Here’s What Happens After VIX spikes

Here’s What Happens After VIX spikes

The historical record tells us what direction the market took following the last 50 times volatility soared

While we can't predict the future, we can analyze historical patterns.

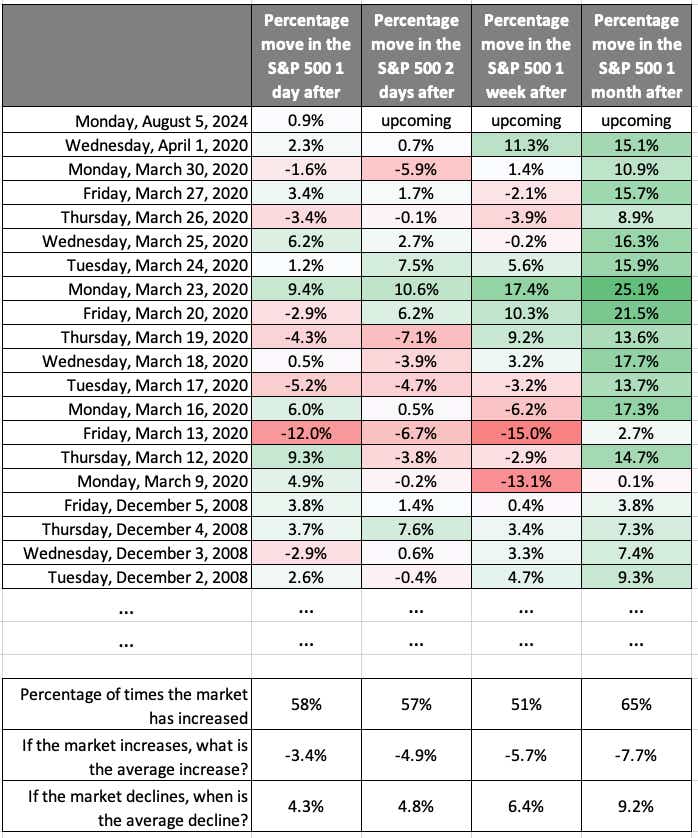

So, in the aftermath of Monday’s precipitous drop in the markets and the accompanying leap in volatility, we examined every instance when the CBOE Volatility Index, or VIX, spiked above 60 intraday over the past 25 years. It’s happened about 50 times by our count.

Findings:

- One Month Later: The market tends to increase 65% of the time.

Average Movement:

- When the market increases, the average gain is 9.2%.

- When the market declines, the average loss is 7.7%.

This historical trend suggests a higher likelihood of market recovery after significant VIX spikes, with gains generally outweighing losses.

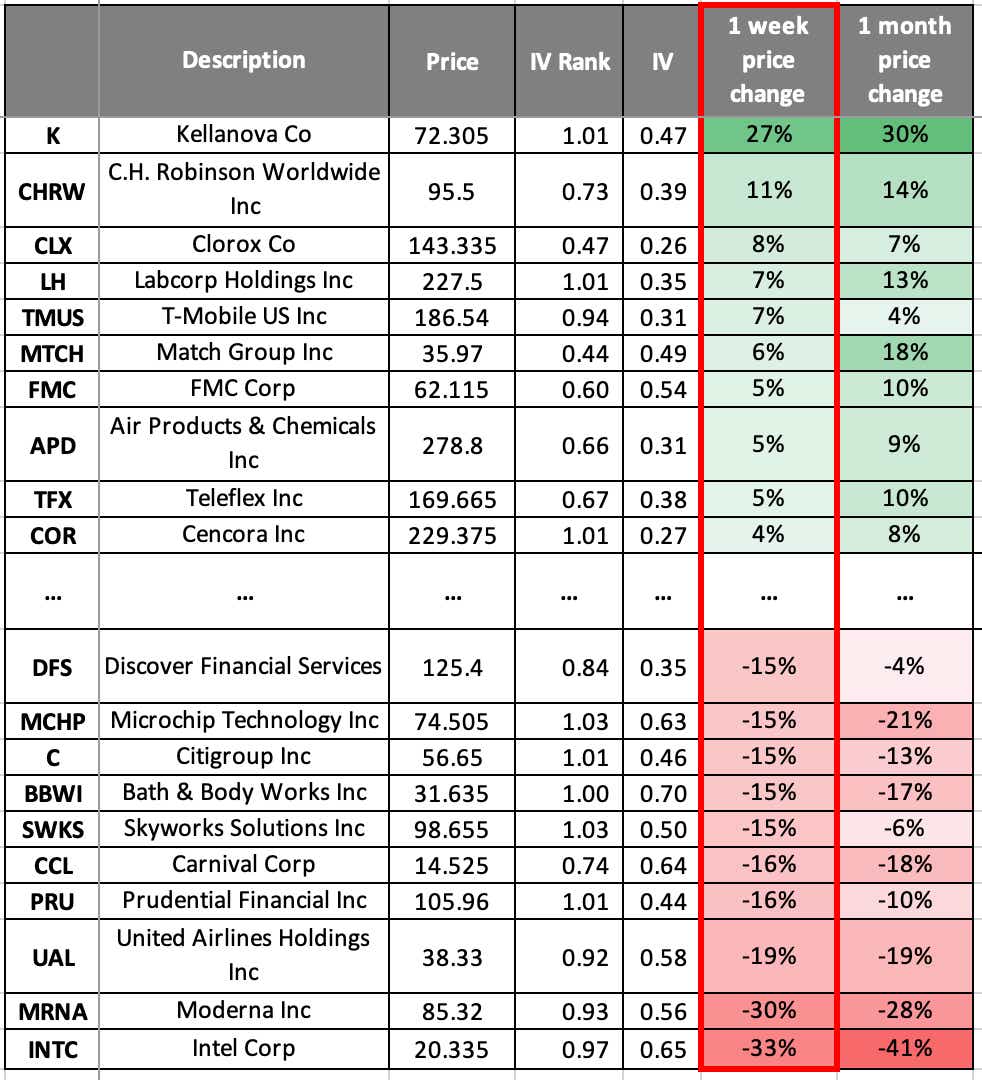

Biggest Weekly Movers in the S&P 500

A few stocks are up week-over-week. Most are down.

See below.

Skew in the S&P 500

Even though the VIX has come down from yesterday, options are still priced significantly higher than they were a few days ago. The demand for options suggests active investors still expect substantial price movements in the S&P 500.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Two Trade Ideas

SPY ($523) Iron Condor (SEP)

With the VIX spiking into the 30 handle, out-of-the-money (OTM) premium is at highs we haven't seen in a long time. If you think the worst is behind us and we might chop around for a bit with some contraction in volatility, it’s time for a wide iron condor or strangle. Short the 500/480 put spread with the 555/575 short call spread trades at roughly $6.04 and covers a range roughly to the high/low since January.

NVDA ($104) Short Put Spread (SEP)

Nvidia (NVDA) is down nearly 30% from highs post split. With volatility exploding, call buyers are experiencing their first vol crush, but there is still potentially more to come. If you want to lean slightly long into earnings, a wide short put spread is an interesting way to play the upside and a volatility contraction. Short the 100/85 put spread trades at around $4.67 or roughly 1/3 the width of the strikes.

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He is best known for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.