SMCI Stock has Soared From $90 to over $1,000 in Just a Year

SMCI Stock has Soared From $90 to over $1,000 in Just a Year

By:Mike Butler

The company, Super Micro Computer, builds energy-saving servers with liquid cooling

- In the past year, Super Micro Computer's stock has surged from $90 to over $1,000.

- SMCI's technological solutions are in demand for powering AI initiatives efficiently.

- Super Micro Computer has an expected stock price range of over +-$400 through 2024.

What is Super Micro Computer?

A year ago, you may not have heard of Super Micro Computer (SMCI). Now, with the rise in demand for artificial intelligence (AI) and day-to-day AI implementation, traders and investors alike are wondering what the deal is with this tech stock that's surged from $90 to over $1,000 a share in just a year's time.

The staggering rise in SMCI's stock price makes it feel like a meme stock, but is it sustainable? First, we need to understand what's under the hood. What is it about Supermicro's product offering that is creating such high demand?

Supermicro was founded in September 1993 by current President & CEO Charles Liang. The company has grown to provide jobs to over 5,000 employees and offers a diverse IT suite.

"Supermicro is a global technology leader committed to delivering first-to-market innovation for enterprise, cloud, AI, metaverse and 5G telco/edge IT infrastructure,” the company says. “We are a rack-scale total IT solutions provider that designs and builds an environmentally-friendly and energy-saving portfolio of servers, storage systems, switches, software—along with global support services."

The part about ”energy-saving portfolio of servers" caught my eye. That’s because so many tech companies are making big AI expansion efforts across the globe. You can only press a machine to do so much for you before it taps out, and Supermicro offers a liquid-cooling solution for their servers.

When it comes to cooling capacity, thermal conductivity and energy transport, water takes the cake compared to air. Water has 1000x more cooling capacity than air.

For Supermicro, this means more efficient machines that can be maximized in terms of computing capacity per square foot. The icing on the cake is the reduced power usage and lower carbon emissions for those looking for green solutions, which is where the corporate world is moving.

It seems as though SMCI was well prepared for the swift shift to AI computing solutions, and they've reaped the benefits thus far. In 2018, IDC ranked Supermicro the third largest server systems supplier in the world. In 2023, Supermicro had its first $2 billion revenue quarter, resulting in a $7 billion revenue year.

Why are traders and investors interested in SMCI?

In the most recent Super Micro Computer press release on Jan. 29, President and CEO Charles Liang expressed his confidence in 2024 performance:

“We continued to demonstrate our market leadership in fiscal Q2 2024, reporting record revenue results of $3.66B, year-over-year growth of 103%. While we continue to win new partners, our current end customers continue to demand more Supermicro’s optimized AI computer platforms and rack-scale Total IT Solutions. As our innovative solutions continue to gain market share, we are raising our fiscal year 2024 revenue outlook to $14.3 billion to $14.7 billion.”

These are huge growth figures by anyone's standards. In the stock market, gaining traction and attention from long-term investors, short-term traders, and everyone in-between, can be as simple as seeing a stock multiply in a big way. This rings true for SMCI stock, which is also offering some two-sided price action with bulls and bears battling to find the new normal stock price for Supermicro.

A bullish case for SMCI stock

If you believe the demand for AI product solutions is just getting started, it seems SMCI is ready to answer the call. Their product-suite is immense, and they're checking all of the boxes from a sustainable and efficient energy solution standpoint. Some of the largest customers currently include Intel (INTC), Advanced Micro Devices (AMD) and Nvidia (NVDA). Expansion efforts into Asia tell us Supermicro is prepping for continued growth, and it will be interesting to see if the stock can continue to climb higher this year.

A bearish case for SMCI stock

Like many other tech stocks, Supermicro isn't the only game in town. Competitors include household names like Dell (DELL), and stiff competition can always create stock price friction. If big-name customers like Nvidia, Intel and Advanced Micro Devices decide to move in a different direction for whatever reason, we could see product demand plummet along with SMCI's stock price. At the very least, it's prudent to expect continued realized volatility in the stock price whether you're a bull or a bear.

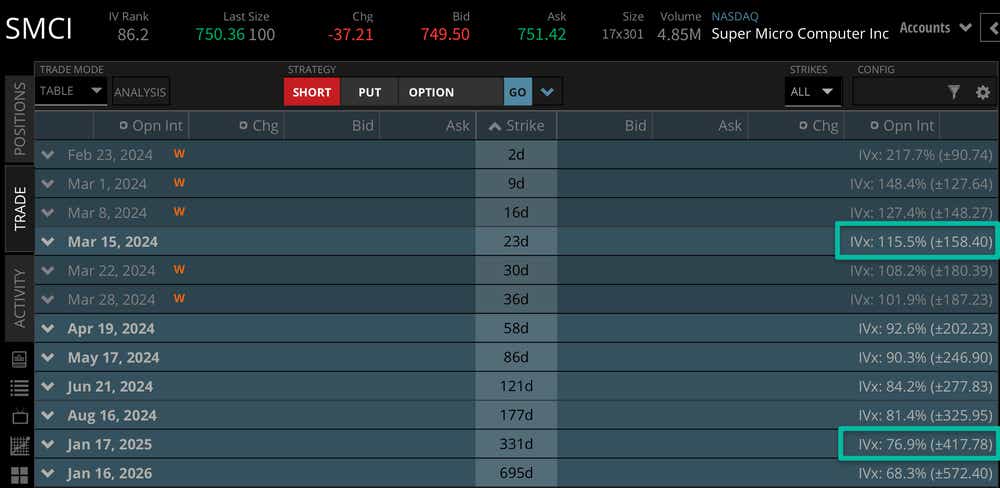

SMCI stock boasts an implied volatility near 100% in long-term options cycles, which implies that the options market is expecting this stock to have massive swings going forward.

Through the January 2025 options cycle, SMCI stock has an expected stock price move of +-$417.78. The stock currently sits around $750 per share with Nvidia earnings to be announced today after the close.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.