U.S. Dollar Aims Higher vs. Euro, British Pound as PMIs Shift Rate Cut Bets

U.S. Dollar Aims Higher vs. Euro, British Pound as PMIs Shift Rate Cut Bets

By:Ilya Spivak

The U.S. dollar aims to continue higher against the euro and the British Pound as PMI data argues for deepening divergence in the expected path for interest rates

- February PMI data is likely to show resilience in the U.S. and trouble in Europe.

- Economic divergence may widen the gap in Fed vs. ECB, BOE policy bets.

- The U.S. dollar aims to extend the rise against the euro and the British pound.

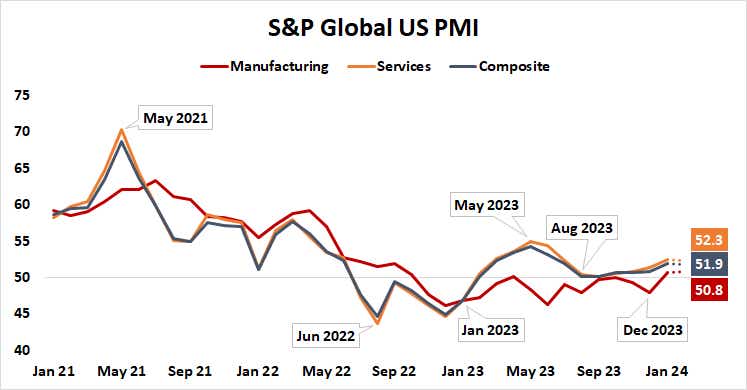

The release of January’s edition of U.S. purchasing manager index (PMI) data from S&P Global proved to be a watershed moment for financial markets.

The results spoke to growth that was much stronger than economists anticipated. Economic activity grew at the fastest pace since July 2023. Baseline forecasts envisioned near-standstill.

These impressive results set the tone for a string of upside surprises on top-tier economic indicators. Fourth-quarter gross domestic product (GDP) data and January’s nonfarm payrolls (NFP) and consumer price index (CPI) measures of jobs growth and inflation registered north of expectations.

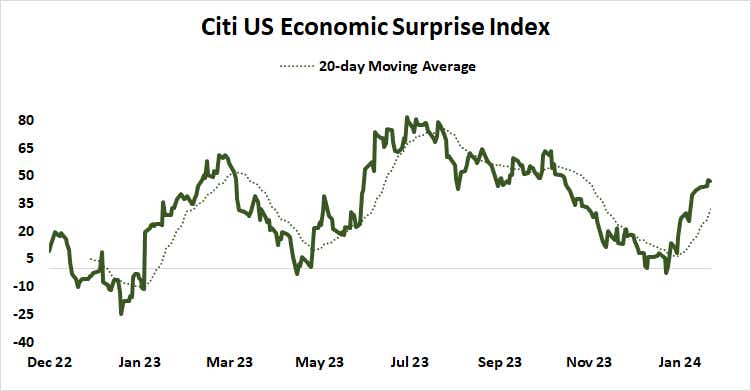

Summarizing the trend, the Citigroup economic surprise index tracking the performance of U.S. data outcomes relative to expectations has jumped to a three-month high. Such buoyancy has eaten into Federal Reserve rate cut expectations. The priced-in outlook for 2024 has shed a hefty 70 basis points (bps) of easing in a mere five weeks.

U.S. PMI data: from strength to strength?

Experts expect February’s batch of PMI surveys to reinforce the sense that the U.S. economy is on strong footing. A slight cooling in the service sector coupled with a modest pickup on the manufacturing side is projected to keep the overall pace of growth largely unchanged from the previous month.

The steep rise in the Citigroup surprise gauge implies that analysts’ models continue to undervalue U.S. economic vigor, tilting surprise risk on the upside. This points to an outsized possibility of another batch of rosy outcomes that forces traders to downgrade the rate cut outlook further.

PMIs tracking European performance look likely to point in the opposite direction. Analysts expect to see that activity in the U.K. is slowing, with a recent string of disappointments on key data including CPI and GDP flagging downside surprise risk. In the Eurozone, ongoing recession-like conditions are expected to bring the eight consecutive month of contraction.

Euro and British pound at risk vs. U.S. dollar

A widening divergence in monetary policy expectations will probably follow. European Central Bank (ECB) policy bets have already added 20bps to the 2024 rate cut outlook over the past month. The expected trajectory for the Bank of England (BOE) may be in the initial stages of a similar dovish realignment.

This seems likely to put the U.S. dollar on firm footing against the euro and the British pound. The greenback has already gained 4% against the former and 2.4% against the latter since the beginning of the year. It appears poised to continue building upward after PMI data comes across the wires.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.