U.S. Dollar Up as Fed Rate Cut Bets Cool, RBA and China CPI May Help

U.S. Dollar Up as Fed Rate Cut Bets Cool, RBA and China CPI May Help

By:Ilya Spivak

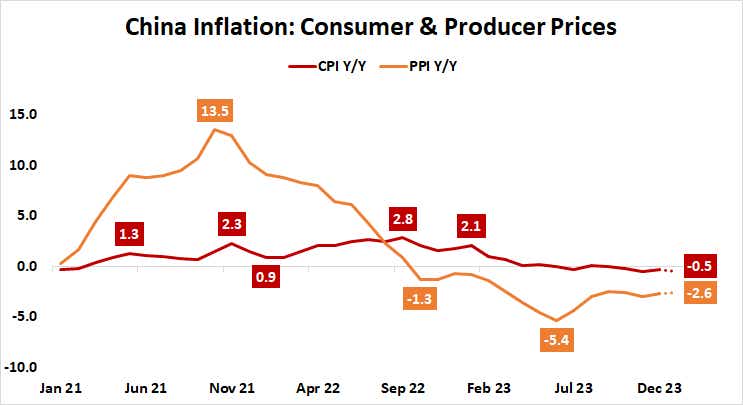

Deflation in China is continuing to stoke fear of a global recession

- Stocks are holding up, and the U.S. dollar is gaining amid cooling Federal Reserve interest rate cut expectations.

- The Australian dollar may continue to fall if the Reserve Bank of Australia strikes a dovish posture.

- Deepening deflation in China might revive worries about global recession.

Stocks continued to rise last week, with the bellwether S&P 500 index adding 1.3% to post the highest weekly close on record. Shares suffered a sharp mid-week setback as the Federal Reserve signaled interest rate cuts are unlikely to start at its March meeting. Upward momentum returned within a day, however.

The release of January’s U.S. employment statistics seemed particularly telling. The results overshot analysts’ forecasts by a wide margin, echoing the recent trend favoring outperformance on U.S. economic data. Nonfarm payrolls added 353,000 jobs, nearly double the expected 185,000. Wage inflation unexpectedly accelerated to 4.5% year-on-year.

That pushed back on Federal Reserve interest rate cut bets. Fed Funds futures show markets are now pricing in four 25-basis-point (bps) interest rate cuts in 2024, or 1% in cumulative easing. That is down from 158bps—implying six cuts—recorded just three weeks ago. Impressively, stocks were unphased by the change despite balking at a hawkish Fed just 48 hours prior.

The U.S. dollar cheered as stimulus speculation cooled, rising to a seven-week high. Bonds fell in the second half of the week, but sharp gains in the first half left them little changed at the close. Gold prices managed gains but struggled to break free of a narrow range anchored at the $2000/oz threshold.

Crude oil prices tumbled, suffering a bruising weekly loss of 7.35%. Selling pressure persisted through most of the week, with the WTI (West Texas Intermediate) contract breaking up back-to-back losses with just one day of upward retracement. The move seemed divorced from broader macro moves. Newswires flagged easing fears of Middle East supply disruptions.

Here are the macro waypoints likely to shape price action in the week ahead.

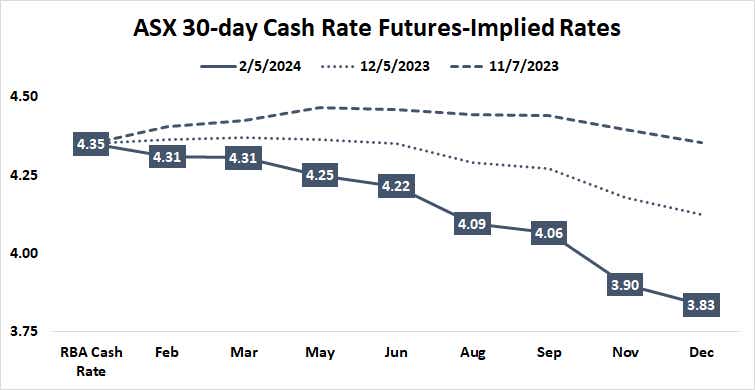

Reserve Bank of Australia policy meeting

The Reserve Bank of Australia (RBA) is expected to keep its target interest rate unchanged at 4.35% at this week’s policy meeting. With that in mind, traders will focus on guidance on offer in the policy statement. As it stands, markets are pricing in two 25bps rate cuts this year. The first is set to appear in August and the second in December.

Australia’s economy is struggling while inflation has helpfully dropped to a two-year low of 4.1% in the fourth quarter. Leading purchasing managers’ index (PMI) data suggests economic activity shrank for a fourth consecutive month in January, and Citigroup analytics suggest incoming economic data is tending to undershoot baseline forecasts.

The Australian dollar is likely to suffer if this inspires a dovish adjustment in RBA rhetoric that brings the rate cut timeline forward. The currency has plunged to the lowest point in two months against its U.S. counterpart at the start of this week, thanks to diminishing Fed rate cut speculation.

Chinese consumer price index data

China is set to report that deflation deepened in January. The consumer price index (CPI) is expected to fall 0.5% year-on-year, pushing deeper into negative territory after declining 0.3% in December. The release is set to mark the fourth consecutive month of falling prices, pointing to anemic demand in the world’s second-largest economy.

Chinese economic data outcomes have deteriorated relative to forecasts in the past three months, suggesting analysts’ models are overestimating the battered economy’s attempt at recovery. This warns that surprise risk is tilted on the downside. A disappointment may revive concerns about global recession, weighing on stock markets.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.