Stocks and Bonds Surge After December FOMC Meeting

Stocks and Bonds Surge After December FOMC Meeting

Final rate hike for 2023 nixed, number of 2024 cuts boosted to three and projected cuts for 2025 held at four

- The Federal Reserve held its main rate steady at 5.25-5.5%, as expected (100% chance, per CME’s FedWatch Tool).

- The rate hike cycle is officially finished, and markets foresee the first rate cut coming as early as March 2024.

- Stocks and bonds were trading near their highs of the day, week and month at the time this report was written.

Market Update: S&P 500 up 3.67% month-to-date

It’s official: The Federal Reserve rate hike cycle is finished. The December Federal Open Market Committee (FOMC) meeting yielded exactly what was expected when policymakers left the main rate on hold at 5.25-5.5%.

However, the FOMC nixed a final hike from the 2023 projection, boosted the cuts anticipated in 2024 to three and left the cuts projected for 2025 at four. In total, 175 basis points’ (bps’) worth of rate cuts are anticipated over the next two years. That’s not quite as much as markets continue to anticipate—five cuts are discounted through the end of 2024, according to Fed funds futures—but it was a strong acknowledgement that the market is largely correct on the direction of rates moving forward.

There were some shifts in the FOMC’s expectations for inflation and growth as well. While the Fed sees 2023 ending on a stronger note than previously anticipated (up 2.6% vs. 2.1% in the September projections), it did note the growth rate is likely to be slower in 2024 (up 1.4% vs. 1.5%). Similarly, the inflation rate was revised lower for 2023 (up 2.8% vs. 3.3%) and for 2024 (up 2.4% vs. +2.5%). The unemployment rate (U3) projections remained unchanged from September.

In totality, the projections and dot plot point to a dovish turn by the FOMC, which was welcomed as good news by market participants: The Fed is backing off of its rate hike cycle because victory over inflation is in sight, not because they are concerned about the economy careening into a recession.

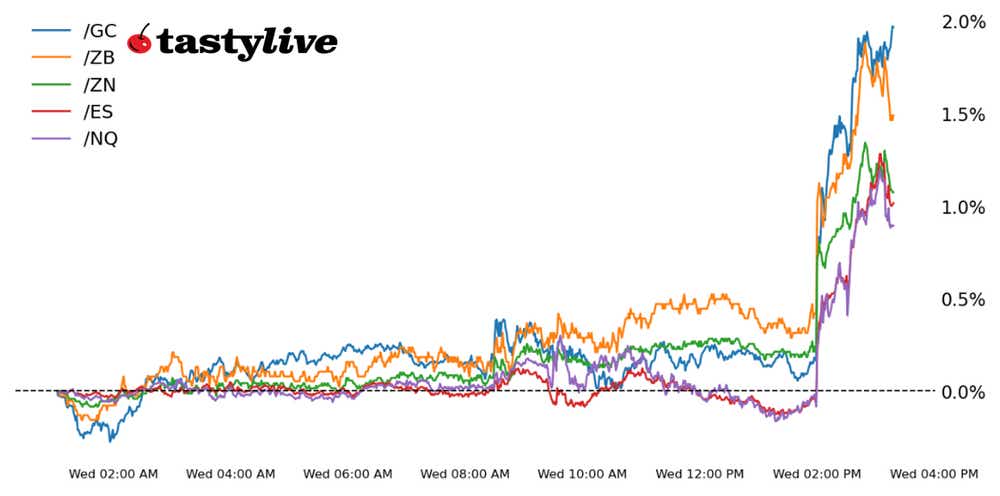

Stocks and bonds surged on the initial announcement and during the ensuing press conference by Federal Reserve Chair Jerome Powell, with the S&P 500 (/ESH4) and Nasdaq 100 (/NQH4) moving up to fresh daily, weekly and monthly highs; the Nasdaq 100 itself is at fresh yearly highs as well. Bonds rallied across the curve, and the ensuing push lower in yields now sees the U.S. Treasury 10-year yield at 4.030%, its lowest level since Aug. 10.

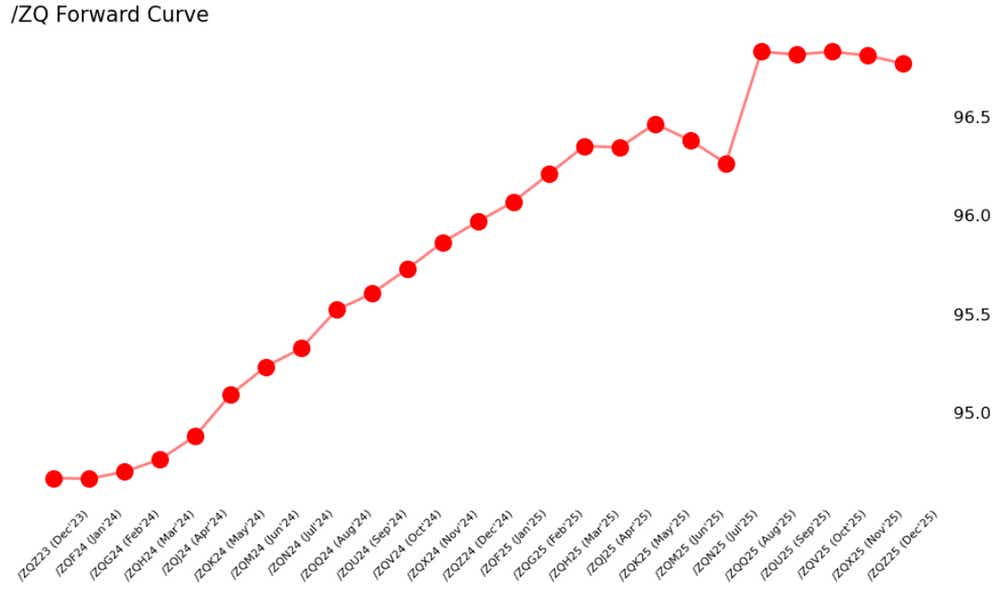

/ZQ Fed Funds Futures Forward Curve (December 2023 to December 2025)

The /ZQ (Fed funds) term structure shows an expectation that the Fed will begin cutting rates soon: There is greater than a 67% chance that the first cut is delivered in March. Rate cut odds build steadily thereafter, with additional cuts anticipated in May, July, September and December 2024.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.