Nasdaq 100 Reverses as Yields Follow Oil Higher

Nasdaq 100 Reverses as Yields Follow Oil Higher

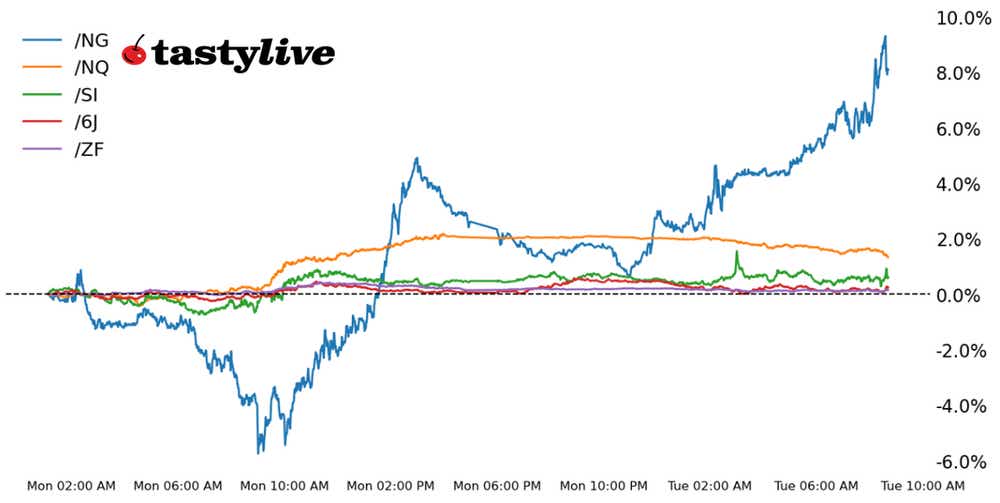

Also, five-year T-note, silver, natural gas, and Japanese yen futures

- Nasdaq 100 e-mini futures (/NQ): -0.81%

- Five-year T-Note futures (/ZF): -0.14%

- Silver futures (/SI): +0.34%

- Natural gas futures (/NG): +4.66%

- Japanese yen futures (/6J): +0.10%

If the drop in energy pulled yields lower yesterday, giving stocks room to rally, then the opposite is happening today.

Crude oil (/CLG4) and natural gas (/NGH4) prices are sharply higher on the session, provoking a bounce in market-based measure of inflation, pushing yields higher. All four major U.S. equity indexes are trading lower.

Elsewhere, precious metals are snapping back despite a mostly stronger U.S. dollar. Curiously, the Japanese yen (/6JH4) is gaining ground in what should theoretically be a difficult environment.

Symbol: Equities | Daily Change |

/ESH4 | -0.55% |

/NQH4 | -0.81% |

/RTYH4 | -1.16% |

/YMH4 | -0.45% |

Russell 2000 drops

Yesterday’s rally helped eliminate most of the losses seen in U.S. equity markets in 2024, but there’s been no follow through to the upside on Tuesday. The rate-sensitive Russell 2000 (/RTYH4) is down over more than 1% ahead of the cash equity open, while the Nasdaq 100 (/NQH4) isn’t too far behind. Attention is turning to the December U.S. inflation report on Thursday and the start of earnings season later this week.

Strategy: (51DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 16100 p Short 16200 p Short 17200 c Long 17300 c | 37% | +1100 | -900 |

Long Strangle | Long 16100 p Long 17300 c | 40% | x | -6955 |

Short Put Vertical | Long 16100 p Short 16200 p | 70% | +520 | -1480 |

Symbol: Bonds | Daily Change |

/ZTH4 | -0.07% |

/ZFH4 | -0.14% |

/ZNH4 | -0.22% |

/ZBH4 | -0.36% |

/UBH4 | -0.50% |

Bonds fall

If the strength in bonds yesterday was due to an energy-induced decline in inflation expectations, the other side of that relationship is playing out today. U.S. Treasury bonds are down across the curve, led lower by the long-end 30s (/ZBH4) and ultras (/UBH4)). The three-year note auction results will be announced at 1 p.m. EST/12 p.m. CDT today, likely provoking more volatility in 2s (/ZTH4) and 5s (/ZFH4).

Strategy (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 106.75 p Short 107 p Short 109 c Long 109.25 c | 39% | +140.63 | -109.38 |

Long Strangle | Long 106.75 p Long 109.25 c | 40% | x | -632.81 |

Short Put Vertical | Long 106.75 p Short 107 p | 81% | +70.31 | -179.69 |

Symbol: Metals | Daily Change |

/GCG4 | +0.58% |

/SIH4 | +0.34% |

/HGH4 | -0.21% |

Gold prices move up

Gold prices (/GCG4) are clawing back some of their losses from yesterday, up about 0.5% ahead of the Wall Street open. However, the metal’s technical chart continues to show a trend lower over the last several weeks, although prices remain above the 50-day simple moving average. If this week’s inflation data comes in hotter-than-expected, it would likely accelerate the metal’s losses.

Strategy (48DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 22.5 p Short 22.75 p Short 24 c Long 24.25 c | 29% | +845 | -405 |

Long Strangle | Long 22.5 p Long 24.25 c | 42% | x | -4190 |

Short Put Vertical | Long 22.5 p Short 22.75 p | 64% | +465 | -785 |

Symbol: Energy | Daily Change |

/CLG4 | +2.44% |

/HOG4 | +2.33% |

/NGG4 | +4.66% |

/RBG4 | +2.72% |

Natural gas futures rise

A deep freeze that is expected to swallow large parts of the United States over the next week is sending natural gas futures (/NGG4) sharply higher. Prices are up over 8% this week following last week’s 15% gain.

The price move is squeezing speculative shorts out of the trade, helping to fuel further upside. According to CFTC data, non-commercial short bets are coming off the most elevated levels since the first half of 2023.

Strategy (48DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2.35 p Short 2.4 p Short 2.95 c Long 3 c | 32% | +330 | -170 |

Long Strangle | Long 2.35 p Long 3 c | 39% | x | -2900 |

Short Put Vertical | Long 2.35 p Short 2.4 p | 62% | +190 | -310 |

Symbol: FX | Daily Change |

/6AH4 | -0.40% |

/6BH4 | -0.28% |

/6CH4 | -0.13% |

/6EH4 | -0.19% |

/6JH4 | +0.10% |

Japanese yen adds to modest gains

Whereas most assets are reversing Monday’s price action, the Japanese yen (/6JH4) is not.

Modest gains yesterday have been followed by modest gains today. That happened even though an environment with higher U.S. Treasury yields and stronger energy prices has typically hurt the Yen. Perhaps this is a sign of resiliency. A quiet macroeconomic calendar on Tuesday leaves foreign exchange markets at the whims of broader cross-asset flows.

Strategy (59DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.00685 p Short 0.0069 p Short 0.00715 c Long 0.0072 c | 39% | +362.50 | -262.50 |

Long Strangle | Long 0.00685 p Long 0.0072 c | 37% | x | -1150 |

Short Put Vertical | Long 0.00685 p Short 0.0069 p | 75% | +187.50 | -437.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.