The Hold Steady: FOMC Pauses, Markets Rally

The Hold Steady: FOMC Pauses, Markets Rally

Another 2023 rate hike is looking less likely

- The Federal Reserve held its main rate steady at 5.25%-5.5%, as expected. (There was a 98% chance, per the Chicago Mercantile Exchange (CME) FedWatch Tool).

- Another rate hike can’t be ruled out, but markets are viewing it as increasingly unlikely.

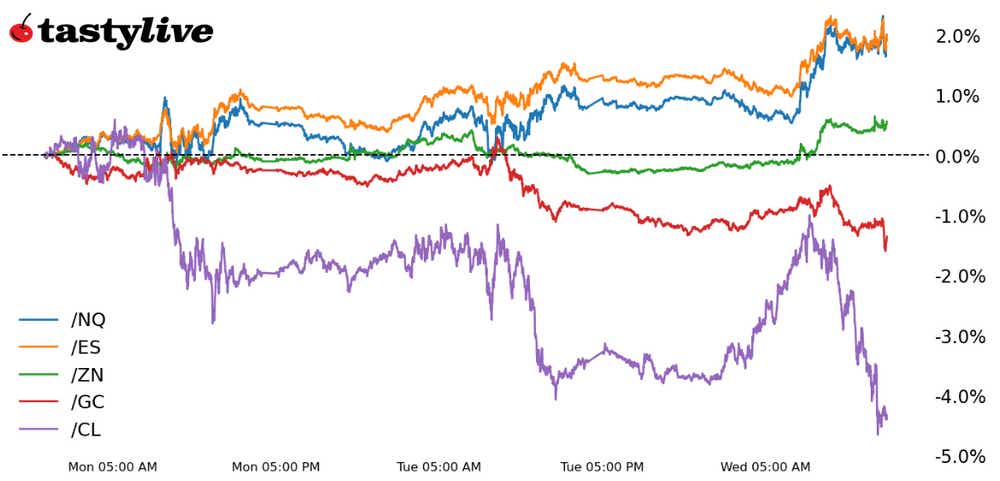

- Stocks and bonds were trading at their highs of the day at the time this report was written.

Market update: S&P 500 up 0.42% month-to-date

Another Federal Open Market Committee (FOMC) meeting, another lack of surprises. The Federal Reserve did exactly what was expected today when it left its main rate on hold at 5.25%-5.5%.

Throughout September and October, FOMC officials, including Fed Chair Jerome Powell himself, suggested the shift higher in U.S. Treasury yields produced tighter financial conditions that undercut the need for an additional rate hike. It has been a familiar refrain in recent months—the FOMC remains data dependent while reacting to incoming economic figures.

With a stronger U.S. economy during the third quarter, a still-strong U.S. labor market and moderating but not-yet-defeated inflation, the Fed believes keeping rates elevated for the foreseeable future remains necessary. While another rate hike can’t be ruled out, the FOMC is assuredly ‘paused’ as it awaits incoming data. You could argue that there was a dovish hue to the policy statement, given the inclusion of a comment on tightening financial and credit conditions.

On balance, both stocks and bonds took the November FOMC policy statement and Powell’s press conference fairly well. While the initial reaction was lackadaisical, the S&P 500 (/ESZ3), the Nasdaq 100 (/NQZ3), two-year notes (/ZTZ3), and five-year notes (/ZFZ3) all were at their highs of the day at the time this note was written.

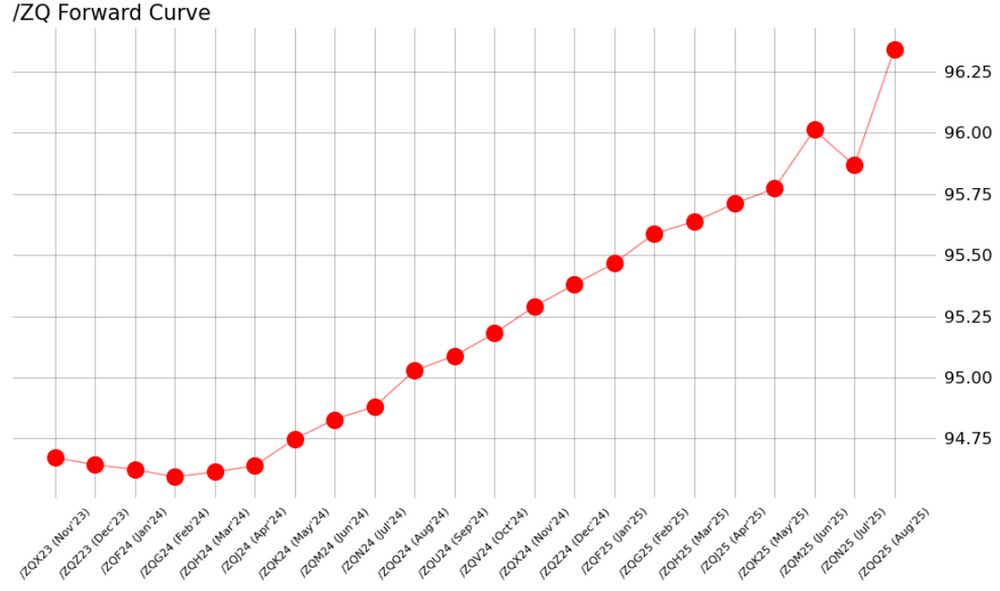

/ZQ Fed Funds Futures Forward Curve (December 2023 to August 2025)

The /ZQ (Fed funds) term structure still shows an expectation that the Fed will not raise rates again this year: there is less than a 20% chance that another hike is delivered before the end of the year. Rate hike odds peak at 29.6% at the January 2024 meeting, then rolls downhill from there. The next FOMC meeting is on Dec. 13, so there is a lot of time for the data landscape to evolve and thus change the minds and hearts of traders.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.