Bonds Find Their Bottom

Bonds Find Their Bottom

The U.S. 10-year yield down to 4.672%

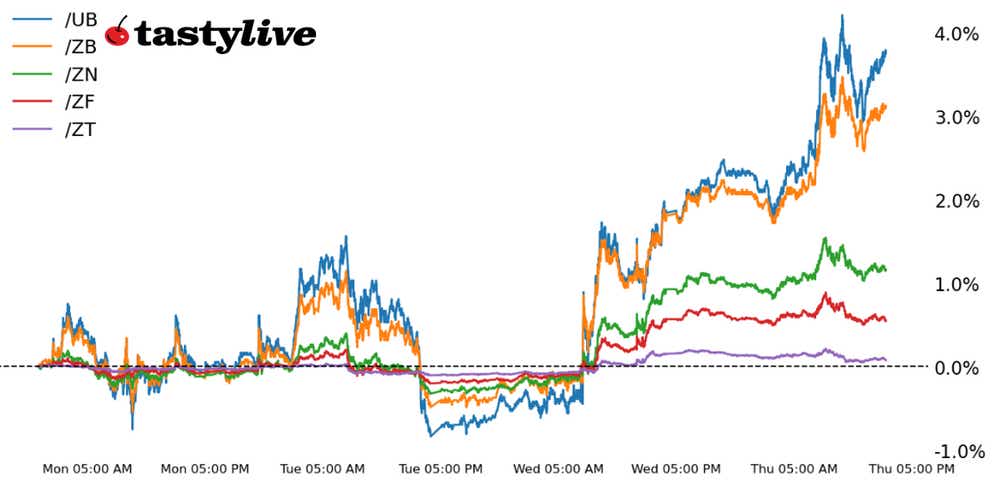

- Technical downtrends a being demolished across the U.S. Treasury curve, particularly at the long end.

- Volumes had previously reached exhaustion levels, while positioning in the futures market was the most net-short in history.

- The Federal Reserve is done with its rate-hike cycle.

The writing was on the wall in mid-October, when a parade of Federal Reserve officials talked about how yields had risen far enough such that another rate hike wasn’t necessary. That was confirmed at the November Federal Open Market Committee (FOMC) meeting, when Fed Chair Jerome Powell effectively laid the groundwork for no more rate hikes moving forward.

End of the most net-short market in history

Before yesterday, volumes had reached exhaustion levels. Positioning in the futures market was the most net-short in history. And now, the price action has finally turned the corner. The three boxes have been ticked: there’s formidable evidence that a bond market bottom has been reached.

As we said in mid-October, “it’s always darkest before dawn, and there are legitimate signs that the sun is coming beginning to rise once again.” Daylight is now breaking over the horizon for bonds.

/ZB U.S. 30-year bond price technical analysis: daily chart (May to November 2023)

The last time we looked at /ZBZ3, we noted that “a short put vertical (long 108 put/short 110 put) for the November 24 expiry (44DTE) is suggesting a POP of 75%.” Now, that same trade (22DTE) is pricing in a POP of 76%. Volatility remains high (IV Rank = 58.4, IV Index = 17.4%).

30s (/ZBZ3) are going to clock their first close above their daily 21-day exponential moving average, or EMA (one-month moving average) for the first time since Aug. 31. Moving average convergence divergence (MACD) is trending higher, and slow stochastics have moved above their median line for the first time since late-August. Downside momentum has been broken, through and through.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.