Walmart Earnings Preview: Can it Keep the Beat Streak Going?

Walmart Earnings Preview: Can it Keep the Beat Streak Going?

By:Mike Butler

Walmart (WMT) is set to report quarterly earnings on Thursday, Nov. 16 before the market opens. What can traders and investors expect?

- Walmart (WMT) is set to report quarterly earnings on Thursday before the market opens.

- The discount retail store beat EPS and revenue expectations four quarters in a row.

- Analysts expect Walmart to report an EPS of $1.52 on $158.50 billion in revenue.

- Continued economic concerns resulting in conservative consumer spending could be good for Walmart's bottom line.

Walmart (WMT) has had a strong 2023 while we've dealt with inflation and other economic concerns. That makes total sense at a time when consumers look to pinch pennies.

The stock opened the year at $142.55 and reached a new all-time high today of $167.68, boasting a 17.6% return for the year so far. The stock is more than $30 higher than the low of $136.09 it realized in March of this year.

Looking at the expected move through this week, which contains the earnings announcement, the market is projecting the stock to move +-$4.59 based on current implied volatility. This expected move is exceptionally low, considering it's only 2.7% of the current stock price. Compare this to Target (TGT), which has about a 7% earnings expected move based on its current stock price, and you can see just how big of a difference this really is.

Bullish on Walmart stock for earnings

Walmart has had a momentous year, and projections call for demand and sales growth to continue through the near future.

We get the benefit of seeing some consumer data this week before the earnings announcement, with the consumer price index (CPI) report coming on Tuesday morning, and the producer price index (PPI) report coming on Wednesday morning.

When times are tough it's not surprising to see stores like Walmart get a little boost. Walmart famously has a low-price business model and consumers can save at the cash register choosing Walmart over some competitors.

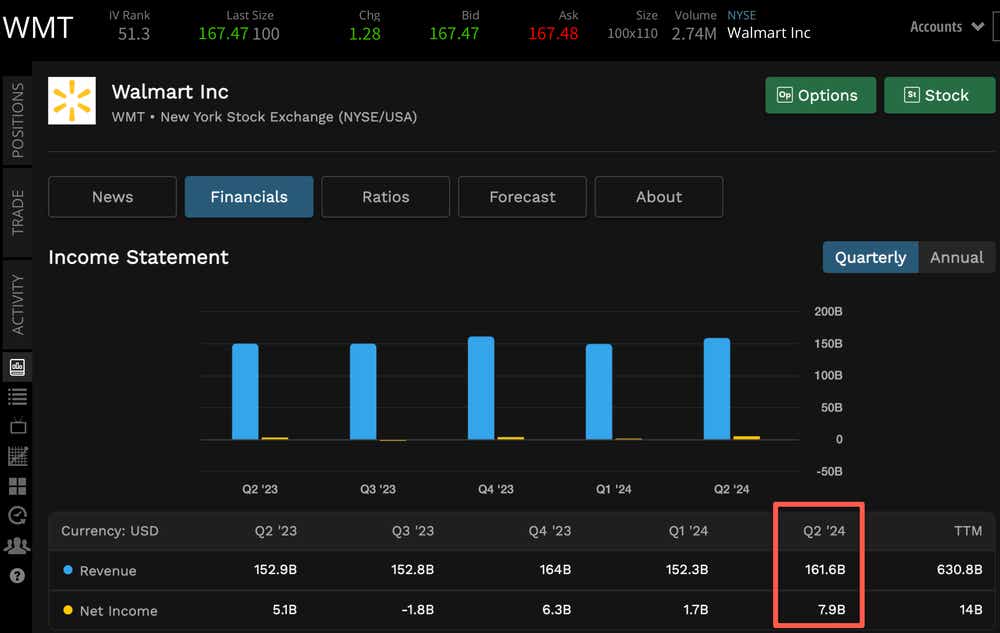

Walmart had a strong year, but a specifically strong quarter last time around, posting $7.9 billion in net income last quarter which was significantly higher than the previous quarter.

The revenue and EPS expectations are also a bit lower than last quarter, so if the retailer blows the estimates out of the water, we could see a bullish move in the stock price.

Bearish on Walmart stock for earnings

With a ton of positive sentiment swirling around Wall Street ahead of Walmart earnings, it's important to note that the stock is still at all-time highs.

Any slight miss on EPS or revenue estimates, or weak guidance could result in a stock price selloff. This is especially true given the fact that the company posted such strong earnings results over the past four quarters. Anything less than a big earnings beat could send the stock south.

Tune in to Options Trading Concepts Live on Wednesday, Nov. 15 for a full earnings preview with options strategies.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.