U.S. Banks to Report Earnings on Friday: Will JPM, C and WFC Impress?

U.S. Banks to Report Earnings on Friday: Will JPM, C and WFC Impress?

The banks represent nearly $1 trillion in market capitalization— much of the U.S. financial sector

- Bank earnings will come into focus to start the U.S. earnings season.

- JPMorgan, Citi and Wells Fargo are to report earnings on Friday.

- Analysts expect solid performances from large U.S. banks.

JPMorgan Chase (JPM), Citigroup (C) and Wells Fargo (WFC) are scheduled to report earnings on Friday before the market opens. Together, the banks represent nearly $1 trillion in market capitalization and make up a significant portion of the U.S. financial sector. As usual, the big banks mark the start of the quarterly earnings season.

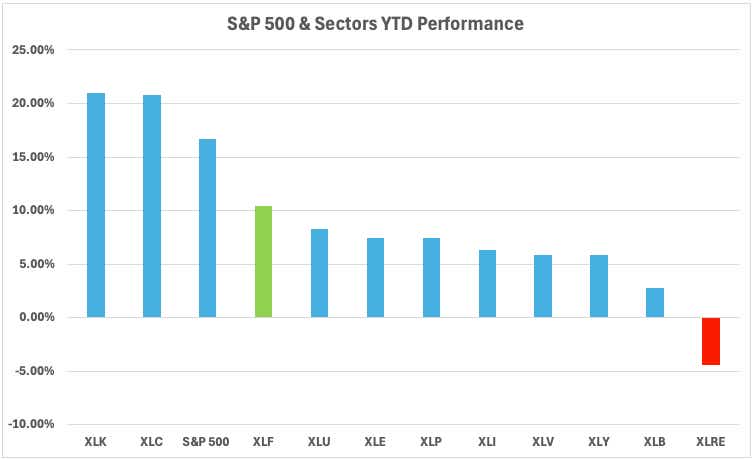

The financial sector lags behind the S&P 500, although it is the third-best performer in the S&P 500, with the SPDR Financial Select Sector exchange-traded fund (ETF) up 10.4% on a year-to-date basis. Investors are bullish on bank stocks ahead of expected interest rate cuts from the Federal Reserve.

All three banks announced increased capital returns to shareholders after passing the Federal Reserve’s annual stress test last month. JPMorgan announced a new quarterly dividend of $1.25 per share, up from $1.15; Citigroup raised its quarterly dividend to $0.56 from $0.53; and Wells Fargo increased its quarterly dividend to $0.40 from $0.35.

What do investors expect?

For the quarter ending June 30, investors expect JPMorgan to post earnings per share (EPS) of $4.26, with estimates ranging from $3.86 to $5.79. Revenue is expected to come in at $39.5 billion, which would be down slightly from $42.4 billion a year ago. JPM beat EPS estimates in three of the last four earnings.

Expectations for Citi are for EPS of $1.41 on $20.1 billion in revenue. EPS estimates range from $1.29 to $1.66. Citi reported $19.44 billion in the current quarter ended last year. Analysts were slightly more optimistic about earnings 30 days ago. Citi beat EPS estimates in four of the last four earnings.

Wells Fargo is expected to post EPS of $1.28, with a range from $1.16 to $1.39. Revenue is expected to come in at $20.23 billion, mostly in line with last year’s $20.5 billion revenue. Estimates for WFC have been mostly steady over the last 30 days. WFC beat EPS estimates in four of the last four earnings.

**EPS and revenue figures sourced from Yahoo! Finance**

Trading bank earnings

Options markets don’t expect huge moves from the banks, likely because of their above-par performance vs. the broader stock market and increased appetite to reward shareholders.

JPM is currently trading with the highest implied volatility rank (IVR), and the July 19 expiration shows an expected move of +/- 6.44 points. That is only about 3.1% of the stock price.

While C trades with a lower IVR of 27.5, the July 19 expiration shows an expected move of +/- 2.28 points, translating to about 3.5% of the stock price. That said, it still doesn’t offer much volatility to play earnings.

WFC is trading with an IVR of 37.3 and shows an expected move of 2.31 for the July 19 expiration. That gives a 3.9% expected move, which is the highest of the group.

The low IV environment and modest expected moves don’t leave much in the way of premium selling strategies but if you’re bullish and expect one of these banks to outperform after announcing results, buying a call spread provides a viable strategy to play that view.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.