Will the Rising Stock Market Get a New Lift on U.S. CPI Inflation Data?

Will the Rising Stock Market Get a New Lift on U.S. CPI Inflation Data?

By:Ilya Spivak

Where stock markets go from here will depend on whether April’s U.S. core inflation tops economists’ expectations

- U.S. stock markets teeter-totter as PPI data comes out in line with forecasts.

- With the Fed rate cut outlook in focus, all eyes now turn to U.S. CPI data.

- Wall Street has most to fear from hotter-than-expected core inflation.

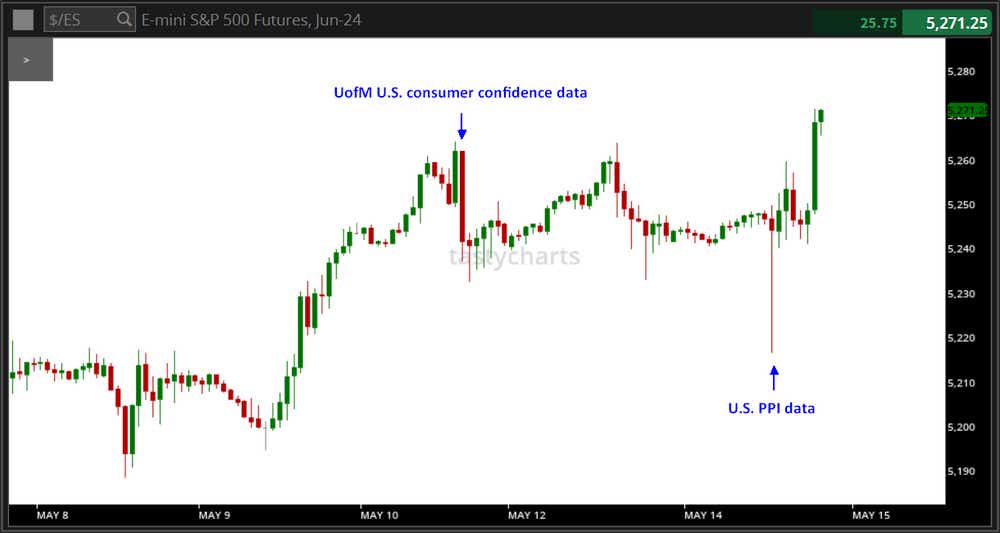

Stock markets felt relieved as April’s producer price index (PPI) data printed in line with expectations, leaving intact investors’ baseline Federal Reserve monetary policy outlook. Headline wholesale prices grew 2.2% year-on-year. The analog core measure excluding volatile food and energy components came in at 2.4%.

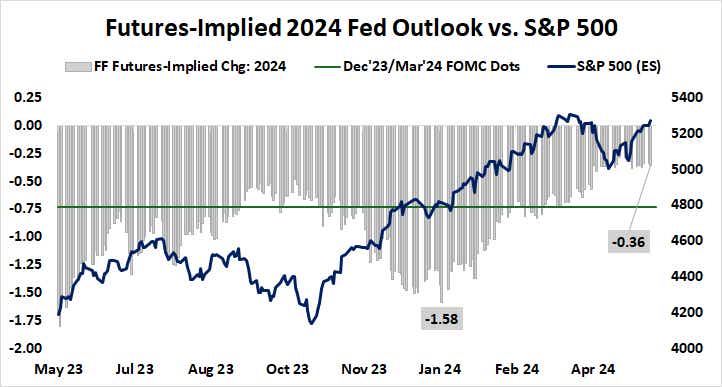

While both outcomes marked a pickup from March, they registered squarely in line with economists’ median forecasts. That left undisturbed what has emerged as the “new normal” for rate cut bets over the past month. Fed funds futures reflect 36 basis points (bps) in cuts this year. That means one 25bps reduction and 44% chance of another one.

Wall Street teeter-totters as markets weigh Fed rate cut outlook

The bellwether S&P 500 stock index lunged lower as the PPI report crossed the wires, then quickly reversed. Within an hour, it erased intraday spike lower and began trading to session highs.

The tech-tilted Nasdaq echoed these moves, as did Treasury bonds and most major currencies not named “U.S. dollar”.

This whipsaw price action stands in contrast to Wall Street’s defensive reaction to last week’s U.S. consumer confidence data from the University of Michigan (UofM), which showed a worrying jump in inflation expectations. Survey respondents’ one-year outlook jumped to a six-month high, threatening Fed stimulus prospects.

The spotlight now turns to April’s all-important consumer price index (CPI) data. It is expected to show that U.S. inflation cooled last month. The headline rate is seen falling to 3.4% year-on-year, down from the six-month high of 3.5% set in March. The core gauge is penciled in at 3.6%, the lowest in three years.

Can stock markets shrug off U.S. inflation data?

An upside surprise on the headline figure may be in the cards. Rising crude oil prices since the beginning of the year have entered the CPI calculation with about a one-month lag. The WTI benchmark slipped in April, but the March rise is yet to be accounted for.

Whether stocks can take such an outcome in stride will depend on whether core disinflation remains intact. This is the metric most emphasized by policymakers. Recent price action suggests that only an unmistakably hotter than expected figure here is likely to undermine market-wide risk appetite in a substantive way.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.