Are Stocks in Europe and Emerging Markets Ready to Rally?

Are Stocks in Europe and Emerging Markets Ready to Rally?

By:Ilya Spivak

Stocks outside the U.S. may see catch-up gains even as PMI data shows the global economy continues to flirt with recession. The corresponding currencies may follow suit, rebounding against the U.S. dollar.

- October PMI surveys are likely to show a global recession remains dangerously close.

- Nevertheless, economic data outcomes have increasingly improved relative to forecasts.

- Bargain-hunting may ensue, with non-U.S. stocks and currencies playing catch-up.

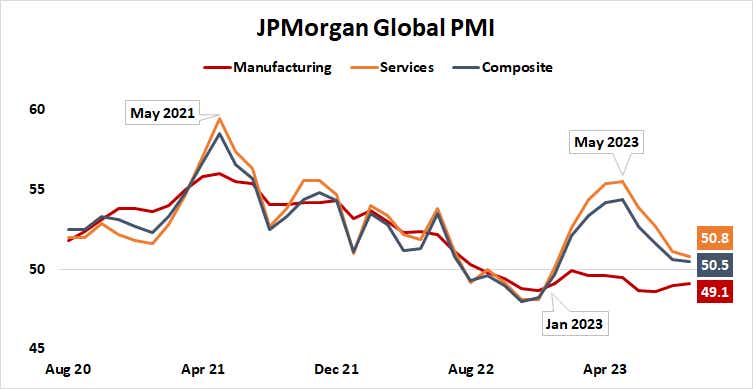

The threat of global recession seemed uncomfortably acute after September’s round of monthly purchasing managers index (PMI) data.

The monthly surveys—mostly from S&P Global, but also from the Institute of Supply Management (ISM) in the U.S. as well as the China Federation of Logistics & Purchasing (CFLP)—offer a timelier glimpse into economic growth trends than gross domestic product (GDP) figures. Those tend to come out only quarterly and with significant lag.

Global economic activity growth slows

The picture looked sobering across the board. Global economic activity growth slowed for the fourth consecutive month, registering at the weakest since January. The same pattern repeated across developed and emerging economies: Moribund manufacturing was offset by a pickup in services in early 2023 until the uplift fizzled, cresting in May.

Taken together, developed-market economies are already in contraction mode, weighed down by what is almost certainly a recession already underway in Europe. Emerging markets are still growing, but their dependence on rich-world demand might mean more catch-up weakness remains on the horizon.

Global recession risk: how bad is bad enough?

Absent a miraculous reprieve, the landscape will probably continue to look challenging when October’s round of PMI updates begins to trickle out next week. Preliminary surveys are due from Japan, Australia, the United Kingdom, the Eurozone and the United States. Final revisions will follow in two weeks.

The key question now is whether more evidence of anemic economic conditions still holds sway with traders.

Financial markets are inherently forward-looking. Movement in asset prices is generated as investors’ expectations are continuously tested against outcomes. Where there are discrepancies, the markets move as portfolios are repriced to reflect realized results and the updated outlook for what is to come next.

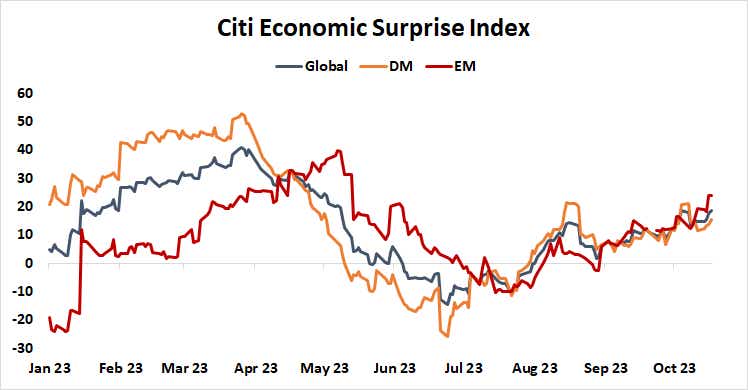

That means economic weakness by itself is not an inherent hurdle for risk appetite if conditions are not worse than the markets are anticipating. On this score, a tailwind may be gathering. Data from Citigroup shows global economic data outcomes have increasingly improved relative to forecasts since July.

Most critically, results now tend toward outperformance relative to economy-watchers’ baseline forecasts. In a tell-tale inversion of the PMIs, data from developed markets has seen the most-spirited improvement, with Europe leading the charge. Where actual weakness is greatest seems to be where it is most overestimated, too.

Stocks and currencies outside the U.S.: bargains on offer?

On balance, this means that surprise risk is asymmetrically tilted to the upside when October PMI readings cross the wires, even as the economic conditions they describe continue to look challenging. What’s more, all the central banks corresponding to the incoming releases apart from Australia seem to be finished with rate hikes.

Bargain-hunting might ensue against this backdrop.

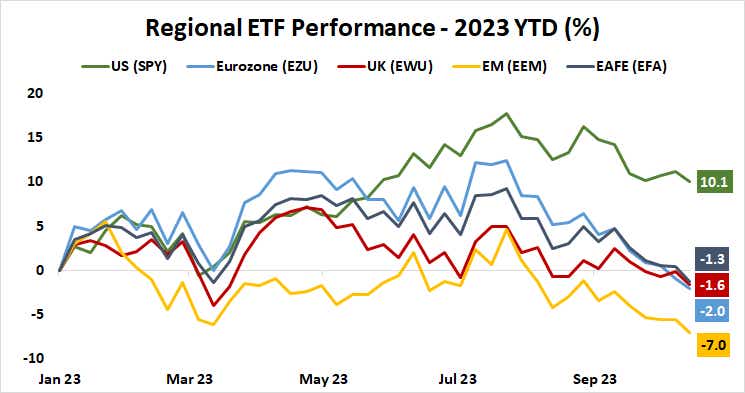

European and emerging-market shares have underperformed their U.S. counterparts by a wide margin so far in 2023. Some catch-up may be in store, boosting exchange-traded funds (ETFs) tracking the Eurozone (EZU), the United Kingdom (EWU), emerging economies (EEM) as well as those offering broader non-U.S. exposure (EFA). The underlying currencies may benefit as well, sending the euro, British pound and Australian dollar higher against the U.S. dollar.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.