U.S. Non-Farm Payroll Report Preview: Will More Jobs Be Bad News for Stocks?

U.S. Non-Farm Payroll Report Preview: Will More Jobs Be Bad News for Stocks?

By:Ilya Spivak

The markets may not like an upbeat U.S. jobs data report because traders are hoping the Fed will begin cutting interest rates

- September’s U.S. jobs report is in focus as markets fixate on the Fed rate cut timeline

- Most leading indicators and recent data flow dynamics hint at upside surprise risk

- Signs of labor market resilience may spook traders fearing “higher-for-longer” interest rates

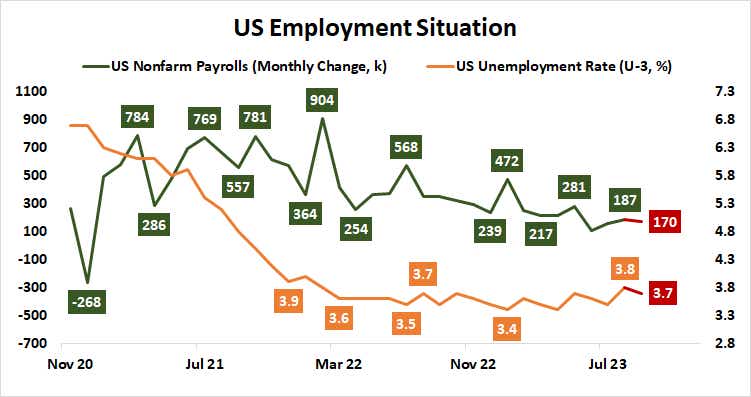

The U.S. economy is expected to have added 170,000 workers to non-farm payrolls in September. That would mark a slight decline from the rise of 187,000 recorded in August but fall broadly in line with recent trends. The jobless rate is seen ticking a touch lower to 3.7%.

Leading economic data ahead of the release seems to be tilted toward a relatively upbeat outcome.

The U.S. labor market: good tidings

Surveys of purchasing managers by S&P Global and the Institute of Supply Management (ISM) pointed to brisk job gains. The former said hiring picked up at the fastest pace since June. The latter added that job growth in the manufacturing sector turned positive after three consecutive months of contraction.

Jobless claims data paints a similarly upbeat picture. Initial applications for unemployment benefits dropped precipitously last month, plunging below monthly and quarterly trend averages to record the lowest weekly increases since January. Continuing claims also dropped to levels unseen since the start of the year, implying good uptake by employers.

A leading private-sector payrolls estimate from Automatic Data Processing (ADP), the human-resources management giant, offered a bit of a counter-narrative. It showed a private payrolls increase of just 89,000 in September, against expectations of a meatier 150,000 gain. That marked the smallest monthly uptick in almost four years. By contrast, analysts see 158,000 of the overall increase in the official nonfarm payrolls number coming from private enterprises.

Context, context, context

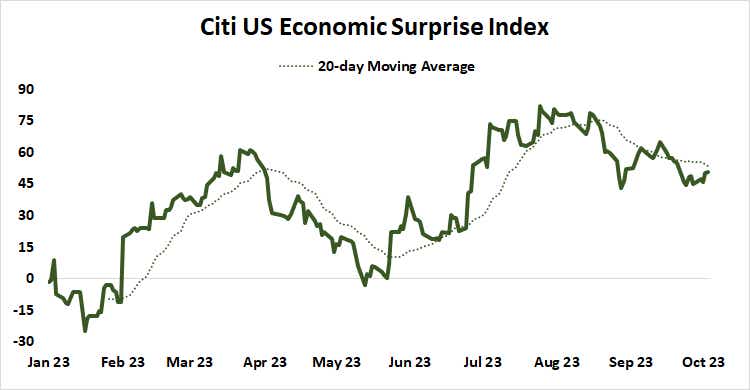

Data from Citigroup suggests U.S. economic news flow still tends to surprise on the topside relative to baseline forecasts. Meanwhile, a Bloomberg survey of economists shows expectations for U.S. economic growth for 2023 and 2024 have been revised notably higher since mid-August.

On balance, this appears to mean the likelihood of an upside surprise in September’s jobs data is greater than that of the alternative. While that sounds like a good thing at face value, it isn’t likely to be met with much enthusiasm by stock markets yearning for the Fed to begin reversing its blistering rate hike cycle.

Price action so far this week has been unmistakable. Stock markets swooned after the job openings and labor turnover survey (JOLTS) showed vacancies rose to 9.61 million in August, topping forecasts penciled in at 8.82 million. July’s reading was also revised higher, from 8.83 to 8.92 million. Shares popped higher on the soggy ADP result.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.