U.S. Retail Sales Preview: Stocks to Cheer Soft Data as the Dollar Falls

U.S. Retail Sales Preview: Stocks to Cheer Soft Data as the Dollar Falls

By:Ilya Spivak

Stocks may continue to build higher while the dollar suffers if weak U.S. retail sales data pulls forward Federal Reserve interest rate cut expectations

- Stocks are surging and the U.S. dollar is plunging as soft CPI data stokes Fed rate cut bets.

- October retail sales data is expected to show weakening consumer demand.

- Wall Street is likely to cheer if soft numbers are seen as pulling Fed easing closer.

Financial markets raced to price in October’s U.S. consumer price index (CPI) data, with stocks roaring higher as the dollar slumped against its major currency counterparts (as expected). The report put the headline inflation rate at 3.2% year-on-year, a touch lower than the 3.3% expected. Falling energy prices drove most of the decline.

Perhaps most critically, the core CPI gauge—a focal point for shaping Federal Reserve policy expectations because the U.S. central bank doesn’t have much agency to influence global food and energy prices—ticked unexpectedly downward to 4%. Economists were penciling in 4.1% ahead of the release.

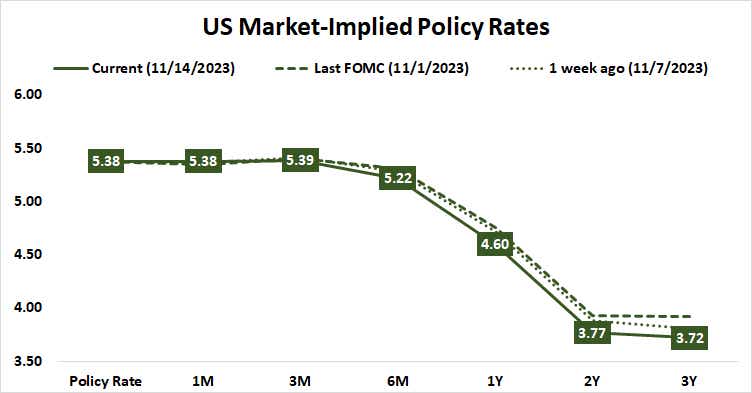

Fed rate cut expectations jump after October CPI data

The priced-in interest rate path promptly shifted after the figures crossed the wires. The probability of another rate hike has been fully erased and the likelihood of a 25-basis-point (bps) cut as soon as May now stands at a commanding 82%. A decrease by June is now fully baked into Fed Funds futures pricing, as is 100bps in easing by year-end 2024. That’s one more 25bps cut compared to the prevailing wisdom before the CPI release.

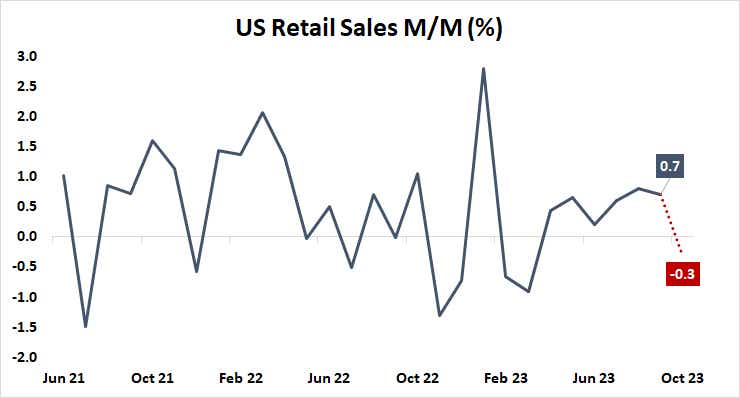

The spotlight now turns to October’s U.S. retail sales report. As with CPI, the focus here will be whether the outcome marks any considerable change in the Fed rate-cut outlook. Analysts are looking for a soft result, with receipts down 0.3% to mark the first decline since March.

Soft U.S. retail sales data to lift stocks, hurt U.S. dollar

Leading consumer confidence data from the University of Michigan suggests sentiment has been deteriorating recently. The headline sentiment index has fallen for four consecutive months, with November’s reading amounting to the weakest since May. Consumer loan delinquency rates have increased in tandem. The share of credit card loans 30 or more days behind on repayment jumped in September to the highest since June 2020.

Meanwhile assorted labor market indicators are signaling emerging weakness.

October’s leading surveys of purchasing managers from the Institute of Supply Management showed the second-slowest month of service sector hiring, while manufacturers shed jobs at the fastest pace since July. The unemployment rate rose to 3.9% in the same month, the highest since January 2022. Continuing jobless claims hit a 28-week high by month-end, signaling that seekers are having a harder time finding new work.

For markets hoping for the soonest possible start of interest rate cuts, numbers showing that all of this has translated into sluggish retail activity are likely to be supportive. Wall Street will probably cheer soft results—pushing equity indices upward—while the U.S. dollar faces renewed pressured lower against its top counterparts.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.