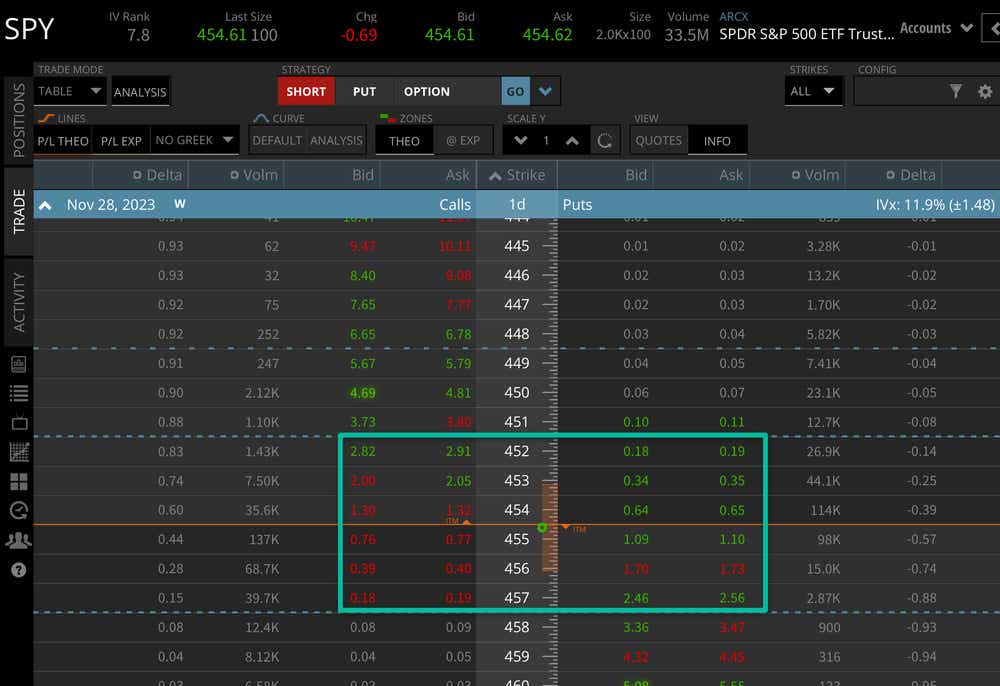

As you can see, these options are inexpensive relative to options in the standard December monthly expiration cycle with 18 DTE. This options cycle will expire tomorrow, Nov. 28 at 4 p.m. EST, 3 p.m. CST.

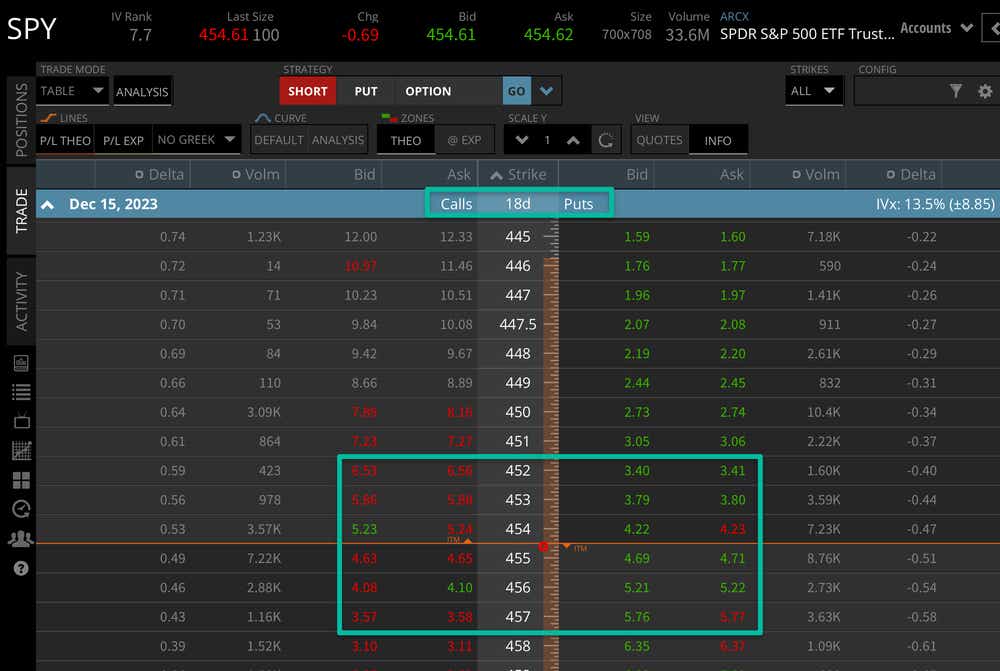

These same options are trading for about 10x the value in the December monthly cycle:

Using 0DTE long options strategies can come with a lot of leverage if you're directionally right. But that also means that if you're directionally wrong, there isn't much time for things to recover, so these options can lose all of their value quickly. It's important to understand that with a shorter timeframe, the implied volatility of the option's price can be higher, compared to longer-duration options.

Why do traders and investors use 0DTE options?

Traders and investors can use 0DTE options for a number of reasons. If investors own shares of stock and want to protect their downside risk ahead of a binary event like a Federal Reserve announcement or an earnings report, they can purchase a put contract in a 0DTE cycle, which would offset 100 shares of intrinsic value risk below the strike price they choose.

The option may cost only a fraction of the risk that they have in the shares. And if the stock rallies in a nice way, the gains on the shares could offset the cost of the long put hedge.

On the other hand, the stock may not move at all, or move down a little bit, where the investor could realize a loss on the shares as well as a full loss on the put options contract.

Traders may decide to get in and out of 0DTE options contracts quickly, speculating on the intraday movement of a stock. Other traders may decide to sell these options to bet the market just isn't going to move that much at all. If these options expire worthless, the trader would keep the credit received from selling the options up front as full profit.

There are many ways to deploy options strategies using 0DTE options cycles, and these are just a few possible examples. There are even ETF funds that deploy 0DTE strategies, like QQQY .

What are the risks and rewards with 0DTE option trading?

The potential reward with 0DTE options trading can be explained simply—more leverage if you're correct in your assumption. These options still represent 100 shares of exposure beyond the strike if it moves ITM, and these options are cheap relative to long-term options or even a share of the stock itself. If a trader is bullish and buys a call option expiring today and the market explodes higher, this trader could see a great return relative to the cost of the option.

The potential risk with 0DTE options trading is just the opposite: If you are wrong in your assumption, you can quickly lose the full debit paid for the option contract. If you're an options seller, the position can become a big loss quickly because the options contracts are not worth that much to begin with. If I sell an option for $0.50 and it moves $5 in the money, that is a net loss of $500-50 = $450.00. Almost 9x the credit received up front. Defined risk options strategies are likely more popular for this reason—you know your risk up front before entering into the trade.

Either way, 0DTE options being added to more products outside of the S&P 500 ETF (SPY) and the Nasdaq ETF (QQQ) can be seen as a good thing.

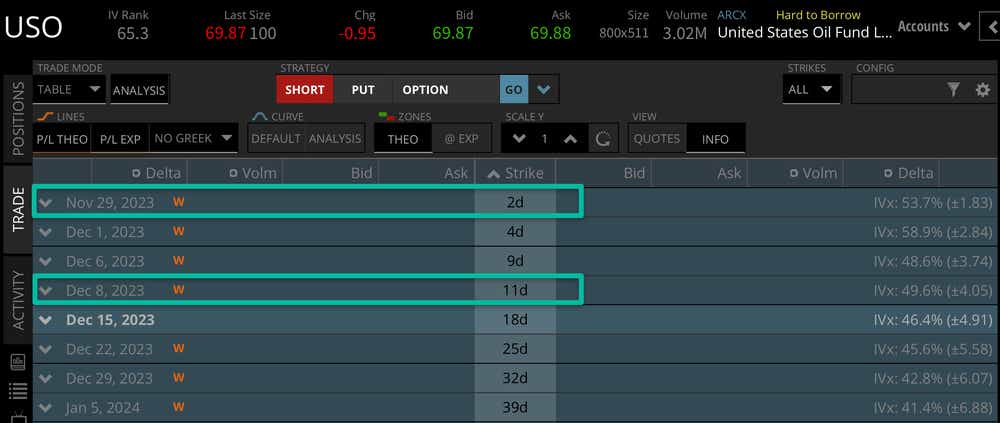

Here is an example of the new Wednesday expirations for the United States Oil Fund (USO):

The more market participants there are, the more likely the market makers are to add more expiration choices and strike price choices. So the fact that these Wednesday expirations are being added to commodity products tells you the options market is healthy.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.