U.S. Retail Sales, China GDP, Fed Chair Powell Speaks: Macro Week Ahead

U.S. Retail Sales, China GDP, Fed Chair Powell Speaks: Macro Week Ahead

By:Ilya Spivak

Stock markets may find a way to rise despite a dire economic and geopolitical backdrop. Bond markets may follow while the U.S. dollar starts to backpedal

- U.S. retail sales activity seen cooling, but that might be cheered by Fed-minded markets.

- China’s GDP data to show growth slowed in the third quarter, but will traders still care?

- Fed Chair Powell will cheer Wall St. if he hints at endorsing an end of the rate hike cycle.

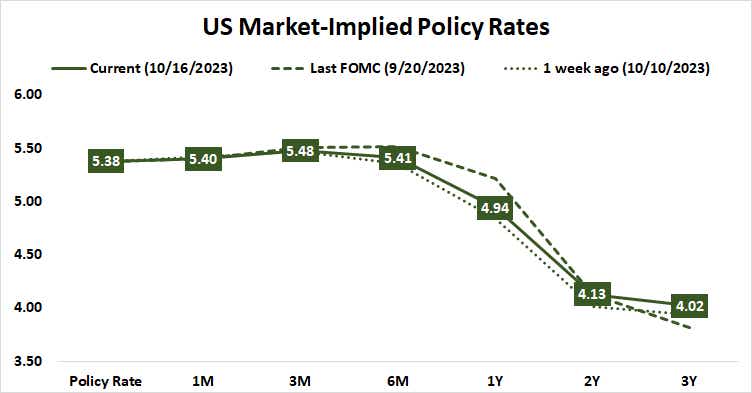

Last week, financial markets busied themselves worrying about the Federal Reserve again.

Geopolitical problems appeared at the start of the week as Israel looked increasingly likely to mount a ground offensive into Gaza after Hamas extremists based there carried out a historically murderous terrorist attack. Crude oil and gold prices gapped up, and stocks wobbled at the weekly open. Apart from bullion, however, the moves faded fast.

The rest of the week was mainly shaped by U.S. consumer price index (CPI) data and the University of Michigan (U-M) consumer confidence survey. The former showed slightly hotter inflation than expected. The latter showed sentiment slumped to the weakest in five months even as respondents’ inflation expectations jumped more than anticipated.

Wall Street jeered both releases, with investors seeming to take the pair to mean the U.S. central bank will remain biased toward keeping interest rates “higher for longer,” even as growth slows (as expected).

Here are the key macro waypoints for traders in the week ahead:

U.S. retail sales

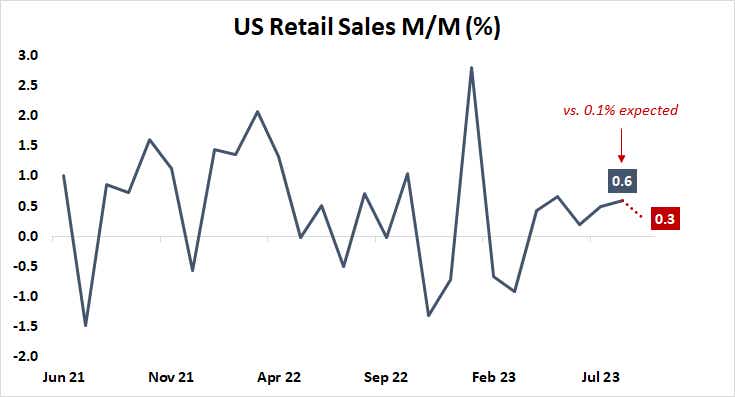

U.S. retail sales activity is expected to have slowed in September. Receipts are seen rising 0.3%, halving the 0.6% increase recorded in August. Easing gasoline costs might skew the outcome lower, much as prices at the pump created the appearance of a larger increase in the prior month.

Analysts were expecting a 0.1% rise in retail sales in August, only to be surprised by the hefty 0.6% result. Gasoline accounted for a hefty 0.4% of that rise, however, while spending on everything else came to a net increase of just 0.2%.

How that “core” sales component fared in September will be interesting. Consumption accounts for the lion’s share of U.S. economic growth. The deterioration in sentiment on display in the U-M data suggests a troubling trend is developing. Seeing that surface in sales data as gasoline distortions fade might set of investors’ recession radar.

The response from price action may be telling. If last week’s price dynamics hold, worries about a delay of the Fed rate cut cycle might color traders’ response so that a soft result is read as “good” for risk appetite. This might help power a recovery in stocks and bonds alike, while weighing on the U.S. dollar.

China gross domestic product

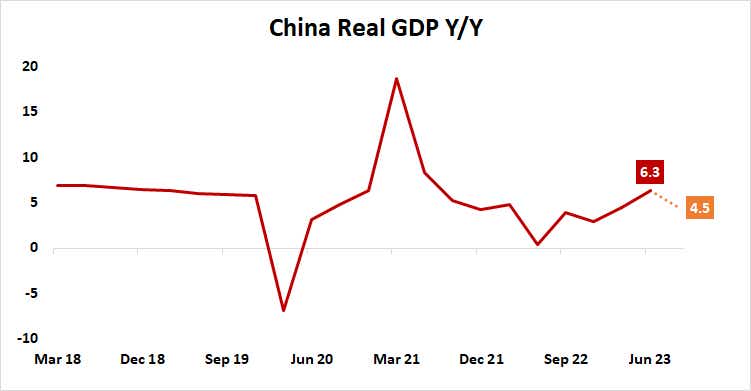

Data due to arrive this week is expected to show China’s economy decelerated in the third quarter. Analysts pencil in an increase of 4.5% year-on-year, down from 6.3% in the three months through June. Leading surveys of purchasing managers endorse the case for a slowdown.

The key question seems to be whether markets will still be moved by further evidence of China's struggle to regain momentum after scrapping COVID lockdowns in December 2022.

A pickup in lending data published over the weekend put aggregate financing at 4.1 trillion yuan in September, up from 3.1 trillion in August. That adds up to about 8 billion yuan more in borrowing for the third quarter, compared with the second, suggesting a bit of a thaw might be underway.

Data from Citigroup warns that China’s economic data outcomes still skew toward surprising on the downside of baseline forecasts, but the margin for disappointment has narrowed as analysts have revised expectations lower. That means the bar for a “bad” outcome might be asymmetrically higher than a “tolerable” one.

It might translate as supportive for China-sensitive assets, from exchange-traded funds (ETFs) tracking local stock markets like FXI and ASHR to commodities like copper and currencies like the Australian dollar. The broader risky asset universe—stocks and other cycle-sensitive assets—may also get something of a lift.

Federal Reserve Chair Powell speech

Fed Chair Jerome Powell will retake the spotlight to close out the week, appearing at the Economic Club of New York. He will deliver prepared remarks, then sit for a moderated Q&A session. Such outings can be potent opportunities to communicate with markets and frame policy expectations. Investors will listen with great interest.

Recent comments from a host of officials on the Fed’s rate-setting Federal Open Market Committee (FOMC) have started to hint cautiously at satisfaction with the current setting of interest rates, echoing priced-in expectations that imply the rate hike cycle ended in July. Wall Street is likely to celebrate if Powell appears to agree.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.