S&P 500 Eyes Sixth Straight Week of Gains

S&P 500 Eyes Sixth Straight Week of Gains

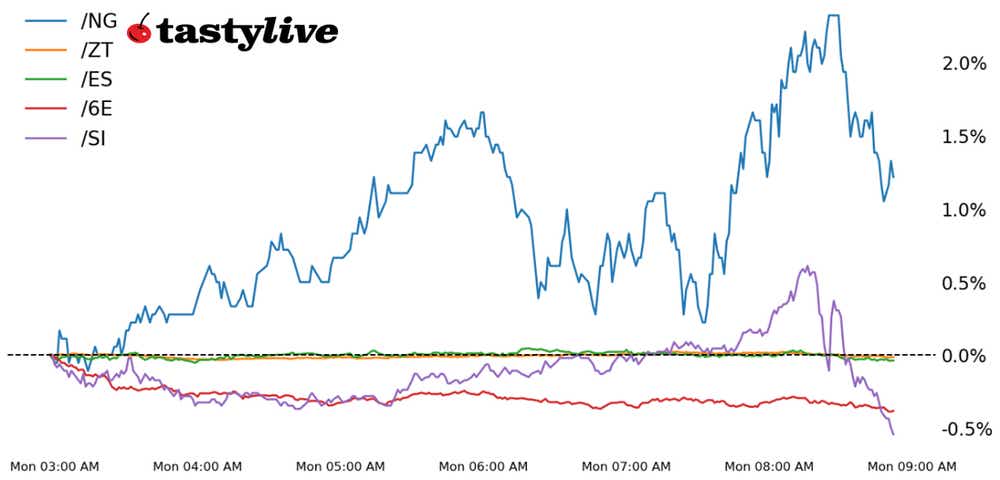

Also 2-year T-note, silver, natural gas and euro futures

- S&P 500 e-mini futures (/ES): -0.03%

- 2-year T-Note futures (/ZT): +0.03%

- Silver futures (/SI): +0.80%

- Natural gas futures (/NG): -0.97%

- Euro futures (/6E): -0.13%

With major Asian markets on holiday (not to mention Taylor Swift’s Chiefs winning the Super Bowl), trading at the start of the week got off to a slow start on Monday.

U.S. equity markets are little changed, while bonds are higher across the curve. The January U.S. inflation report tomorrow may keep a lid on price action today.

Elsewhere, energy markets are starting the week on softer footing after reports of increasing natural gas rig counts were released late last Friday. The U.S. dollar is seeing a minor gain amid a dip in the Euro.

Symbol: Equities | Daily Change |

/ESH4 | -0.03% |

/NQH4 | -0.03% |

/RTYH4 | +0.26% |

/YMH4 | -0.11% |

Muted start for stocks

Equity markets are off to a quiet start on Monday after the S&P 500 hit a record high on Friday.

Big technology names helped fuel those gains last week after investors were impressed by earnings reports from Meta (META) and Amazon (AMZN).

Today’s focus turns to the upcoming consumer price index (CPI) for January due tomorrow, which offers the first inflation data for the year.

Analysts expect year-over-year inflation to drop to 3% from December’s 3.4%.

Strategy: (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5030 p Short 5050 p Short 5150 c Long 5170 c | 20% | +725 | -275 |

Short Strangle | Short 5050 p Short 5150 c | 48% | +5812.50 | x |

Short Put Vertical | Long 5030 p Short 5050 p | 63% | +325 | -675 |

Symbol: Bonds | Daily Change |

/ZTH4 | +0.03% |

/ZFH4 | +0.11% |

/ZNH4 | +0.14% |

/ZBH4 | +0.18% |

/UBH4 | +0.15% |

Treasuries move up

Treasuries are trading higher along the curve to start the week. Traders are watching Fed speak from several members, including Minneapolis Federal Reserve President Neel Kashkari and Richmond Federal Reserve President Tom Barkin.

Yields have been higher from the start of the year after the market recalibrated rate cut bets that were running too hot. While the chances for a cut in March have diminished, the Fed is still on course to cut later this year, which should limit the downside for Treasuries. Today will see 13- and 26-week bill auctions from the Treasury.

Strategy (39DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 102.25 p Short 102.375 p Short 103.375 c Long 103.5 c | 39% | +125 | -125 |

Short Strangle | Long 102.25 p Short 102.375 p Short 103.375 c Long 103.5 c | 53% | +578.13 | x |

Short Put Vertical | Short 102.375 p Short 103.375 c | 89% | +62.50 | -187.50 |

Symbol: Metals | Daily Change |

/GCJ4 | -0.33% |

/SIH4 | +0.80% |

/HGH4 | +0.52% |

Silver prices go higher

Silver futures (/SIH4) trimmed earlier gains on Monday but the metal remained higher ahead of the Wall Street open.

This might be a defining week for the next move in precious metals with tomorrow’s U.S. inflation report for January. A lower-than-expected CPI print could reverse the downward trend in silver prices.

Strategy (48DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 22.25 p Short 22.5 p Short 23.5 c Long 23.75 c | 30% | +835 | -415 |

Short Strangle | Short 22.5 p Short 23.5 c | 56% | +4200 | x |

Short Put Vertical | Long 22.25 p Short 22.5 p | 64% | +465 | -785 |

Symbol: Energy | Daily Change |

/CLH4 | -0.77% |

/HOH4 | -1.36% |

/NGH4 | -0.97% |

/RBH4 | +0.55% |

Crude oil dips

Crude oil prices (/CLH4) traded slightly lower to start the week but bullish conditions that helped drive prices higher last week remain in place and the current move might reverse once more volume moves into the market today.

Houthis continue to target shipping lanes in the Red Sea, while tensions around the situation in Gaza remain high as Israeli military forces push further south.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.55 p Short 1.65 p Short 2.05 c Long 2.15 c | 44% | +450 | -550 |

Short Strangle | Short 1.65 p Short 2.05 c | 57% | +1330 | x |

Short Put Vertical | Long 1.55 p Short 1.65 p | 69% | +220 | -780 |

Symbol: FX | Daily Change |

/6AH4 | +0.03% |

/6BH4 | -0.10% |

/6CH4 | -0.05% |

/6EH4 | -0.13% |

/6JH4 | +0.12% |

Japanese data is on the way in

Japanese yen futures (/6JH4) hovered near yearly lows set last week, with Monday trading offering little relief from the bearish price action seen recently.

Later this afternoon, Japan will release wholesale price data and later this week will see the country’s fourth-quarter gross domestic product (GDP) numbers cross the wires. Traders will be watching both numbers to help assess how likely it is that the Bank of Japan can take rates into positive territory. Tomorrow’s U.S. inflation report will also likely be key for yen direction this week.

Strategy (59DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.06 p Short 1.065 p Short 1.09 c Long 1.095 c | 58% | +237.50 | -387.50 |

Short Strangle | Short 1.065 p Short 1.09 c | 66% | +562.50 | x |

Short Put Vertical | Long 1.06 p Short 1.065 p | 85% | +56.25 | -256.25 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.