How Option Delta Impact Buying Power

How Option Delta Impact Buying Power

By:Kai Zeng

Consider buying power expansion risk when trading small-delta options

While the allure of trading small-delta options comes from their high success rate and ability to minimize volatility, there are nuances in risk management that often go unnoticed.

A critical aspects traders might overlook is buying power (BP) expansion risk, especially relevant when dealing with naked positions. BP expansion risk refers to the potential increase in the required margin when a position moves against the trader, typically when an option goes in-the-money (ITM).

This phenomenon can significantly impact a trader's capital allocation strategy, leaving less capital available for other opportunities and adding an extra layer of risk to their overall capital management.

Case study using SPY put options

To shed light on how BP expansion varies with different delta options, a study focusing on SPY put options with 45 days till expiration (DTE) was conducted. Three delta values were analyzed: 5, 16, and 50, representing far out-of-the-money (OTM), moderately OTM, and at-the-money (ATM) positions, respectively.

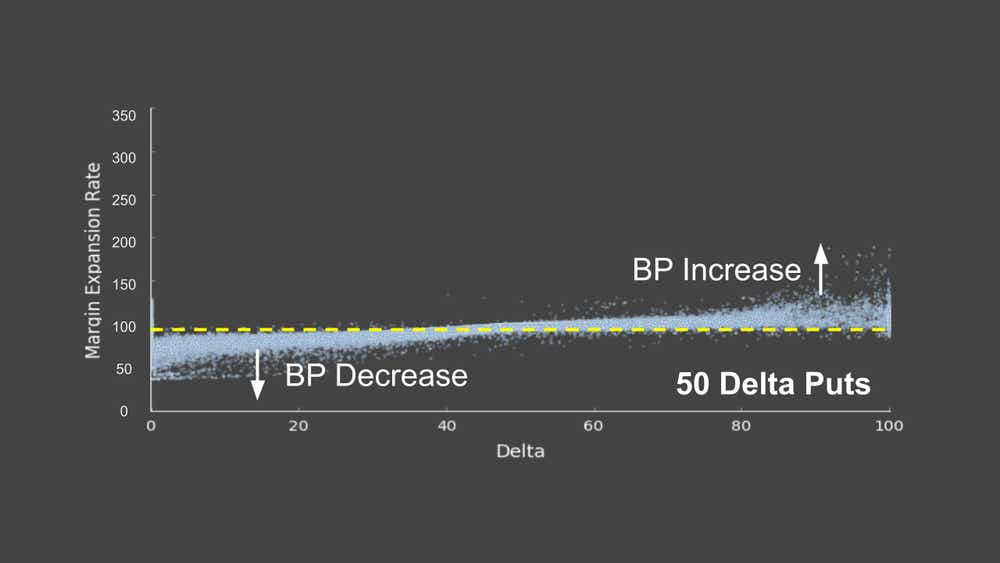

The study revealed interesting patterns in BP expansion across these deltas. Larger delta positions (ATM puts) showed a narrower BP range, typically fluctuating between 40% and 190% of the initial BP.

This range widens as we move towards options with smaller deltas; 16∆ options saw a BP range between 60% and 290%, with most instances staying below 150%.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

The most dramatic fluctuations were observed in the smallest delta options (5∆), where the BP range could extend up to 340% of the initial BP, although most cases still fell within a more manageable increase.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Despite these variations, it was noted that the average BP expansion rates for all three strategies over the 45-day period hovered around 100%. However, the wider range for smaller delta options indicates a potential tail risk that traders must keep in mind.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

This analysis emphasizes a critical aspect of risk management when trading small delta options. While the positions present an attractive high probability of success, they are also susceptible to significant BP expansion, especially as they move closer to being ITM. Traders must remain vigilant, monitoring their positions closely to navigate the thin line between capital efficiency and exposure to undue risk.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.