Stock Rally May Stall If FOMC Minutes See the Fed Itching To Cut Rates

Stock Rally May Stall If FOMC Minutes See the Fed Itching To Cut Rates

By:Ilya Spivak

Dovish rhetoric might fuel speculation of still more defensive guidance at the Jackson Hole symposium

- July brought a major pivot in Fed monetary policy, and the markets noticed.

- Investors worry that the central bank is already behind the curve on rate cuts.

- Stock markets may turn defensive if the July FOMC minutes stoke recession fears.

At face value, last month’s monetary policy decision from the Federal Reserve was a quiet affair. Stock markets were already enjoying a day of spirited gains when Fed Chair Jerome Powell and company delivered their announcement on July 31 and settled into a digestive range near the daily highs thereafter.

The substance of the message that policymakers delivered was decidedly more potent than traders’ staid response. A reshuffling of the language in the policy statement signaled that the central bank now saw the risk of too-high unemployment as approaching par with that of too-high inflation.

Fed policy marked a major turn in July

That marked a critical change from officials’ laser focus on cooling price growth because they acknowledged over three years ago that the issue will not simply resolve itself as pandemic-era disruptions wane. As recently as June, Powell argued a still-strong labor market gave the Fed time to ensure lasting disinflation before cutting rates.

The markets’ nonchalant response probably reflects their familiarity with this new perspective. Indeed, July’s announcement made official a shift in the Fed’s thinking that was unveiled much earlier, making its first major appearance when Powell appeared for semi-annual testimony in Congress July 9-10.

In those remarks, Powell warned that “elevated inflation is not the only risk we face,” adding that cutting interest rates too little or too late could unduly weaken the economy and jobs. Traders were quick to seize on the pivot. When soft inflation data appeared later that week, stocks started to carve out tops that they haven’t reclaimed since.

Recession fears have swelled as rate cuts draw closer

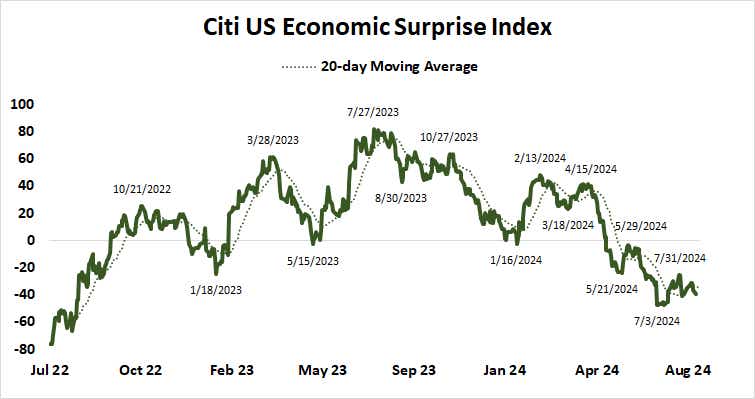

This seems to make sense. By early July, investors had watched three months of increasingly acute deterioration in U.S. economic data flow relative to baseline forecasts, according to Citigroup. Within that context, the Fed’s newfound concern about the labor market seemed to mean that rate cuts were now needed to defend growth.

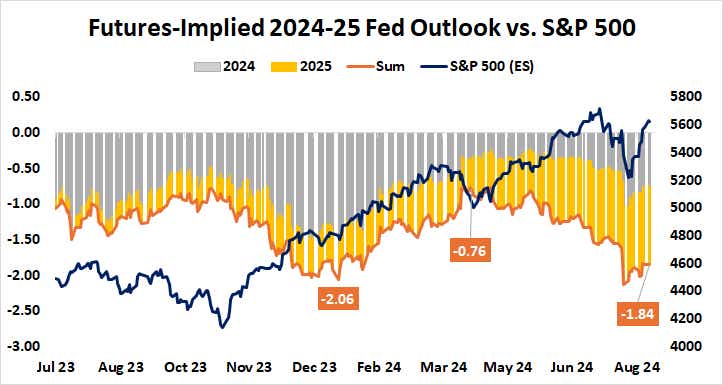

In fact, the markets suspected the Fed was behind the curve on easing long before. As policymakers bemoaned a “lack of further progress toward … the 2% inflation objective” in May and sliced the 2024 rate cut forecast from three to just one 25-basis-point (bps) move in June, repricing for catch-up stimulus in 2025 was already underway.

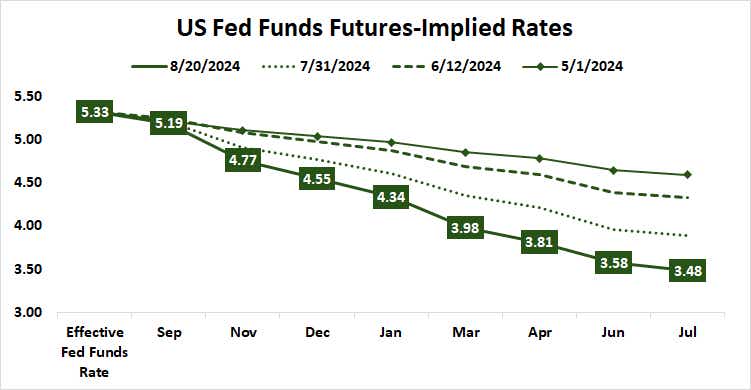

The rates path implied in Fed Funds futures has steadily adjusted to a “flatter”—that is, more dovish—setting after each of the past three Fed policy decisions in May, June and July. The tally of expected rate cuts by the end of 2025 nearly doubled from 76bps in mid-April to 133bps by the start of July, with nearly all the extra easing added for next year.

Stock markets may slip after July FOMC meeting minutes

Since then, divergent results on big-ticket U.S. economic data have brought wild seesaw volatility. Markets plunged after a soggy jobs report poured gasoline on investors’ worries on Aug. 2, leading into an outright panic on Aug. 5. The markets snapped back sharply after the dust settled, helped along by upbeat retail sales numbers last week.

Against this backdrop, minutes from July’s meeting of the policy-setting Federal Open Market Committee (FOMC) take on particular significance. Market participants will be keen to size up just how much cyclical concern was on display in the discussion and how to judge whether the subsequent upswell in recession fears appears well-founded.

Stock markets may not take kindly to commentary suggesting a sense of immediacy has emerged in the rate cut conversation, with Fed officials itching to act amid rising risks to economic growth. Such rhetoric might fuel speculation for still more defensive guidance at the Jackson Hole Symposium this week, spoiling market-wide risk appetite.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.