Stocks Are in Trouble if U.S. Consumers Turn Gloomy

Stocks Are in Trouble if U.S. Consumers Turn Gloomy

By:Ilya Spivak

Inflation is slowing but data hints at the possibility of recession

- Stocks and Treasury yields sank as U.S. CPI data showed lower inflation than expected.

- A shift toward more immediate Fed rate cuts seems to be fueling fears about recession.

- The pain may continue if U.S. consumer confidence sours despite easing price growth.

Stock markets shuddered as June’s much-anticipated U.S. consumer price index (CPI) revealed lower inflation than market-watchers anticipated. The bellwether S&P 500 is on pace for its biggest daily drop in six weeks. Treasury bond yields are sharply lower and gold prices have shot higher.

Headline inflation ticked down to 3% year-on-year, the lowest in 12 months. The core measure excluding volatile food and energy prices—a focal point for Federal Reserve policymakers because most lingering inflation is stuck within the service sector—inched down to 3.3% to mark a new three-year low.

U.S. inflation drop stokes recession fears

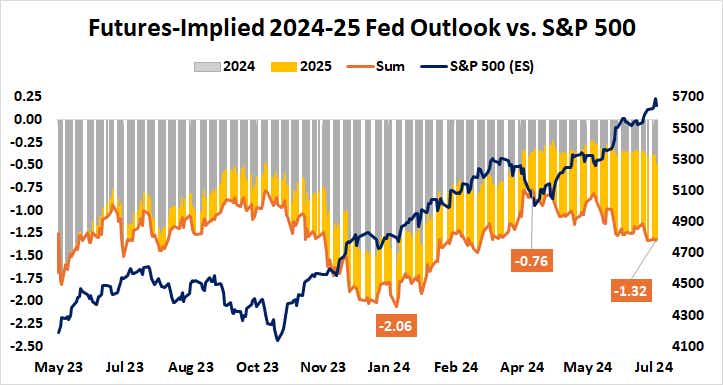

The response from price action suggests traders interpreted the data to imply a sense of immediacy in the arrival of interest rate cuts. Indeed, the policy outlook implied in Fed Funds futures shifted up 10 basis points (bps) of expected easing from 2025 to 2024, such that the markets now anticipate two standard-sized 25bps reductions this year.

The first interest rate cut of the cycle is now fully priced in for September’s meeting of the policy-steering Federal Open Markets Committee (FOMC). A second one is seen as likelier than not in December. Traders seem to be interpreting the growing sense of urgency to imply elevated recession risk, as expected.

Market participants seem a bit like the proverbial dog that caught the car. They were happy with the prospect of rate cuts on the horizon but now feel queasy as their arrival nears because this probably means the Federal Reserve has found economic trends negative enough to act.

Will lower prices make consumers cheerful?

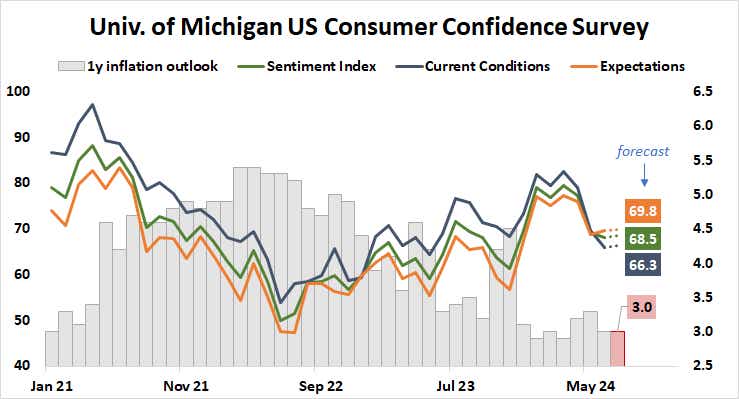

How all this sits with U.S. consumers—the engine driving most economic growth—will round out the story for the week. The University of Michigan (UofM) sentiment survey has told a consistent story in the wake of the COVID-19 pandemic. Consumers’ outlook soured as one-year inflation expectations rose, then started to improve as they turned lower.

The markets may take heart if survey respondents appear to notice disinflation has resumed after a setback earlier in the year. If the relationship breaks down and cooling prices fail to inspire optimism, however, worries about an economic downturn might prevail. If so, stocks might be in for an ugly end to the trading week.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.