Russell 2000 Clobbered After Hotter Inflation Print

Russell 2000 Clobbered After Hotter Inflation Print

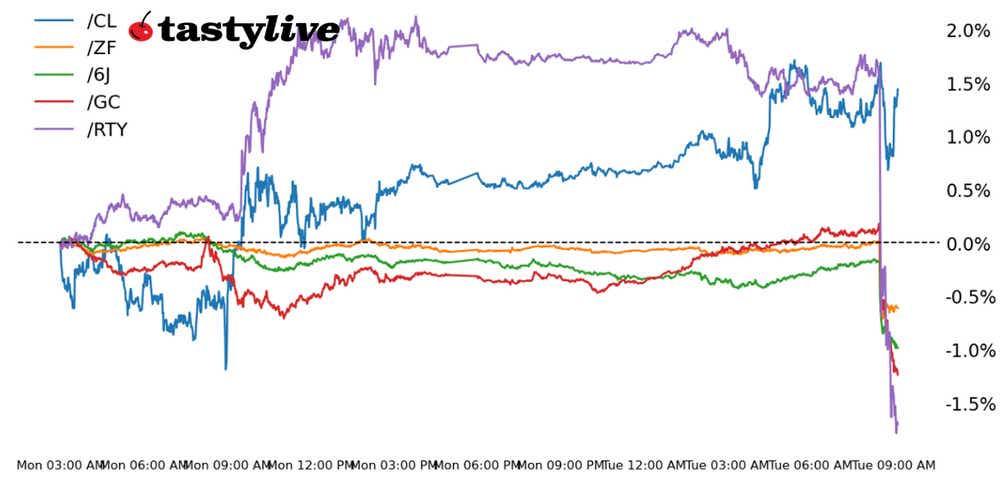

Also five-year T-note, gold, crude oil and Japanese yen futures

- Russell 2000 E-mini futures (/NQ): -1.36%

- Five-year T-note futures (/ZF): -0.55%

- Gold futures (/GC): -0.88%

- Crude oil futures (/CL): +0.68%

- Japanese yen futures (/6J): -0.71%

Disappointment spread across global financial markets this morning following release of the January U.S. inflation report. The January U.S. consumer price index came in hotter than expected, up by 0.3% month over month (m/m) and 3.1% year over year (y/y) on the headline, and 0.4% m/m and 3.9% y/y on the core. Both the headline and core readings were a touch stronger than anticipated (up 0.2% m/m and 2.9% y expected for the headline; and up 0.3% m/m and 3.9% y/y on the core).

The source of consternation may be the shelter reading, which rose by 0.6% m/m. The “supercore” reading, which is core services ex-shelter, rose to its highest level since May 2013. There may be some re-weighting factors in play here, but this fact remains: Inflation came in hotter than expected, sending the odds of a Federal Reserve cut in interest rates tumbling. In fact, rates markets are now fully pricing in the first Fed rate cut in July; before the January Federal Open Market Committee (FOMC0 meeting, a March cut was favored.

The initial reaction immediately sent stock futures lower and bond yields sharply higher. For equities, markets have fallen back to where they were late last week. For bonds, prices are at their lowest since mid-December. Elsewhere, rates sensitive assets were on the move, with precious metals slumping and the U.S. dollar jumping to its highest level since Nov. 14 – incidentally, the day the October U.S. consumer price index (CPI) came in softer than anticipated by nearly the same margin that the January U.S. CPI missed expectations.

Symbol: Equities | Daily Change |

/ESH4 | -1.36% |

/NQH4 | -1.88% |

/RTYH4 | -3.29% |

/YMH4 | -0.87% |

Equities are taking this morning’s inflation report on the chin, but small caps seem to be taking it especially hard, with Russell 2000 futures (/RTYH4) down over 3% ahead of the Wall Street open. That is the biggest daily percentage decline since, checks notes, November 2022. The move puts /RTY at its 50-day simple moving average, and while it would be a stretch for the index to continue dropping on an intraday basis, a break lower would further damage its technical structure.

Strategy: (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1900 p Short 1925 p Short 2100 c Long 2125 c | 44% | +575 | -675 |

Short Strangle | Short 1925 p Short 2100 c | 60% | +2616 | x |

Short Put Vertical | Long 1900 p Short 1925 p | 72% | +290 | -960 |

Symbol: Bonds | Daily Change |

/ZTH4 | -0.26% |

/ZFH4 | -0.55% |

/ZNH4 | -0.69% |

/ZBH4 | -1.12% |

/UBH4 | -1.24% |

Five-year T-note futures (/ZFH4) dropped to the lowest level since late November following this morning’s CPI report. While leading inflation indicators show improvement, traders may brush off today’s print after the dust settles, and look ahead to the PCE measure, the Fed’s preferred gauge. For now, however, the calculus for rate cuts will likely keep pressure on bonds.

Strategy (38DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron condor | Long 106 p Short 106.25 p Short 108 c Long 108.25 c | 40% | +132.81 | -117.19 |

Short strangle | Short 106.25 p Short 108 c | 58% | +664.06 | x |

Short put vertical | Long 106 p Short 106.25 p | 80% | +70.31 | -179.69 |

Symbol: Metals | Daily Change |

/GCJ4 | -0.88% |

/SIH4 | -1.92% |

/HGH4 | +0.30% |

Gold prices (/GCJ4) headed toward the lowest levels in nearly three weeks of trading on today’s inflation numbers. The metal was already struggling amid shifting rate cut bets but faces renewed pressure that could see prices challenge the 2024 lows set in mid-January just above the 2,000 mark. Until we see some data that helps the Fed on their path to cut rates, gold might not see much upside. The rest of the day is light on data, but we do get a slew of Fed speakers tomorrow, which may inform gold prices.

Strategy (41DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1955 p Short 1965 p Short 2065 c Long 2075 c | 52% | +400 | -600 |

Short Strangle | Short 1965 p Short 2065 c | 65% | +2040 | x |

Short Put Vertical | Long 1955 p Short 1965 p | 78% | +230 | -770 |

Symbol: Energy | Daily Change |

/CLH4 | +0.68% |

/HOH4 | +0.20% |

/NGH4 | -4.47% |

/RBH4 | +0.31% |

Crude oil prices (/CLH4) edged higher this morning as fighting in the Middle East remained near a boiling point, with Israeli forces prepared to push into Southern Gaza. Meanwhile, officials from the United States, Israeli and Egypt meet in Cairo to negotiate a truce. Today’s gains were tempered slightly by this morning’s U.S. inflation report. The focus for energy traders turns to inventory reports ahead from the American Petroleum Institute (API).

Strategy (31DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron condor | Long 72 p Short 73 p Short 82 c Long 83 c | 49% | +430 | -570 |

Short strangle | Short 73 p Short 82 c | 62% | +2100 | x |

Short put vertical | Long 72 p Short 73 p | 74% | +220 | -780 |

Symbol: FX | Daily Change |

/6AH4 | -0.93% |

/6BH4 | -0.23% |

/6CH4 | -0.52% |

/6EH4 | -0.53% |

/6JH4 | -0.71% |

Japanese yen futures (/6JH4) sank this morning to their lowest level since Nov. 17, and the currency is down nearly 7% so far in 2024. That makes it one of the worst (BOJ) to hike rates combined with traders trimming rate cut bets for the Federal Reserve has extinguished the bull case for the currency. Tomorrow, Japanese gross domestic product (GDP) for the fourth quarter will cross the wires.

Strategy (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron condor | Long 0.0065 p Short 0.0066 p Short 0.0069 c Long 0.007 c | 53% | +425 | -825 |

Short strangle | Short 0.0066 p Short 0.0069 c | 62% | +887.50 | x |

Short put vertical | Long 0.0065 p Short 0.0066 p | 82% | +112.50 | -512.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.