Tom Sosnoff’s Positions

Tom Sosnoff’s Positions

We spoke with a trading legend to understand what he’s doing in the markets

From the March 19 Cherry Picks, which you can sign up for here:

- https://email.tastylive.com/toms-positions-a-cherry-picks-exclusive

- https://info.tastylive.com/newsletters?utm_source=108&utm_medium=internal_email&utm_campaign=cherry_picks_2024

Futures:

Long /ZB and /ZN: Sosnoff is speculating on falling Treasury yields by being long on 30-year bond and 10-year note futures respectively. Reminder: price is inverse to yields.

Long /6J: He has a long position in Japanese yen futures. He is betting on the yen appreciating against the dollar.

Long /RTY and Short /ES: Sosnoff’s strategy involves a pair trade favoring small-cap stocks (Russell 2000) over large-caps (S&P 500), hinging on stronger performance from smaller companies. For less exposure, he could opt for micro futures (/M2K vs /MES) or exchange-traded funds (ETFs), such as IWM vs. SPY.

ETFs:

Short SPY and QQQ: He is anticipating a potential decline in the U.S. stock market and Nasdaq 100 index.

Stocks:

Long Boeing (BA), Tesla (TSLA) and Apple (AAPL): Tom's bullish bets on these three companies.

Short Microsoft (MSFT) and Nvidia NVDA: Shorting Microsoft and NVIDIA.

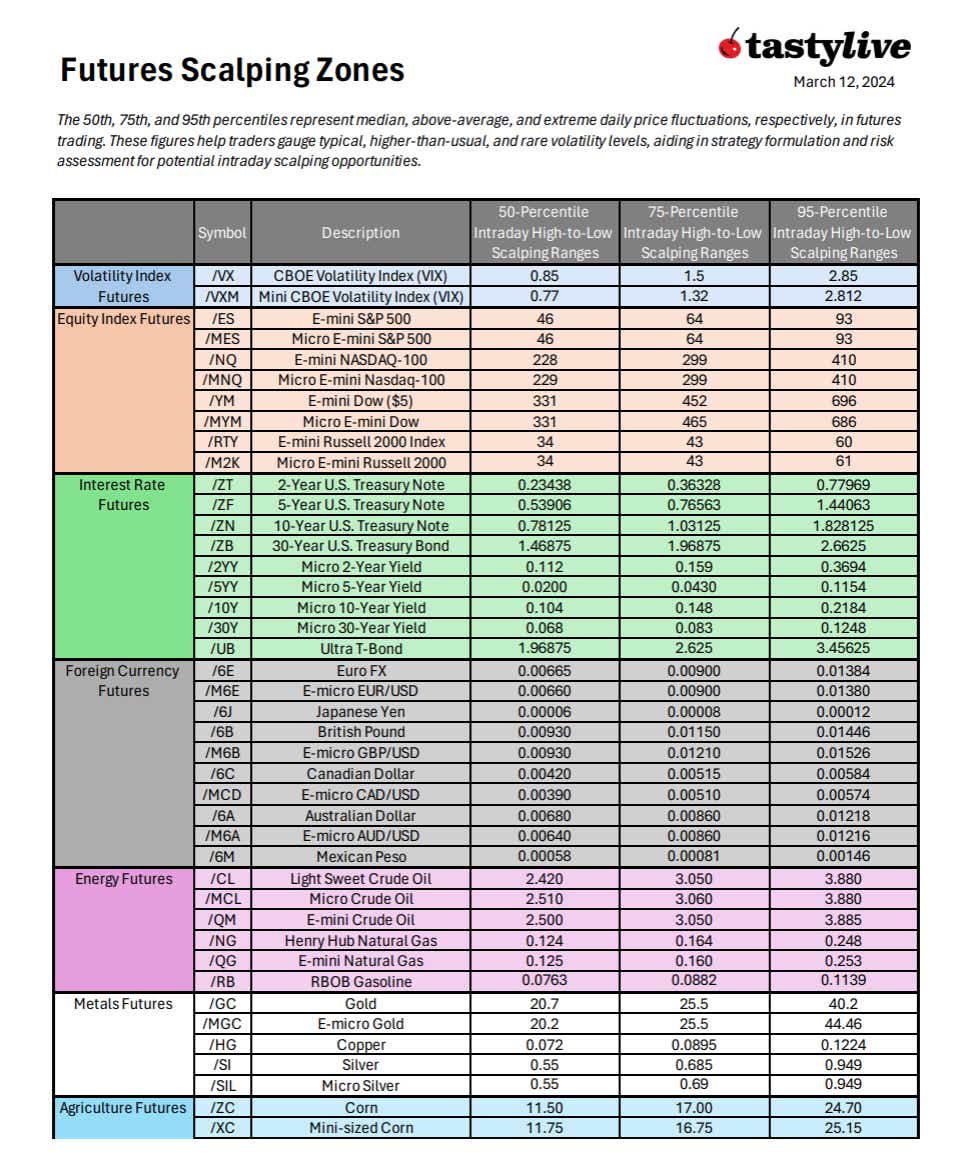

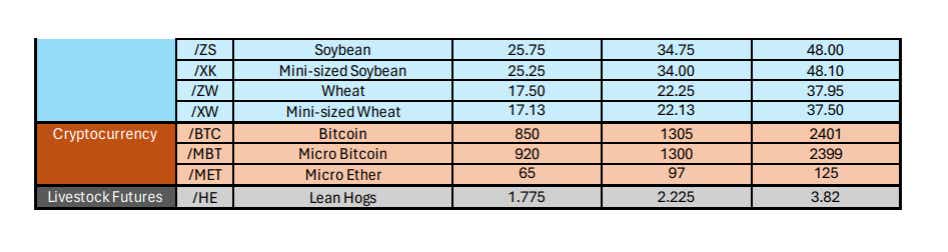

Scalping zones for the futures!

If you didn't catch it last week!

The 50th, 75th and 95th percentiles represent median, above average, and extreme daily price fluctuations, respectively, in futures trading. These figures help traders gauge typical, higher-than-usual and rare volatility levels, aiding in strategy formulation and risk assessment for potential intraday scalping opportunities.

The download is here:

https://cherry-picks-s3-bucket-newsletter.s3.amazonaws.com/live/24_03_12_tastyliveCheatSheet.pdf

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He is best known for his weekly Cherry Picks newsletter. On Thursdays, he appears onTrades from the Research Team LIVE.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.