Why Do Stocks Dislike Rising Bond Yields?

Why Do Stocks Dislike Rising Bond Yields?

When U.S. Treasury bond yields rise, they affect the interest rates we use. Bonds now offer similar returns as stocks.

- Until now, stocks have typically had higher annualized returns than bonds but also carried greater risk

- But bonds now offer similar returns as stocks, while theoretically continuing to carry less risk

- When U.S. Treasury bond yields rise, they affect the interest rates used to calculate the present value of future money

Yields rule everything around me

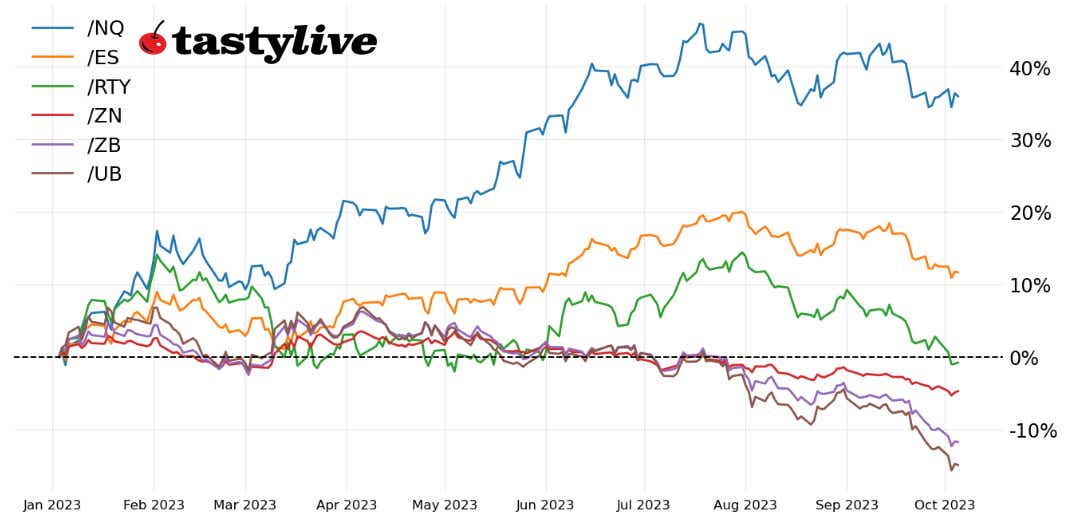

The transition from summer to fall of 2023 has been an uneasy changing of the seasons for equity markets. U.S. equity markets, led by the Russell 2000 (/RTY), are down 7%-14% from their yearly high. The reasoning is straightforward from a macro fundamental perspective: rising bond yields. Since U.S. equity markets peaked in July 2023, the U.S. Treasury 10-year note yield has risen from 3.73% to 4.73%, while the 30-year bond yield has risen from 3.84% to 4.87%.

Whether or not fears around additional Federal Reserve rate hikes are justified, let's discuss why rising bond yields impact traders' desire—or lack thereof—to be long stocks.

The Fed model

In the post-World War II era (1946-2022), U.S. equity markets (S&P 500, including dividends: +12.2% on average) have had a higher annualized return than U.S. Treasuries (T-Bills: +3.87% on average; T-Bonds: +5.23% on average). However, stocks also carry more risk, and thus returns have been more volatile. Specifically, the standard deviation of stock market returns (S&P 500: 16.97%) has been higher than those of the bond market (T-Bills: 3.05%; T-Bonds: 8.74%).

Stocks are riskier than bonds, but they also have higher expected returns. To see how much more return you can get from stocks, use the Fed model. This model compares how much profit (E/P) you can get from the S&P 500 index of stocks with how much interest (10-year yield) you can get from U.S. government bonds.

The E/P is the opposite of the P/E ratio, which tells you how much you pay for each dollar of profit. Stocks are more attractive than bonds when the profit rate (E/P) of the stock market is higher than the interest rate (10-year yield) of the bonds. This is what the Fed model tells us.

The increase in U.S. government bond interest rates in the middle of 2023 made people rethink their investment choices. Bonds and stocks now offer similar returns, but bonds theoretically have less risk. Some investors may find this more appealing and decide to change their portfolio balance.

Future cash flows lose value

The drop in U.S. stock prices when interest rates go up is not only because bonds look more attractive. We have to go back to the basics of finance to understand the main reason: the formula for calculating the present value (PV) of future cash flows (CF).

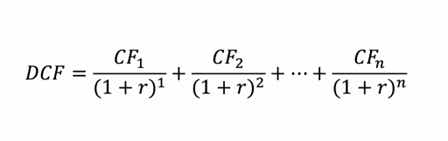

Discounted Cash Flow Formula

The DCF formula tells us how much money we can get from a company in the future, adjusted for the interest rate at each time period: CF are the money we get; r is the interest rate; and n is the time period. Notice that r is at the bottom: this means that when interest rates go up, the PV of the money we get goes down.

So, when U.S. Treasury yields rise, they affect the interest rates we use to calculate the PV of future money. This means the money a company makes in the future is worth less today. For U.S. stock market companies, that means that they are expected to have lower returns in the future. If a company is going to make less money in the future (in PV terms), then its shares are worth less. And if its shares are worth less, then its stock price drops.

This effect is worse for smaller, newer companies that don’t have much money coming in, and even worse for companies that are losing money right now. Companies that are still growing or trying to do something new and innovative—like some small-cap tech stocks, for example—suffer more because they don’t have much money and they may have a lot of debt.

Long or short duration?

Stocks are usually seen as “long duration” assets. This means it takes a long time to get back the money you invest in them. When interest rates go up, long duration assets lose more value; the present value of future money is lower, so it takes longer for the company to pay you back the money you put in today.

The PV formula shows why stocks have trouble, and especially the small-cap stocks in the Russell 2000 index: these companies don’t make much (or any) money, and as interest rates rise, their present value falls fast.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.