Stock Futures Edge Higher on Triple Witching Friday

Stock Futures Edge Higher on Triple Witching Friday

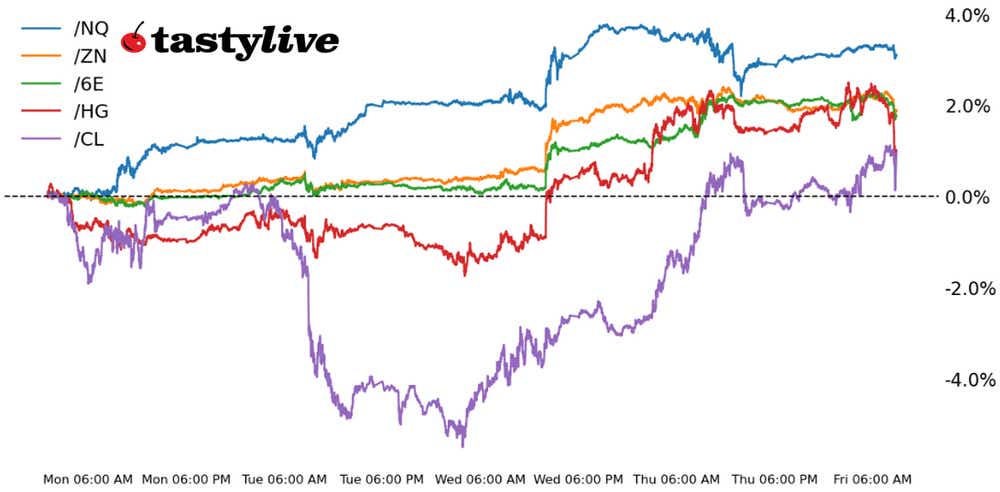

Also, 10-year T-note, copper, crude oil and euro futures

- Nasdaq 100 E-mini futures (/NQ): +0.37%

- 10-year T-note futures (/ZN): -0.19%

- Copper futures (/HG): -0.85%

- Crude oil futures (/CL): +0.52%

- Euro futures (/6E): -0.68%

It’s the third Friday of December, which means it’s time for triple witching.

Triple witching is the date when three kinds of financial contracts expire at once, creating a frenzy of trading four times a year. These contracts are stock options, stock index futures and stock index options. They can make the prices of stocks and indexes see an uptick in volatility, especially in the last hour of the market, called the triple-witching hour.

Symbol: Equities | Daily Change |

/ESH4 | +0.10% |

/NQH4 | +0.37% |

/RTYH4 | +0.23% |

/YMH4 | +0.03% |

Elevated equity volumes

U.S. equity indexes are trying to cap off a seventh straight week of gains, the longest winning streak since October 2017. Both the Nasdaq 100 (/NQH4) and Dow Jones 30 (/YMH4) are working on achieving their highest closing levels ever as well. Triple witching today will see some $5 trillion worth of contracts expire today, 80% of which are linked to the S&P 500. Trading volumes will be elevated across the day, particularly in the final hour of trading.

Strategy: (47DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 16300 p Short 16400 p Short 17200 c Long 17300 c | 34% | +1115 | -885 |

Long Strangle | Long 16300 p Long 17300 c | 43% | x | -6245 |

Short Put Vertical | Long 16300 p Short 16400 p | 69% | +520 | -1480 |

Symbol: Bonds | Daily Change |

/ZTH4 | -0.12% |

/ZFH4 | -0.17% |

/ZNH4 | -0.19% |

/ZBH4 | -0.10% |

/UBH4 | -0.16% |

Bond yields are up across the curve on Friday morning although they remain below where they were before this week’s Federal Open Market Committee (FOMC) rate decision. 10-year T-note futures (/ZNH4) were 0.10% lower before the opening bell but the yield remains below the 4% mark—the lowest since July. U.S. purchasing managers’ index (PMI) data will wrap up this week’s hard-hitting calendar before we enter a period of reduced liquidity as traders take some time away from the desk for the U.S. holiday season.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 110.5 p Short 111 p Short 114 c Long 114.5 c | 44% | +265.63 | -234.38 |

Long Strangle | Long 110.5 p Long 114.5 c | 36% | x | -796.88 |

Short Put Vertical | Long 110.5 p Short 111 p | 76% | +140.63 | -359.38 |

Symbol: Metals | Daily Change |

/GCG4 | +0.09% |

/SIH4 | -0.54% |

/HGH4 | -0.85% |

Copper prices move lower

A rebound in the dollar and yields is pushing copper prices (/HGH4) lower Friday morning but the metal retains its bullish technical stance after crossing above the 200-day simple moving average (SMA) yesterday. The red metal has benefited from several miners, including Anglo American (NGLOY) and Vale (VALE) trimming their output forecasts recently. Anglo cut its 2024 output forecast to 730,000 to 790,000 metric tons, while Vale sees its production at 320,000 to 355,000 tons next year.

Strategy (41DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 3.79 p Short 3.8 p Short 3.92 c Long 3.93 c | 19% | +200 | -50 |

Long Strangle | Long 3.79 p Long 3.93 c | 47% | x | -3262.50 |

Short Put Vertical | Long 3.79 p Short 3.8 p | 61% | +125 | -125 |

Symbol: Energy | Daily Change |

/CLF4 | +0.52% |

/HOH4 | +1.15% |

/NGF4 | +2.42% |

/RBH4 | +0.65% |

Crude oil rises slightly

Crude oil prices (/CLF4) are inching higher this morning and oil is on track to record its first weekly gain in over two months.

The recent dovish tilt in the Federal Reserve’s policymaking view and a larger-than-expected inventory draw has helped bolster sentiment in the commodity. Earlier this week, the Paris-based International Energy Agency (IEA) increased its demand forecast for 2024 to 1.1 million barrels per day, a gain of 130,000 bpd from its last forecast.

Markets are digesting mixed data out of China and some softer data points out of Germany—Europe's largest economy. Going forward, traders have their eyes on inventory data and economic indicators for the rest of the month with major central bank decisions behind us.

Strategy (33DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 69 p Short 69.5 p Short 74.5 c Long 75 c | 29% | +350 | -150 |

Long Strangle | Long 69 p Long 75 c | 43% | x | -3130 |

Short Put Vertical | Long 69 p Short 69.5 p | 64% | +170 | -330 |

Symbol: FX | Daily Change |

/6AH4 | -0.36% |

/6BH4 | -0.33% |

/6CH4 | +0.05% |

/6EH4 | -0.68% |

/6JH4 | -0.27% |

The euro drops

The euro (/6EH4) took a hit overnight on data out of Germany.

The S&P Global’s HCOB Flash Composite Purchasing Managers’ Index (PMI) dropped for a sixth straight month in December, falling to 46.7 from 47.8 and below analysts’ forecast for 48.2.

That sparked fears the European Central Bank (ECB) would be forced to cut rates sooner than expected. FX traders are waiting on PMI figures out of the U.S. this morning, which may inform dollar strength, which could weigh further on the Euro.

Strategy (56DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.07 p Short 1.075 p Short 1.115 c Long 1.12 c | 53% | +250 | -375 |

Long Strangle | Long 1.07 p Long 1.12 c | 32% | x | -700 |

Short Put Vertical | Long 1.07 p Short 1.075 p | 86% | +112.50 | -512.50 |

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.