Fed's Powell Swings Stocks, U.S. Dollar But Markets See Rate Hikes Over

Fed's Powell Swings Stocks, U.S. Dollar But Markets See Rate Hikes Over

By:Ilya Spivak

A speech by Jerome Powell bruised stocks and bolstered the U.S. dollar, but financial markets are still convinced that interest rate hikes are over

- Stocks swoon, U.S. dollar rallies as Fed Chair Powell speaks at an IMF conference.

- Cautious tone keeps rate hike risk alive, but markets expect that it won’t happen.

- Corrective moves may reinforce follow-through for the recovery of stocks and bonds.

Financial markets yawned as expected as Federal Reserve Chair Jerome Powell stepped up to the microphone for the first of his two public appearances this week, speaking at the centennial conference organized by the central bank’s research arm.

Today, traders paid much more attention when Powell returned to take part in a panel discussion on today’s global policy challenges at the annual conference put on by the International Monetary Fund (IMF). In prepared remarks, Powell said U.S. officials are “gratified” by inflation’s comedown so far but see a “long way to go” yet.

Fed Chair Powell: the same old two-step

Perhaps most critically, the Fed chair said the central bank is committed to achieving a sufficiently restrictive policy stance, then ominously added that “we are not confident that we have achieved such a stance." Treasury yields jumped higher along with the U.S. dollar and stocks slumped as those words crossed the wires.

Powell said imbalances from a tight labor market are easing but added that the Fed is attentive to the risk that stronger growth could warrant still-higher rates. Warning that inflation “has given us a few head-fakes,” he said continued progress is not assured. To that end, policymakers won’t hesitate to tighten more if appropriate. By way of balance, Powell conceded that the Fed will move carefully to avoid the risk of over-tightening.

The speech added fuel to moves already underway since the start of the week. U.S. stocks have drifted a touch lower while the greenback perked up after both saw dramatic moves in the opposite direction last week. Besides receding geopolitical jitters, the Fed’s messaging after a meeting of the policy-setting Federal Open Markets Committee (FOMC) was a key catalyst. With all due disclaimers, it signaled that rate hikes have probably ended.

Markets still think the Fed is done raising interest rates

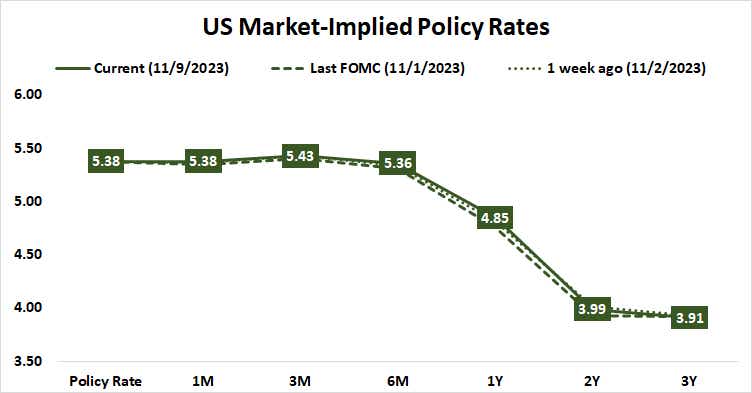

As it stands, the markets put the probability of another rate hike in this cycle at less than 30%. Rate cuts are set to begin no later than July. In fact, the likelihood of a 25-basis-point (bps) reduction at the June FOMC meeting stands at a commanding 80%. A total of 75 bps in easing are fully baked in for 2024.

Mr. Powell’s remarks today seem to change nothing here. After all, the central bank can hardly allow inflation expectations to run wild if it is to show its hand too early. Keeping the risk of a hike on the table is an essential part of ensuring that markets don’t undermine the central bank’s efforts, not least by pushing asset prices higher. Such appreciation would enable a loosening of financial conditions and risk stopping disinflation in its tracks.

To that end, the moves triggered by Powell’s remarks and much of this week’s price action preceding them appear corrective. That's a welcome digestion of last week’s fireworks. To the extent that such a move shakes out weak hands belatedly chasing stocks and bonds higher, it can make for a more orderly continuation of that trend.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.