Unlock Lower Fees with Smart Options Trading

Unlock Lower Fees with Smart Options Trading

By:Kai Zeng

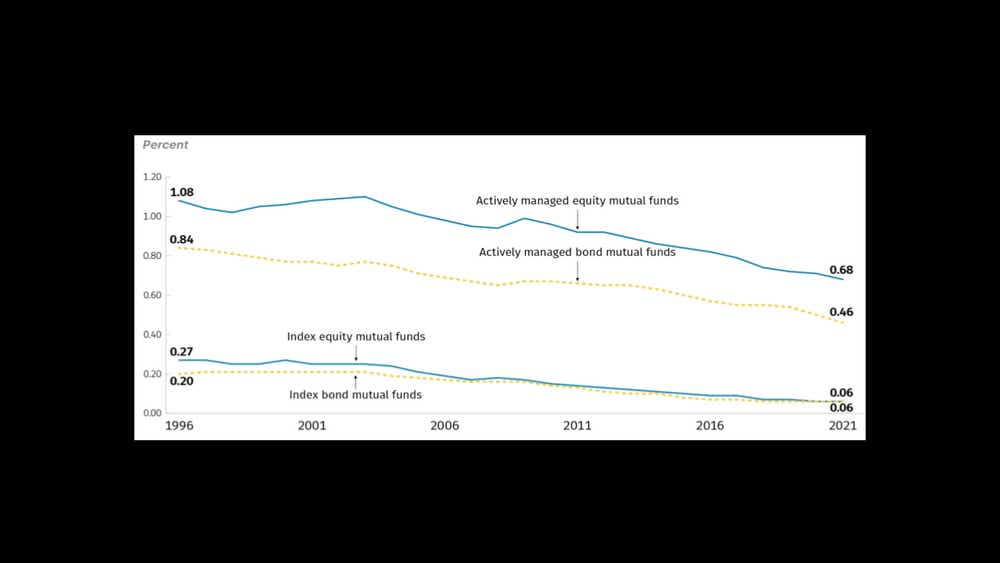

The seemingly small investment costs for mutual funds and ETFs can mount up over time

When considering investment strategies, understanding the costs associated with each option is pivotal. With the financial landscape offering a plethora of investment vehicles—from options to mutual funds and exchange-traded funds (ETFs)—making informed decisions requires a grasp of the associated expenses.

On the surface, investment costs for mutual funds and ETFs appear relatively low, with averages around 0.5% and 0.16% respectively. These numbers, though seemingly insignificant at first glance, can accumulate over time, influencing your overall investment returns. For instance, an investor placing $10,000 in a mutual fund with a 0.5% expense ratio will pay $50 annually in fees, while the same investment in an ETF with a 0.16% ratio costs only $16 per year, showcasing a notable difference in expense.

Diving deeper, the active management of investments through options trading presents an interesting alternative. Consider the strategy of selling S&P 500 ETF (SPY) 30-day puts over a 45-day cycle. Taking into account market conditions such as a volatility index (VIX) near the 15% average, this method yields intriguing results. When compared to the traditional buy-and-hold strategy, selling puts not only incurs lower costs than mutual funds but also competes closely with the low expenses of ETFs.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

In scenarios where large account traders utilize capped rates—say, $10 per leg—the cost benefits become even more apparent. Analyzing various account sizes and assuming full capital allocation to these puts, the consistent lower costs against the average ETF expenses highlight the efficiency of options trading in controlling investment expenses.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Focusing on long-term performance, allocating a portion of capital to strategic options trading, such as 25% into SPY puts, has historically outperformed the standard buy-and-hold approach in an SPY ETF, even with its low expense ratio of 0.0945%. This insight is backed by analysis over a 20-year period in a simulated $1 million account, revealing that the annualized expense ratio for a portfolio managed through options trading is, in fact, lower than that of a purely passive SPY strategy.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

In essence, while passive investment strategies are touted for their simplicity and lower upfront costs, the long-term analysis tells a different story. Active management, particularly through options trading, provides a viable pathway to reducing expenses and potentially enhancing overall returns. Whether you’re managing a substantial portfolio or just starting, understanding the impact of expense ratios and exploring efficient trading strategies could be key to maximizing your investment potential.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.