Russell 2000 Leads Post-Fed Rebound

Russell 2000 Leads Post-Fed Rebound

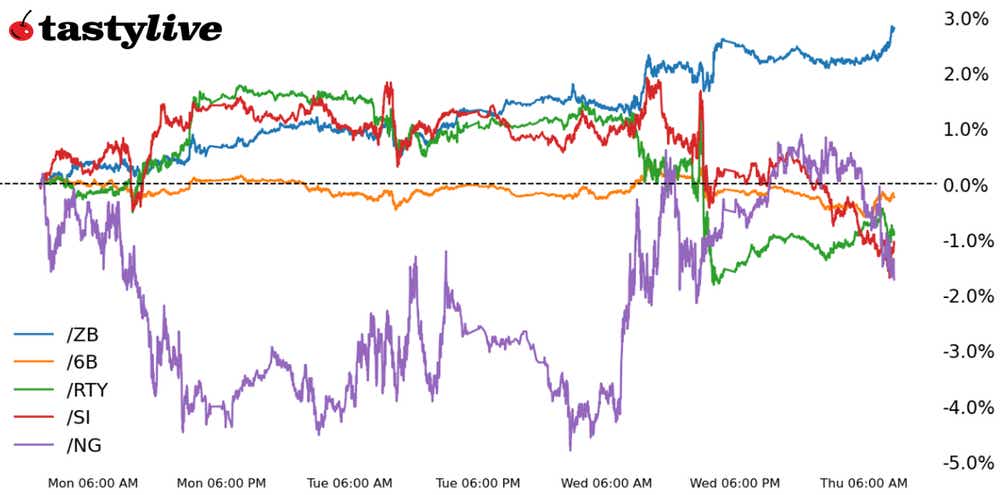

Also, 30-year T-bond, silver, natural gas and British pound futures

- Russell 2000 e-mini futures (/RTY): +0.74%

- 30-year T-bond futures (/ZB): +0.87%

- Silver futures (/SI): -1.51%

- Natural gas futures (/NG): -0.19%

- British pound futures (/6B): -0.42%

Fed Chair Jerome Powell made clear that the Federal Open Market Committee (FOMC) does not see a high probability that it will cut rates starting in March. But the divergent reaction between stocks (lower) and bonds (higher) is finding some resolution Thursday.

Stocks and bonds are each trading higher. Yields continue to slip, particularly at the long end of the curve. Elsewhere, the Bank of England’s hawkish hold helped support the British pound, the U.S. dollar is barely changed on the day.

Symbol: Equities | Daily Change |

/ESH4 | +0.34% |

/NQH4 | +0.52% |

/RTYH4 | +0.74% |

/YMH4 | -0.02% |

Russell 2000 gains

The initial shock of a reduced possibility of a March Fed rate cut hit the Russell 2000 (/RTYH4) harder than anything else on Wednesday. Now, it is reaping the rewards of more sober-minded thinking post-Fed on Thursday as the top performer.

Both the S&P 500 (/ESH4) and Nasdaq 100 (/NQH4) are trading higher as well. But the looming trio of earnings releases—Apple (AAPL), Amazon (AMZN) and Meta (META)—promises to inject volatility to after-hours trading.

Strategy: (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1850 p Short 1875 p Short 2025 c Long 2050 c | 10% | +615 | -635 |

Short Strangle | Short 1875 p Short 2025 c | 15% | +2700 | x |

Short Put Vertical | Long 1850 p Short 1875 p | 50% | +242.50 | -1007.50 |

Symbol: Bonds | Daily Change |

/ZTH4 | +0.06% |

/ZFH4 | +0.23% |

/ZNH4 | +0.35% |

/ZBH4 | +0.87% |

/UBH4 | +1.16% |

30-year bonds do well

30-year T-bond futures (/ZBH4) are extending gains following a rise in the number of weekly jobless claims, which exceeded analysts’ expectations.

The move follows yesterday’s FOMC rate decision. The higher bond prices also come despite a recent Treasury announcement that stated it would need to issue more bonds than previously expected. Tomorrow’s jobs report is in focus for rate traders, although we still have plenty of data left until the next Fed meeting.

Strategy (50DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 119 p Short 120 p Short 126 c Long 127 c | 45% | +515.63 | -484.38 |

Short Strangle | Short 120 p Short 126 c | 62% | +2171.88 | x |

Short Put Vertical | Long 119 p Short 120 p | 79% | +234.38 | -765.63 |

Symbol: Metals | Daily Change |

/GCJ4 | -0.37% |

/SIH4 | -1.51% |

/HGH4 | -1.14% |

Silver prices fall

Silver prices (/SIH4) are adding to losses following a post-FOMC selloff as traders remain cautious about how rate cuts will play out later this year after Powell pushed back on a March cut. Even lower bond prices following this morning’s labor market data aren’t assuaging investors. Tomorrow’s jobs report will offer the next cue for precious metal traders.

Strategy (53DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 22.5 p Short 22.75 p Short 23.75 c Long 24 c | 25% | +915 | -335 |

Short Strangle | Short 22.75 p Short 23.75 c | 56% | +5755 | x |

Short Put Vertical | Long 22.5 p Short 22.75 p | 62% | +520 | -730 |

Symbol: Energy | Daily Change |

/CLH4 | +0.99% |

/HOH4 | +0.17% |

/NGH4 | -0.19% |

/RBH4 | +0.38% |

Natural gas prices drop

Natural gas prices (/NGH4) are down today as warming weather forecasts add to worries that the United States will have an abundance of natural gas following an outage at the Freeport liquified natural gas (LNG) export facility that may last up to a month. The outage at one of the facility’s liquification units could limit the amount of LNG that Freeport is able to export.

Strategy (53DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.8 p Short 1.85 p Short 2.35 c Long 2.4 c | 40% | +260 | -240 |

Short Strangle | Short 1.85 p Short 2.35 c | 58% | +1770 | x |

Short Put Vertical | Long 1.8 p Short 1.85 p | 67% | +120 | -380 |

Symbol: FX | Daily Change |

/6AH4 | -1.13% |

/6BH4 | -0.42% |

/6CH4 | -0.31% |

/6EH4 | -0.25% |

/6JH4 | -0.18% |

The pound drops, despite rate decision

British pound futures (/6BH4) fell despite a rate decision from the Bank of England (BoE) that was seen as a relatively hawkish meeting with two of its members voting for a 25-bps rate hike.

The Monetary Policy Committee (MPC) stated that it would like to see more evidence that inflation is coming down before implementing a cut. Despite higher Gilt yields, the pound is having trouble in wake of a stronger dollar.

Strategy (36DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.245 p Short 1.255 p Short 1.285 c Long 1.295 c | 50% | +281.25 | -353.75 |

Short Strangle | Short 1.255 p Short 1.285 c | 62% | +625 | x |

Short Put Vertical | Long 1.245 p Short 1.255 p | 77% | +162.50 | -468.75 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.