U.S. PCE Report, Eurozone and Australian CPI Data: Macro Week Ahead

U.S. PCE Report, Eurozone and Australian CPI Data: Macro Week Ahead

By:Ilya Spivak

Stocks look to inflation data to guide Fed, RBA and ECB rate cut bets

- The Australian dollar is at risk as markets and the RBA debate 2024 interest rate cut potential.

- The euro may turn lower if CPI data hints at a double-sized ECB cut in September.

- U.S. PCE data may take on added significance as markets fret about the Fed.

Stock markets offered a timid performance last week as hopes for more clarity on the path of Federal Reserve monetary policy were left mostly unfulfilled. The bellwether S&P 500 index managed a 1.3% gain, while the tech-oriented Nasdaq 100 notched up a mere 0.9% advance.

Treasury yields ticked lower while gold prices extended a bit higher, and the dollar continued to weaken. All this seemingly followed as minutes from July’s Federal Open Market Committee (FOMC) meeting, as well as a much-anticipated speech from Fed Chair Jerome Powell, cemented the U.S. central bank’s readiness to begin a rate cut cycle.

The likelihood of a standard-sized 25-basis-point (bps) rate cut has been almost fully discounted in interest rate futures markets for some time, so last week’s headlines offered little impetus for price action. Meanwhile, traders remain on tenterhooks about the possibility of a 50bps reduction.

Here are the macro waypoints likely to shape what comes next.

Australia monthly consumer price index (CPI) indicator

Economists expect to see that inflation in Australia slowed for a second consecutive month in July. The monthly consumer price index (CPI) gauge is penciled in for a downtick to 3.4% year-on-year, the slowest since February. This lines up with leading purchasing managers’ index (PMI) data flagging weak output inflation as firms absorb rising input costs.

While the Reserve Bank of Australia (RBA) focuses on quarterly CPI readings to guide policy, a soft result in monthly figures may help encourage speculation a rate cut is likely before year-end. This would be despite the central bank’s seemingly defiant stance in recent rhetoric. Such a result may push the Australian dollar lower.

As it stands, the markets are pricing in 21bps in easing for 2024. That amounts to an 84% probability of one standard-sized 25bps increase. By contrast, minutes from this month’s RBA policy meeting revealed that officials considered a rate hike before opting to remain “higher for longer” to press down on sticky prices.

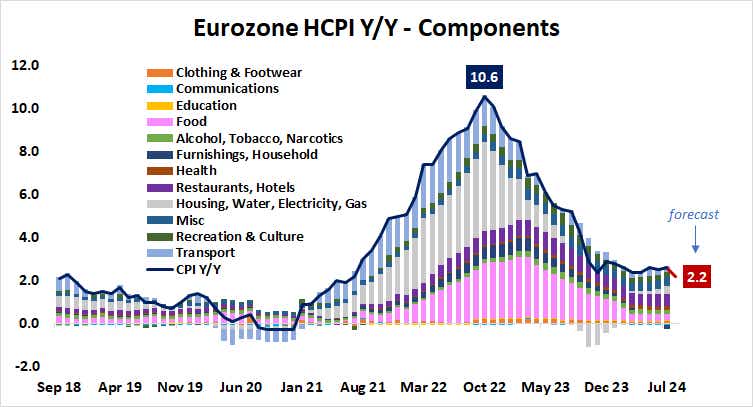

Eurozone consumer price index (CPI) data

Inflation in the Eurozone is expected to slow to 2.2% year-on-year in August, marking a three-year low. Economic data from the currency bloc has increasingly disappointed relative to consensus forecasts, according to analytics from Citigroup. That seems to set up the possibility of a downside surprise.

The markets are pricing in an 80% probability of a 25bps rate cut at next month’s European Central Bank (ECB) monetary policy meeting. Soft CPI data may cement the move as likely, with an especially sharp miss opening the door for a double-sized 50bps reduction.

Asked about such a scenario just last week, Bank of Finland Governor Olli Rehn said the ECB must always be open-minded and data dependent. This seems to imply that at least some members of the Governing Council are considering stepping up stimulus. With that in mind, the euro may turn lower if disinflation gathers steam.

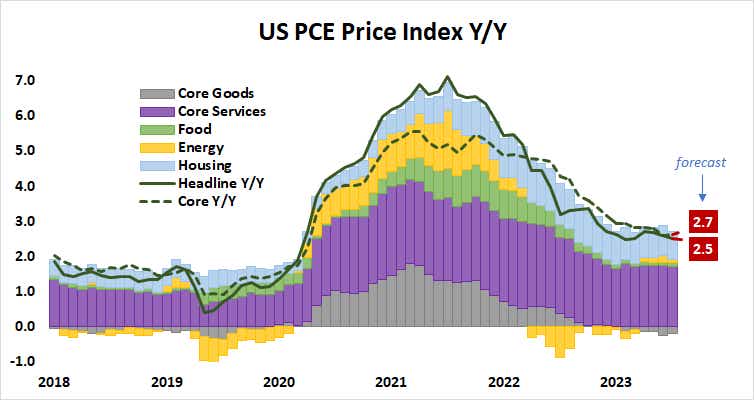

U.S. personal consumption expenditure (PCE) price index data

The Federal Reserve’s favored inflation gauge is expected to show that headline price growth held at 2.5% year-on-year for the second consecutive month in July. The core measure excluding volatile food and energy prices is seen ticking up a bit to 2.7%, the highest since April.

Economists tend to be relatively adept at fine-turning PCE data forecasts once consumer and producer price index numbers (CPI and PPI, respectively) for the relevant period have crossed the wires. This means market-moving deviations are rare, so speculative interest in the outcome is comparatively modest.

Nevertheless, a dearth of Fed-steering news flow this week might imbue the release with added significance as traders try to calibrate the likelihood of a 50bps rate cut at September’s FOMC meeting. That probability is currently priced in at 30.5%.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.