Stock Markets Cheer a Friendly Fed, But Trouble is Looming Ahead

Stock Markets Cheer a Friendly Fed, But Trouble is Looming Ahead

By:Ilya Spivak

The stock market rally may stumble as investors discount the dovish turn in Federal Reserve policy bets and turn their attention to the global recession looming ahead

- Wall Street in celebration mode after the Federal Reserve endorsed rate cut hopes.

- Leading economic data warns that a global recession now seems to be unavoidable.

- History hints that stock markets are entering a dangerous post-tightening period.

Wall Street erupted in loud cheer as the Federal Reserve endorsed dovish speculation with December’s monetary policy update.

Fed Chair Jerome Powell and company revised official forecasts and updated the accompanying commentary to signal that investors have been right to expect that rate hikes have ended and a move the other way beckons in 2024.

The results were unmistakable across key assets. The bellwether S&P 500 jumped 1.4% to trade within a hair of the record high from January 2022. The high-flying Nasdaq wasn’t far behind, adding 1.3% to reach a similar perch. Bonds soared as yields and gold posted its biggest daily gain in two months. Yields and the U.S. dollar cratered.

Global economic growth has nearly stopped

The moves seem to put something of an exclamation point on the rapid repricing of the expected Fed policy path in November. It was marked sharply dovish turn in rate cut expectations. The obvious question now that officials have sided with the stimulus-favoring hopeful is whether these moves still have steam to power on.

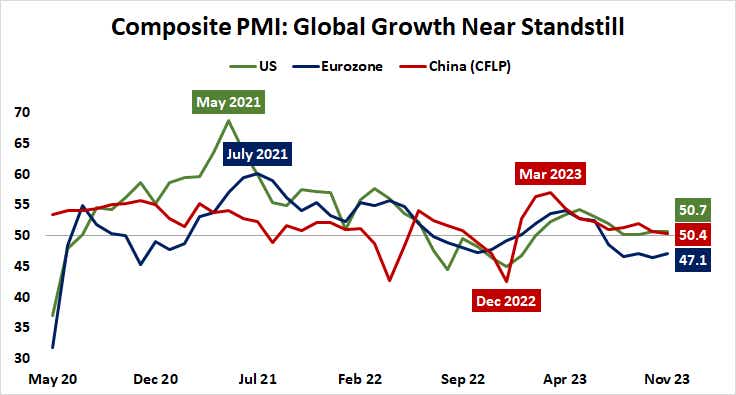

Leading purchasing managers index (PMI) figures from S&P Global hint that the fourth quarter will see the weakest global economic growth since the final three months of 2022. Analysis from Citigroup reveals that worldwide economic outcomes deteriorated relative to analysts’ expectations in November. Inflation numbers undershot most conspicuously.

It isn’t surprising that such outcomes have encouraged dovish speculators. It also seems logical to conclude that cheaper money will make economic hardship easier to stomach. Nevertheless, a global recession now seems all-but unavoidable. With the Fed having now shown its hand, cycle-sensitive assets including stocks may be due for a rude awakening.

Stock market in 2024: trouble ahead?

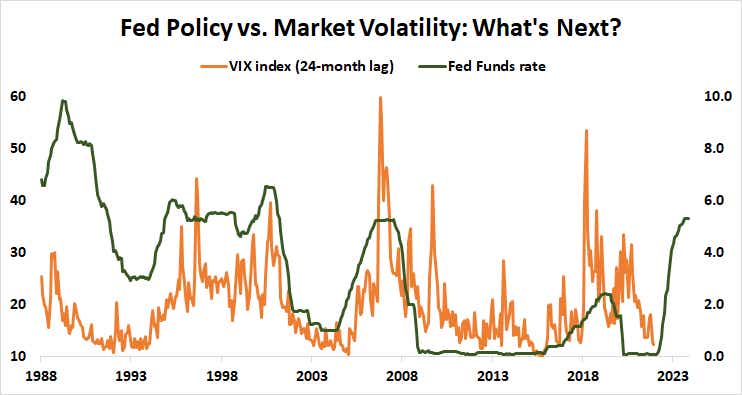

Over the past three decades, a sharp upward spike in the VIX–the implied S&P 500 option volatility index from the Chicago Board Options Exchange (CBOE), investors’ so-called “fear gauge”—has followed the start of a Fed tightening cycle with about a two-year lag. This echoes the Fed’s estimate of 12-18 months for the economy to absorb a single hike.

This warns that trouble is brewing ahead as the calendar prepares to turn to 2024. As hopes for Fed accommodation transition from speculation to a new central-bank-approved baseline discounted by the markets, weak growth and its inherent risks—especially for financial stability—seem likely to surface.

Stocks and cyclical commodities like crude oil appear vulnerable in such a scenario, while anti-risk currencies like the U.S. dollar and Japanese yen seem poised for gains against their major counterparts.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.