Bonds Drop as Fed Cut Odds Tumble

Bonds Drop as Fed Cut Odds Tumble

Slow stochastics are trending toward oversold territory

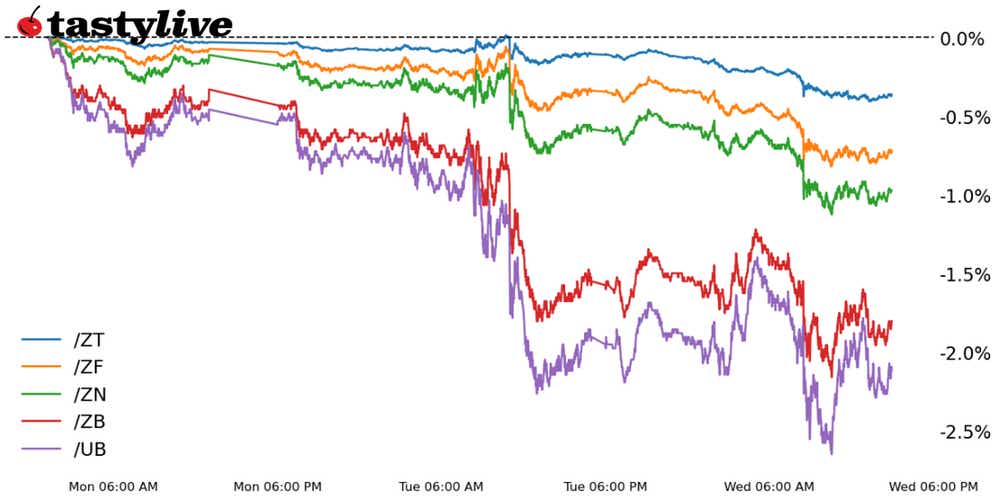

- U.S. Treasury notes and bonds are closing in on their lowest levels of 2024.

- Rate cut odds for 2024 have collapsed in recent days, with the odds of a 25-bps rate cut in March down from 81% on Friday to 57.1% today.

- Bond volatility has not returned despite the move lower in prices.

Market Update: U.S. 10-year yield up to 4.106%

The one-two punch of hawkish commentary from Federal Reserve policymakers and strong U.S. economic data have provoked a dramatic repricing in Fed rate cut odds in recent days. The odds of a 25-basis-point (bps) rate cut in March are down from 81% on Friday to 57.1% today. U.S. Treasury bonds have sold-off alongside the shifting cut odds, proving to be an albatross around equity markets once again.

What changed over the past few days? On the other side of the long weekend, traders were greeted with comments from Fed Gov. Christopher Waller, as well as his counterparts at the European Central Bank, that markets were too aggressive in their expectations for rate reductions in the first half of 2024. A weak 20-year bond auction on Wednesday on the heels of a better than expected December U.S. retail sales report sealed the deal for a shift in expectations as the calendar has moved through the halfway point of the month.

Most of the action this week has been at the long-end of the Treasury curve, though that’s not to dismiss the move in two-year note prices (/ZTH4) and yields (/2YY). Rather, the technical weakness seen in 10s (/ZNH4) and 30s (/ZBH4) is more pronounced, and thus warrants greater attention.

/ZN US 10-year Note Price Technical Analysis: Daily Chart (August 2023 to January 2024)

The U.S. 10-year Treasury note (/ZNH4) is working out its low close for the year thus far today, though it has not traded through the absolute low seen during the first week of 2024. After losing the ascending trendline from the October, November, and December 2023 swing lows, /ZNH4 failed last week to retake the uptrend. Fading momentum - /ZNH4 is below its daily 5-, 13- and 21-EMA envelope (which is in bearish sequential order), Slow stochastics are trending towards oversold territory, and MACD is still trending lower towards its signal—suggests that the path of least resistance remains lower.

A deeper setback toward the late-November swing low/mid-November swing high near 109’20 is feasible short-term. The lack of pickup in volatility (IV Index: 8.1%; IV Rank: 12.2) underscores why bulls need to be patient and let the charts unfold; there is little rhyme or reason to begin trying to collecting premium right now.

/ZB US 30-year Bond Price Technical Analysis: Daily Chart (August 2023 to January 2024)

Unlike /ZNH4, U.S. Treasury 30-year bonds (/ZBH4) has established a fresh yearly low today. The momentum profile is similar as well, although slow stochastics have already entered oversold territory, underscoring the increased bearish tendency. The area around 118’09/28 proved pivotal at the end of November/beginning of December and seems likely to prove to be an area of interest should downside price action develop further. The astounding lack of volatility in /ZBH4 (IV Index: 14.1%; IV Rank: 19.1) alongside the weak technical trajectory offers an unappealing risk/reward setup in being bullish at these levels.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.