Stocks Struggle After Hitting Record High. What Has Investors Worried?

Stocks Struggle After Hitting Record High. What Has Investors Worried?

By:Ilya Spivak

Stocks are struggling to follow through after surging on strong U.S. jobs data even as Fed rate cut expectations cooled. Are credit stress worries returning?

- Strong U.S. jobs data cut into Fed rate cut bets, but stocks rose anyway.

- Absence of bullish follow-through since then hints at loss of conviction.

- Investors might be worried about a repeat of the 2023 banking crisis.

Stock markets’ enthusiastic response to the release of January’s U.S. employment data last week seemed to put a kind of exclamation point on the argument for further gains.

The numbers registered sharply better than expected across every key indicator. That pushed markets to scale back Federal Reserve rate cut bets, but shares roared anyway.

Fed funds futures now fully price in 114 basis points in rate cuts by the end of the year, implying four standard-sized 25 basis-point reductions and a better-than-even probability of a fifth one. That’s down from 158 basis points in mid-January, implying the markets have shed nearly two rate cuts from the baseline outlook in a mere three weeks.

Stocks holding strong as Fed rate cut expectations fade … or are they?

The bellwether S&P 500 stock index lurched lower briefly as the jobs report hit the wires, then surged to issue the highest close on record. It was as though the markets were emphatically signaling that sustaining risk appetite did not demand the promise of rapid credit easing.

Price action since has been decidedly less confident. Two days of soggy trading so far this week amounted to a slight pullback of just under 0.5%, locking the S&P 500 within a narrow range. As surefooted as the markets seemed after the jobs report, they now seem to be struggling to follow through.

Such lackluster performance need not necessarily signal trouble ahead. The markets may simply have opted for a period of digestion having entered a period of diminished event risk after hitting record levels. A more ominous interpretation may be that storming the highs has left traders with a sense of vertigo, sapping bullish conviction.

Are markets worried about a banking crisis replay?

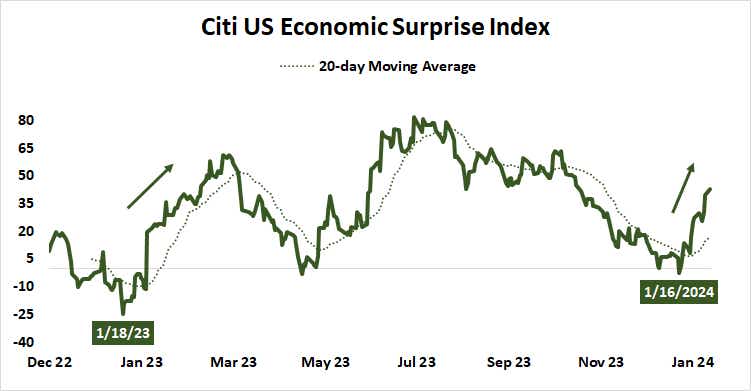

Why the sudden turn to caution? Recent events have troubling parallels to what transpired in the lead-up to the Silicon Valley Bank-led banking crisis in the first quarter of 2023. Then too, a run of upbeat economic data drove a hawkish shift in Fed policy expectations. Stocks cheered initially, then buckled amid credit stress.

This doesn’t mean that markets are inherently doomed to repeat last year’s trauma. However, a vast pile of debt needing to be refinanced at much higher interest rates today than just two years ago offers plenty of fertile ground for credit trouble if the latest adjustment in borrowing costs finds a pocket of vulnerability to press on.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.