Private Consumption Expenditure (PCE) Release Preview: Are Stocks at Risk?

Private Consumption Expenditure (PCE) Release Preview: Are Stocks at Risk?

By:Ilya Spivak

Stocks won’t like it as the Fed’s favored PCE gauge of U.S. inflation signals a “higher for longer” path for interest rates

- Incoming U.S. PCE inflation data is unlikely to change “higher for longer” Fed stance.

- The central bank still looks to unstick labor-driven services costs by squeezing growth.

- Stocks are likely to fall further as longer-dated Treasury yields and the U.S. dollar rise.

The latest update of U.S. inflation data is likely to leave the outlook for Federal Reserve monetary policy broadly unchanged. That’s probably unwelcome news for stock markets.

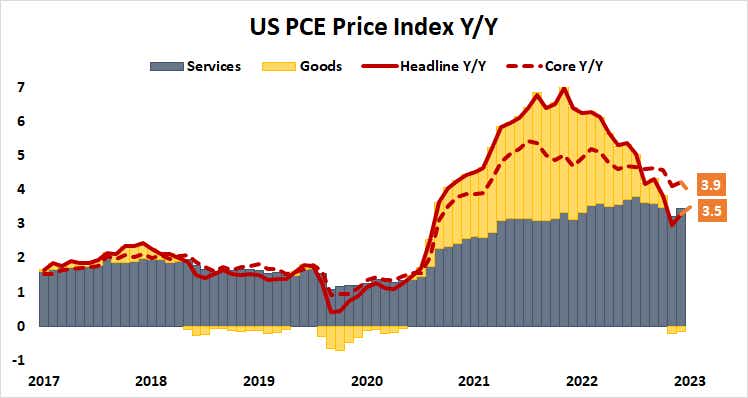

The Fed’s favored private consumption expenditure (PCE) price growth gauge is expected to show that price growth accelerated for a second consecutive month in August, ticking higher from 3.3% to 3.5% year over year. The so-called “core” PCE index, which excludes volatile food and energy prices, is seen slowing from 4.2% to 3.9%.

These outcomes look set to echo analog consumer price index (CPI) data published two weeks ago. Those figures revealed rising oil prices as the source of the disconnect, as expected. There isn’t much that the US central bank can do with monetary policy to address that issue in a targeted way, so its focus is likely to remain on the service sector.

Looking under the hood, the cost of housing is the main driver of services prices. Here too, the Fed has relatively little agency to influence near-term outcomes. Its own rate hike cycle has translated into illiquidity because mortgage rates offered in the market exceed those locked in by owners by close to 400 basis points (bps) on average. That has discouraged sellers, drawing down inventories and underpinning prices.

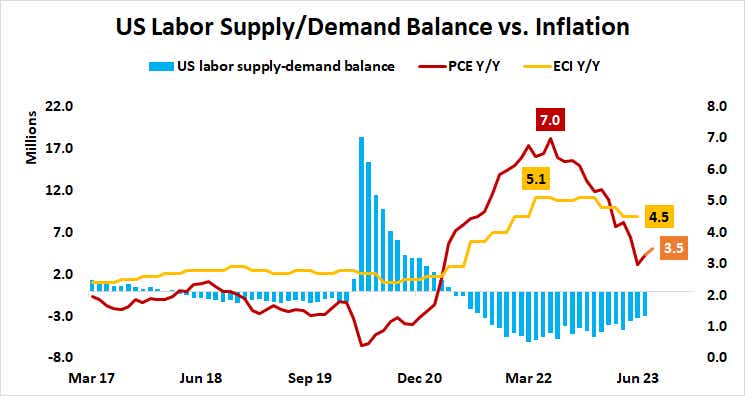

The Fed inflation-fighting effort is aimed at the labor market

That leaves the labor market. Employment costs have proven to be stickier than overall inflation because lingering labor shortages have underpinned wages. The U.S. central bank hopes to use higher borrowing costs to cool economic activity, reduce labor demand and trigger a wave of wage agreement resets (i.e., layoffs). It hopes to dial in just enough pain for this process to pass through the economy without too much damage, the much-hoped-for “soft landing”.

With core inflation inching lower and purchasing managers index (PMI) data suggesting economic activity has already slowed to near standstill, the central bank has opted to sit on its hands for now. It intends to wait for the cumulative effects of prior tightening to build.

How long the Fed plans to keep at this has become the main object of speculation for financial markets. The first 25 bps reduction is expected by July, and another has been penciled in by November 2024. The likelihood of a third one before the calendar turns to 2025 is estimated at 60%. On balance, this means markets lean toward 75bps in rate cuts next year.

Sticky inflation begets sticky interest rates, menacing markets

That marks a contrast with the Fed’s own reckoning. The markets’ prognosticating shakes out to a Fed Funds rate at 4.6-4.7% by the end of 2024. Officials on the Fed’s policy-setting FOMC committee set their median estimate at 5.1% in the latest forecast update released last week.

This “higher for longer” signal has spooked markets. They reacted by driving up longer-term Treasury bond yields, lifting the US dollar, and sinking stocks. Fed Chair Jerome Powell and company are unlikely to change their tune without an improbably larger-than-expected core PCE drop. That signals more of the same is likely to be ahead.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.