Stocks and Bonds Cheer as the U.S. Dollar Sinks After Shock ISM Data

Stocks and Bonds Cheer as the U.S. Dollar Sinks After Shock ISM Data

By:Ilya Spivak

While the dollar took a beating after a shock miss on U.S. service-sector data, stocks and bonds recover

- Financial markets scramble after shocking services ISM data.

- Stocks and bonds recover as the U.S. dollar takes a beating.

- Fed Chair Powell reiterates that rate cuts are likely in 2024.

The U.S. service sector stumbled in March, sounding alarms about the health of the world’s largest economy and validating cautious comments from Federal Reserve Chair Jerome Powell.

The Institute of Supply Management (ISM) unexpectedly reported that last month, services activity growth slowed to the weakest since December. The release marked a stark contrast with the companion manufacturing report published earlier in the week, which beat expectations by a considerable margin.

Markets swing sharply after services ISM shock

Signs of deceleration permeated the data set. New orders grew at the slowest in three months, echoing the headline figure. Prices grew at the slowest rate since March 2020, the low marked amid the early months of the COVID-19 pandemic. Employment contracted for a second consecutive month.

Financial markets raced to respond after the survey crossed the wires.

Treasury bonds roared higher across maturities, erasing intraday losses. Gains were tilted to favor longer-dated paper, with the 10-year note futures (ZN) up 0.5% and the 30-year contract (ZB) up 0.9% from their session lows. Gold prices turned an intraday loss into the eighth consecutive day of gains.

The response was a bit more muted in stock markets. Futures tracking the bellwether S&P 500 (ES) were trading with an intraday loss before the data arrived and managed to erase it thereafter, but cumulative gains look meager at less than 0.2% as the closing bell approaches. The U.S. dollar tumbled, shedding 0.6% on average against its major peers.

Chair Powell reiterates Fed call for rate cuts in 2024

Speaking about the U.S. economic outlook at an event in Stanford, California just two hours after the release, Powell said monetary policy is tight and warned that it is too soon to tell if recently elevated price growth readings were anything more than a temporary bump on the road to disinflation.

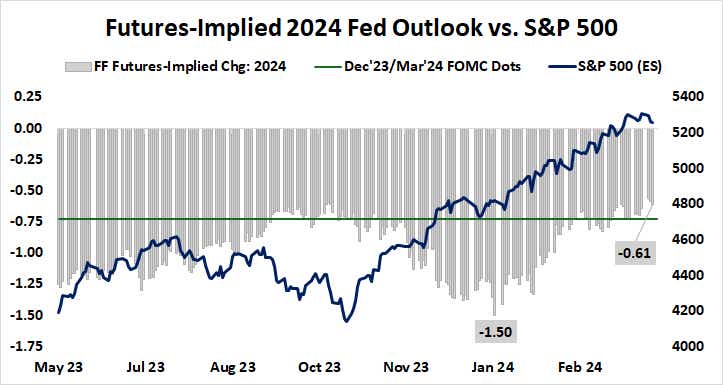

The comments seemed to reinforce Fed officials’ belief that lowering interest rates this year remains the likely course of action. The central bank stuck to its call for three 25-basis-point (bps) cuts this year when it updated official projections last month, despite a run of upbeat data that had markets speculating about a reduction in stimulus expectations.

As it stands, fed funds futures are pricing in 61 bps in easing for 2024. That amounts to two standard-sized 25 bps reductions and a narrowly better-than-even 56% probability of a third one. This marks a slightly dovish adjustment from the 57 bps that markets were anticipating at the start of the week.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.